If you’re a homeowner, then you’ve likely thought about the possibility of using your home’s equity to fund pressing expenses through a home equity line of credit. After all, the equity you’ve built in your home may represent a large chunk of change. Why shouldn’t you take advantage of that resource when things get tight?

Although a HELOC can be a great way to fund life’s expenses, obtaining the line of credit can be a time-consuming process. But there is one company that is working to streamline the often arduous process. Figure is a relatively new financial company that is using technology to revolutionize the lending process.

The company could be the streamlined loan solution that you have been looking for to efficiently manage your mortgage.

Let’s take a closer look at what Figure has to offer.

What is Figure?

Figure is a lending company that currently offers two different products. You can obtain:

- Mortgage refinancing.

- Home equity lines of credit.

Of course, many lenders provide these types of loans. So the question of the hour: what makes Figure special?

For one, Figure offers a 100% online-only application experience– that allows you to finalize your entire application from the comfort of your home.

Another major benefit of working with Figure: the speed at which they process their loans.

With the power of technology behind their online application process, they are able to significantly decrease the amount of time it takes to process and fund a loan.

According to their site, you can:

- Close on your mortgage refinance in just weeks, not months. Figure notes that quick closing is dependent upon timely completion of the application process and timely scheduling and completion of the appraisal and closing. Funding will occur three business days after your recession period ends.

- Receive the funding of your home equity line of credit in just five days. Figure also notes that closing in five days is dependent upon timely completion of the application process and closing with the remote online notary, which is not available in all locations.

Instead of waiting days or weeks for loan approval, Figure aims to make a decision within minutes for their HELOC product. With other lenders, you might be waiting for weeks to finalize the loan process and receive your funds.

Pros & cons

Pros

- Simple application process — The technology behind Figure eliminates the time-consuming paperwork of a traditional loan application.

- Quick funding — You’ll receive your funds very quickly after the loan is approved (for a HELOC)

- Top-notch customer service — You can contact their team at any time to help you through the process.

- Competitive rates — The interest rate on your loan will affect your budget for years. With that, it is important to take advantage of a solid interest rate. Plus Figure has mortgage points, also known as discount points, which are fees paid directly to the lender in exchange for a reduced interest rate.

Cons

- Loan fees — There is an origination fee with a HELOC. Fees are never fun, however, this is fairly standard for the mortgage industry.

- Not available everywhere — Each of these products is available in most states, but not all states. It could be a problem if you live in an area that Figure doesn’t cover

- Funding cap — Figure has a loan cap of up to $400,000 for its HELOC product which could be a limitation depending on why you need the funds

How does Figure work?

Figure has a very simple online application process that essentially eliminates the painstaking process of tracking down all of your paperwork to scan or fax to the lender.

If you’ve ever gone through a loan process, then you understand how frustrating it can be to track down all of the paperwork that a mortgage lender typically requests. It can take many unrelenting hassle-filled days of working with a traditional lender to work through the lending process.

Fortunately, Figure takes the frustrations out of their lending process. Instead, you can walk through the online application in minutes and receive your approval after a few more minutes for HELOC. On average, it takes about 20 days before you receive a decision for Mortgage Refinance upon completing your application.

