If you eat well, exercise, and take care of your health in general, doesn’t it make sense that you should be rewarded?

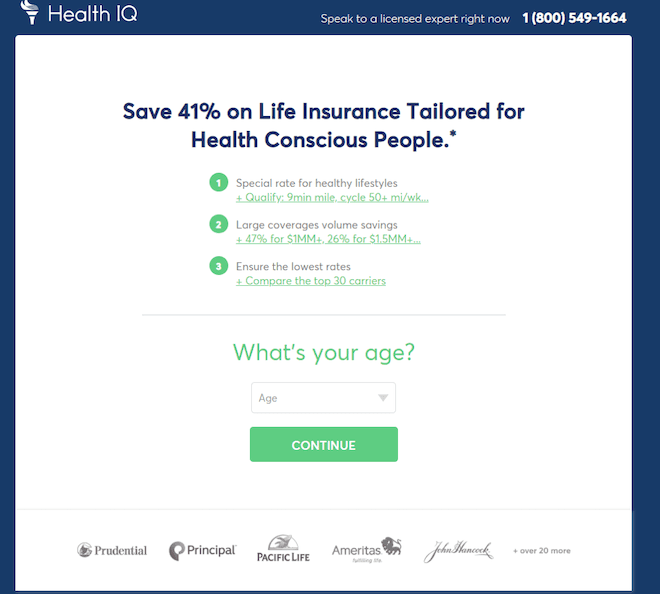

Health IQ certainly thinks so, which is why Health IQ offers lower insurance rates to members who run, jump, swim, and make other types of health-conscious choices all the time.

Consumers can earn discounted rates based on healthy diets, more active lifestyles, and other health-conscious choices. Health IQ has programs for young and old, and there is also a diabetes-friendly policy option!

What is Health IQ?

Health IQ is an insurance carrier portal with a mission: to reward people who choose to live healthy lifestyles.

Founded in 2013, Health IQ has done years of research in the area of health and lifespan. What it discovered was that people who took better care of their health in general, lived longer, healthier lives (go figure).

To promote healthier living then, Health IQ decided to celebrate those who are already making responsible decisions. So, whether you’re a yogi, a weightlifter, a vegetarian, or even a diabetic who works hard to take care of themselves, Health IQ applauds this behavior by finding you discounts on your insurance rates.

How does Health IQ work?

Health IQ is a life insurance middle man. Meaning, it doesn’t provide the insurance policy, but rather it pairs you up with a partner carrier after scoring you for a discounted rate.

Signing up with Health IQ is a little more complex than other more straightforward life insurance policy providers. If you are looking for better rates, though, then this process is definitely worth the initial extra few minutes. And honestly, the whole quiz format kind of made it fun!

Here’s how it works:

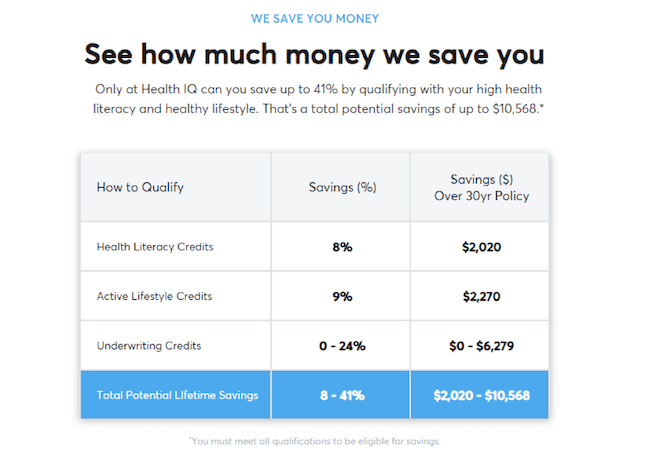

- Health IQ assigns credits for every category you qualify for.

- You’ll receive an 8% savings for health literacy, a 9% savings for leading an active lifestyle, and up to 24% savings for other underwriting factors.

In order to qualify for any of these credits, you’ll have to go through a few preliminary steps, including:

Take the Health IQ basic health quiz

Here, you’ll answer a few basic questions about your current health status. You’ll then be given a free medical exam at home if you qualify.

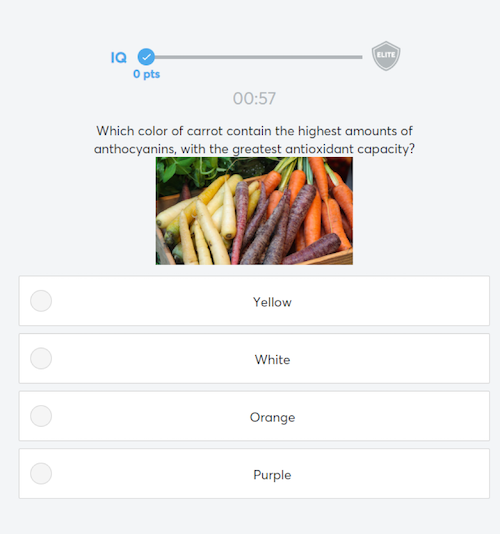

Next, you’ll take the Health IQ Quiz

This is a health literacy test. This will test your knowledge of basic health information.

