With over a thousand different credit cards to choose from in the U.S., how do you know which to apply for?

There are few things more disappointing than spending hours comparing credit card options only for your application to then be denied. You shouldn’t have to spend time guessing what you’ll qualify for and you certainly shouldn’t have to set a whole afternoon aside for card research.

There’s an easier way to comparison shop for credit cards, and it’s called Experian CreditMatch.

Experian CreditMatch brings the best credit cards to you — without a hard pull on your credit. Instead of searching through all the options out there one by one, see estimated approval odds for select cards before you apply and check if you have pre-approved card offers.

- Free to use

- No impact on credit

- Offers credit score monitoring

- Only shows matched options

- Limited options

- Few premium card results

What is Experian CreditMatch?

Experian CreditMatch brings the best credit cards to you — without a hard pull on your credit. Instead of searching through all the options out there one by one, you receive credit cards matched specifically to your profile that you’re likely to be approved for. This can help you feel more confident when applying, avoid rejection, and save time when shopping.

Better yet, it’s not just aimed at those looking for credit cards. If you’re looking to borrow money CreditMatch can also match you with debt consolidation, personal, and student loans.

Experian CreditMatch uses the FICO Score 8 model to calculate your credit score and find credit card offers within a compatible score range. Although this doesn’t guarantee approval, you’re more likely to qualify for cards you are matched to. Using this tool does not affect your credit score in any way because there are no hard inquiries unless you apply for a card.

Read more: What’s the difference between your FICO scores?

How does Experian CreditMatch work?

To start using Experian CreditMatch, you need to create an Experian account. You’ll provide your name, address, and email address to register.

Note that when doing this, you’re authorizing Experian Consumer Services to obtain your credit report and score in order to provide you with updates about your profile and match you to products. You do not need to sign up for a paid Experian account to use CreditMatch.

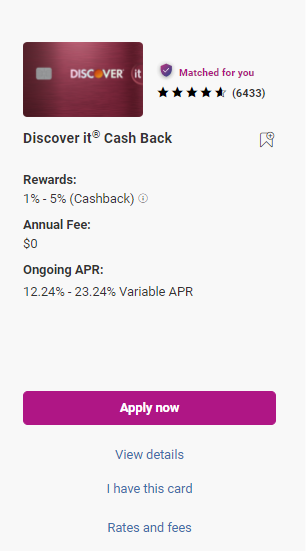

Once you’re signed in, click “See your options” in the Marketplace section to see your credit card matches. You’ll see your top three matches shown with their rewards-earning range, annual fee, and APR, as well as their user rating out of five stars. Below each matched card, you can apply, view details, indicate that you already have the card, or see rates and fees.

When you click “I have this card,” CreditMatch will remove the product from your recommendations and tell you about perks for the card you might not have known about. Use the back arrow to get back to your matches, and a new card will be in the former card’s place.

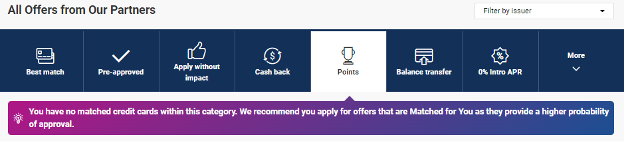

Scroll down to “All Offers from Our Partners” to see even more matches organized into categories. These are:

- Best match

- Pre-approved

- Apply without impact

- Cash back

- Points

- Balance transfer

- 0% intro APR

- Travel

- No annual fee

- Low interest

For each category, you can select “See Unmatched Offers” to see cards not recommended for you based on your profile. This doesn’t mean you don’t qualify, but your approval odds might be lower. Experian recommends applying for matched products first.

Be sure to bookmark the cards you’re interested in if you’re not applying for one right away.

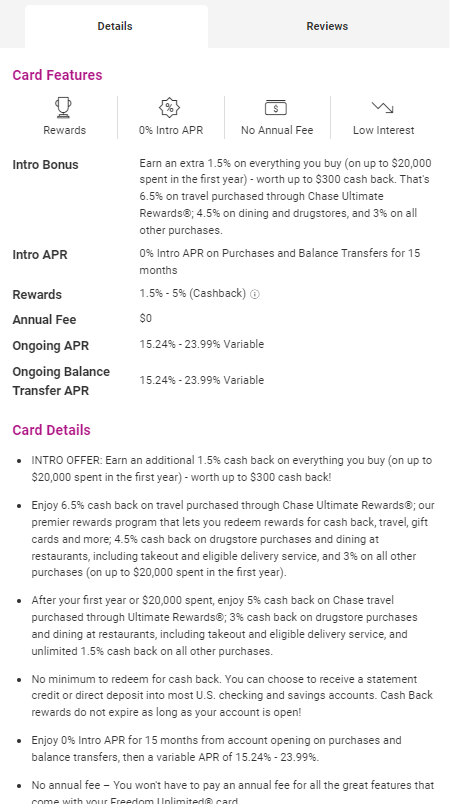

When you select “View details,” you’ll see everything you need to know about a card from features to pros and cons. This includes the introductory bonus, if there is one; APRs; rewards details (e.g. which categories earn cash back and how much); and more. Here’s an example:

In the “Reviews” tab, you can, you guessed it, read reviews from real users about a given credit card.