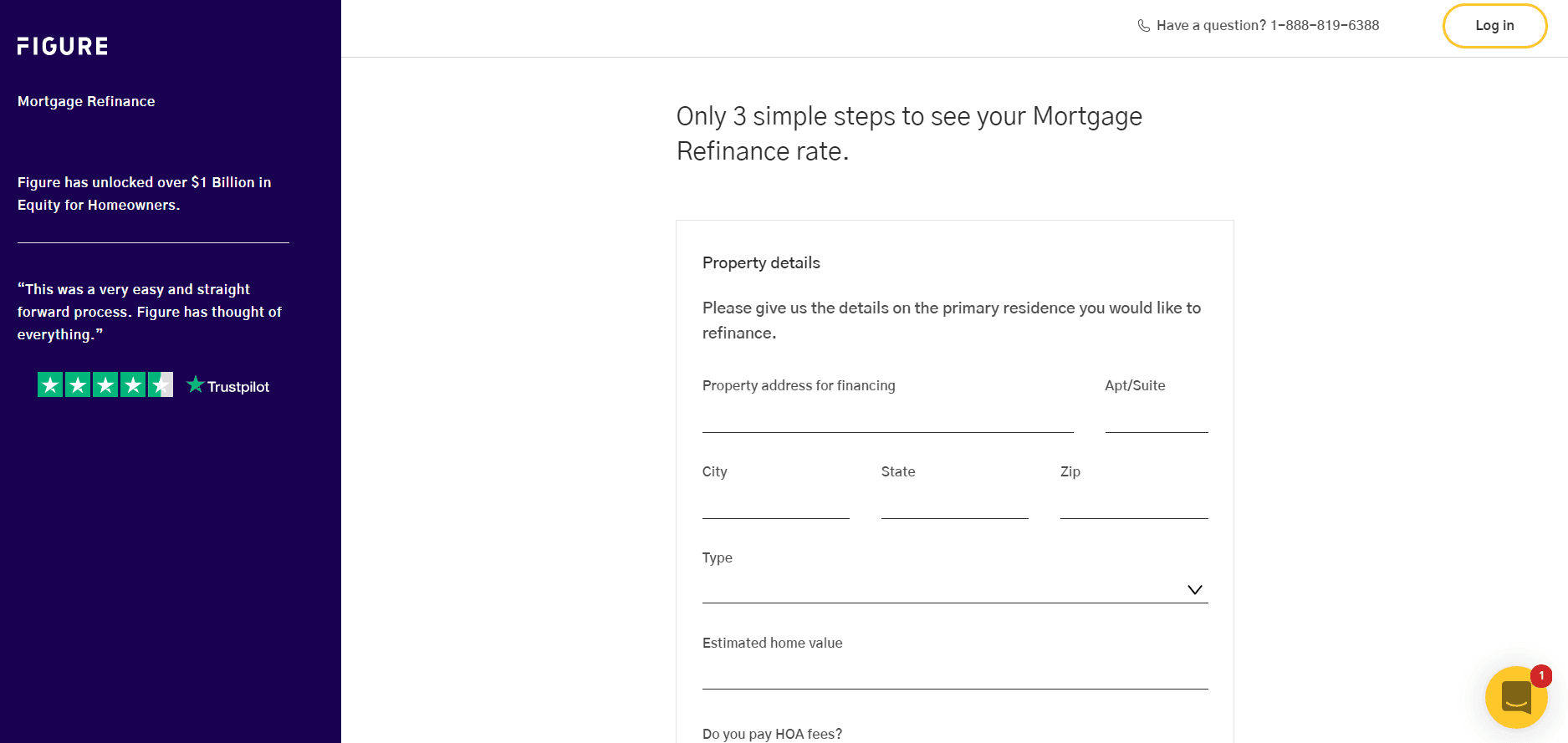

In order to get started with Figure, you click on the “Find My Rate” button in the top right corner.

That will take you to the first part of the process to determine what your rates would be.

You’ll be asked to provide some basic information. It would help to have the following information on hand:

- Your legal name.

- Date of birth.

- Citizenship status.

- An estimate of your annual income.

- Your primary address.

- Your email.

With this information, Figure will run a soft credit check. You’ll have access to your initial loan offers within minutes.

It is important to note that you will need to apply for each lending product separately. For example, if you wanted to work with Figure for your mortgage refinance and a home equity line of credit, then you will need to fill out two separate applications.

But rest assured – the application process is so fast, it won’t take up too much of your time to do this.

Once you receive your loan offers, you’ll be able to select which offer works best for you. If you decide that you want to move forward with your loan offer, then you can finish the official application. At this point, you will be required to provide additional information.

You will be asked to:

- Agree to a hard credit check.

- Connect at least one checking account for income verification.

- Prove your identity with a government-issued ID.

It can help to have this information handy to speed up your application.

With the information you provide in your HELOC application, Figure will use automation to evaluate your financial habits. When you are approved for the loan, you will need to work with a remote notary to sign the documents and finalize your loan. Note that remote notaries are not available nor accepted in all states and counties. Specifically though, if the borrower’s location does not allow Figure to use remote notarization, they send a mobile notary to your location who notarizes in person.

If you have any questions throughout the loan application process, then you should contact Figure directly. The company can offer assistance via email at help@figure.com or live chat on their website.

Plus, they have customer service members available if you prefer that route.

How much does Figure cost?

The hassle-free style of Figure makes it an enticing lender to work with. Luckily, the rates that Figure offers are also very attractive!

Let’s take a closer look at the costs of using Figure as a loan provider.

Mortgage refinancing

As with all mortgage refinancing processes, there are some fees to be aware of. Unfortunately, you’ll be faced with these types of fees regardless of the mortgage lender you choose to work with.

Fees that apply include appraisal, settlement, title and recording fees. There may be several more that will depend on your unique situation.

Home equity line of credit

You can also land low APR rates on your home equity line of credit through Figure.

In order to open your home equity line of credit, you will need to pay a one time origination fee equaling a percentage of the initial draw amount and you may also be required to pay recording fees charged by the county where your property is located. However, you will not be subject to any maintenance fees that other lenders usually require.

There are ways to reduce your HELOC’s costs. Figure offers discounts on your APR¹ if you choose to sign up for autopay or opt into a credit union membership.

Features of Figure

Let’s take a closer look at the features that Figure has to offer.

Painless application process

The importance of a quick and painless loan application process cannot be understated. After all, you are a busy person with things to do. No one has time to run back and forth to the bank several times just to finalize your loan.

With the power of automation, Figure takes the hassle out of sharing your information with your lender. It is a truly expedited process that can remove a lot of the stress traditionally associated with applying for a new loan.

Competitive rates and terms

The rates that Figure offers are highly competitive across the board. The rates are especially attractive if you have a good or excellent credit score.

Figure also offers both 30-year and 15-year fixed terms for their refinances, giving borrowers options when it comes to their refinance schedule.

Options for borrowers with low credit scores

Although you can land a better rate with a higher credit score, Figure offers options for those with less than perfect credit. In fact, you might be able to secure a HELOC with a credit score as low as 620 (720 in Oklahoma) or 620 for mortgage refinance confirming loans (minimum 660 for jumbo loans).

If you’ve been seeking out a HELOC or mortgage refinance, then you’ll know that finding a competitive APR with a mediocre credit score is a challenge. Figure offers the option for securing the funding you need without a sky-high rate.

Jumbo loan refinancing

Figure offers two types of jumbo loan refinancing – rate refinancing and cash-out jumbo refinancing. With rate refinancing, you can refinance up to $2,000,000 and get better terms on your loan.

With cash-out jumbo loan refinancing, you can refinance up to $1,000,000, with a cash-out max of $500,000.

Note that, to apply for these types of refinancing with Figure, you will need to have a credit score of at least 700.

My experience researching Figure

While researching Figure, I created an account to understand the features of the company better. Overall, the website was incredibly easy to use. Figure led me through the application process, which was quick and simple – a welcome change to other lenders that have lengthy, often frustrating applications.

Not only was Figure easy to use, but Figure also explained their terms in a useful way. Throughout the process, I felt that the company explained what was happening. I liked that because sometimes applying for a loan can feel like an overwhelming process.

Instead of drowning in a sea of jargon, Figure was very clear about the terms of their loans. I was comfortable that I knew what I was getting myself into when I signed on the dotted line. Not only was the website straightforward, but it allowed for a quick application process to finalize these financial moves.

The rates offered by Figure are definitely competitive compared to the overall market. A good rate is one of the most important things in my book at the end of the day.

Although I did not move forward with refinancing my mortgage with Figure, it was a smooth learning process. If I was in need of mortgage refinancing and Figure was able to offer the best loan terms, I am fairly certain I would move forward with this company.

Who should use Figure?

Those looking to refinance their mortgage

If you are looking to refinance your mortgage, then you should consider Figure because the application process is a breeze. Other lenders could monopolize your life for the next week, but Figure will only take up minutes of your time to apply.

Those looking for a home equity line of credit

Finally, if you want to obtain a home equity line of credit, Figure is an amazing option because you will have access to the money you need sooner. In fact, you could receive funding in as few as five days².

Who shouldn’t use Figure?

It’s not a good idea for everyone to work with this company. If you have a credit score below 620 (720 for Oklahoma), then you will not be able to secure a HELOC (or 620 for mortgage refinance conforming loans; 660 for jumbo).

Also, consider why you are taking the equity out of your home. Unless it can be used to solve a pressing financial issue, the funds might be better off left in your home’s equity.

The competition

Those looking for alternatives to Figure for mortgage refinancing or accessing funds have a couple of other options.

Figure vs Mortgage Research Center

Our partner, Mortgage Research Center, allows you to get personalized rate quotes from multiple mortgage lenders after answering just a few simple questions. It’s a great way to begin your mortgage search or look into refinancing your home with no obligation.

Mortgage Research Center is the Internet's leading source for mortgage rates from dozens of lenders.

Answer a few questions to see your personalized mortgage rates in minutes.

- Purchase or refi

- Won't affect your credit

- Options for first-time buyers, VA and FHA loans

- Must provide your email address

Figure vs Hometap

However, if you’re looking to access your home equity without taking on more debt, equity sharing through Hometap could be an option.

The company gives you cash in exchange for a stake in your home’s value — essentially becoming a co-investor in your property. You then have 10 years to either buy out Hometap or sell your home and share in the profits.

It’s important to note that Hometap is not a lender and does not offer loans. Instead, they invest in properties they know will gain value over time. For this reason, the amount of cash you’re eligible for will depend not only on how much equity you have, but also on Hometap’s estimated value of the property. According to the company, homeowners can access up to 15% of their home’s current value.

Summary

If you are seeking out a way to refinance your mortgage, or obtain a home equity line of credit, Figure is a company that is going to open up your options and make your life a heck of a lot easier.

My advice – do yourself a favor and avoid the tedious paperwork process for traditional banks. Instead, take a few minutes to fill out an application with Figure and cross this off your to-do list in just a few minutes.