Read more: What are the different types of credit cards out there?

Experian CreditMatch pricing

Experian CreditMatch is completely free to use. After you sign up for the basic Experian account, you automatically qualify to use CreditMatch. You don’t need a subscription or anything.

Experian CreditMatch features

Comparison shopping

With personalized suggestions for you based on your credit profile and a comprehensive summary of every product, you can make side-by-side comparisons of different cards without leaving the Experian site. The CreditMatch service is easy, fast, and convenient to use.

Credit card pre-approval

You can decrease your chances of getting denied (and taking a hit to your credit for no reason) by applying for matches you are pre-approved for. See your approval odds for pre-approved products, check your CreditMatch percentage for matched products, and avoid unmatched offers to make the decision less stressful.

Read more: Soft vs. hard pull — how each affects your credit

Credit monitoring

Experian can really help you work on your credit with continuous score monitoring services. Check your FICO Score 8 and see what’s affecting it so you have a good understanding of your own creditworthiness and how your spending and borrowing affect your profile.

Safety

Experian uses SSL encryption to protect your data from fraud.

Who is Experian CreditMatch ideal for?

People who want to improve their credit or reduce debt

The Experian CreditMatch tool gives matches for secured credit cards; matches you can apply for without affecting your credit; and balance transfer cards to help you save when paying down high-interest debt.

First-time credit card users

CreditMatch is ideal for first-time credit card users because it features student cards and cards with no annual fee.

Who isn’t Experian CreditMatch good for?

People who want a premium card

You may notice that some of the highest-earning travel and rewards cards out there are not featured in CreditMatch. That’s because if you have excellent credit and an established credit history that would qualify you for premium cards, this tool isn’t really designed for you.

Read more: Best credit cards if your credit score is above 750 (excellent credit)

Business owners

Experian CreditMatch doesn’t show any business credit card offers. If you’re looking for a credit card with perks for business-related spending or travel, you’re going to have to either comparison shop the old-fashioned way or check out our round-up of the best business credit cards.

Pros & cons

Pros

- Free to use — Only a basic Experian account is needed to use CreditMatch.

- No credit impact — Using CreditMatch won’t affect your credit.

- Credit score monitoring — Check your FICO Score 8 at any time from the Experian dashboard.

Cons

- No details about unmatched cards — It would be helpful to know why a credit card isn’t considered a good match for you or why you’d be unlikely to qualify for it, but this information isn’t offered.

- Limited options — You won’t see every card from every issuer in the matched or unmatched sections.

- Few premium cards — Many upscale cash back, travel, and rewards cards are not featured on CreditMatch.

My experience using Experian CreditMatch

From a functionality perspective, the Experian CreditMatch tool is easy to use, fast to load, and beginner friendly.

But overall, I didn’t think Experian CreditMatch was that helpful for me personally. I felt like the cards I was matched with weren’t good fits for my goals and the cards I wasn’t matched with would have been more appropriate.

For example, I did not have any matched offers in the “Points” category.

I found this strange considering how many rewards cards are out there, and I’m certain I qualify for at least a few. Because cash back and points are the two main things I look for in a new credit card, I was frustrated by how limited these categories were. Where were all the cards I’ve had my eye on for months? My credit is “very good,” but I was still matched with secured and student cards instead of rewards cards.

I also felt that the offers could have been more comprehensive. I was seeing a lot of cards from certain brands and none or very few from others. Most American Express rewards and travel cards, for example, were nowhere to be found.

But while I didn’t benefit much from this service now, I know I would have at the start of my credit journey. This platform would have saved me a rejection (and a dent in my credit score) when I was applying for my first credit card as a student. I had no idea which card was best for me then and didn’t even know how to narrow down my options.

Note: Experian advertises a loan matching feature alongside credit card matching. But loan offers were nowhere to be found when I tested out the platform. If you’re interested in loans you have to navigate to a separate part of the website to see what you qualify for.

Summary

Whether you’re looking to get your first or fifth credit card, Experian CreditMatch can make the process a lot less nerve-racking. As a trusted credit reporting company, you can feel confident using Experian to track your score, work on your credit, and find a credit card or loan that’s right for you.

While I don’t recommend this product to more advanced and experienced credit card users, it’s a great tool for building and improving credit.