This is – in my mind, – the heart of the entire operation. You’re asked a variety of questions relating to your own health as well as healthy living overall. Based on your answers, Health IQ will generate an insurance quote that rewards healthy lifestyle choices and knowledge.

You’ll also need to take the Healthy lifestyle Health IQ quiz

Here, Health IQ asks you questions about how to live a healthy lifestyle.

Verify your healthiness

The last part of the application process requires you to actually verify your healthy lifestyle. While I was a little taken aback by the process initially, I actually appreciated this part the most.

It is during this part of the application process that you can actually prove your level of fitness or activity, so you can’t just lie your way through the application (like a lot of people try to do with life insurance applications, in general).

There are a few ways you can verify your healthy lifestyle, including:

- Running: Run an 8-minute mile or an age-based equivalent (it’s also nice that Health IQ offers age-based verification standards rather than a generic marker that wouldn’t be appropriate for every applicant).

- Cycling: Ride 50+ miles

- Swimming: Compete in a meet

- And more…

Choose a plan

Finally, you’ll be given a choice of life insurance policies to choose from. Health IQ has more than 30 partners it works with, including some top names life Mutual of Omaha, Prudential, and John Hancock.

As I mentioned already, you can receive much lower rates than you would if you went directly to the insurance carriers themselves.

Related: Calculator: How Much Life Insurance Do I Need?

How much does Health IQ cost?

It’s completely free

Using Health IQ is free for everyone. You’ll have to pay the specific life insurance provider according to their fee structure. What’s nice is that you’ll receive the lowest rates possible thanks to the Health IQ rating system. The claim is that you can save up to 41% on typical policy rates.

Health IQ has a different pricing model

Most life insurance providers charge everyone their life insurance rates based on their current health status alone. But Health IQ works on a dramatically different pricing model. This provider looks at three areas of health:

- Your current health status

- Your level of health literacy

- Your lifestyle activity level

These factors weigh heavily in determining how much you’ll actually pay for your life insurance. Someone who is very aware of current best practices in health and fitness or eats a recommended diet for their lifestyle will end up paying less than someone who doesn’t know much about healthy living or doesn’t implement that knowledge.

You get discounts for living a healthy life

The premise is simple. You work hard to be healthy, and you deserve credit for that hard work. While it would be nice to think that Health IQ was solely concerned with rewarding healthy lifestyles, there’s a more technical explanation behind this discount.

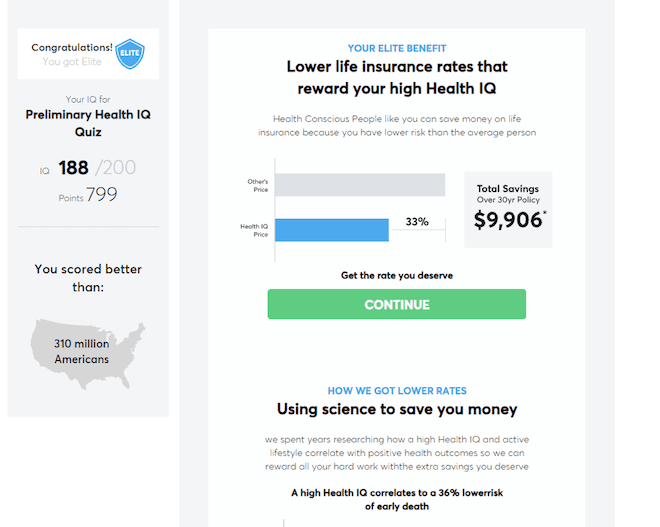

Since you’re taking better care of your body and your health, you are less likely to get sick and/or require life insurance payouts. In fact, studies have shown that a healthy lifestyle corresponds to a 36% lower risk of early death, 57% lower risk of heart disease, and 88% lower risk of type 2 diabetes.

So, Health IQ is simply using statistics in its favor to give people who are probably not going to cost them much anyways lower rates on their insurance policies.

Health IQ features

Health IQ is turning the entire life insurance industry on its head. The service is working to coax society into living healthier by bestowing better insurance rates upon people who are already taking care of their own health.

It’s working on an inside-out kind of methodology, and personally, I like it! Here are some Health IQ features that are worth noting:

1. Life insurance

Obviously, the most appealing product for the majority of the public, Health IQ finds discounted life insurance policies for those who qualify. It is interesting to note that Health IQ recognizes that people living a healthy lifestyle are overpaying for their life insurance. When the math is all done, Health IQ customers can potentially save close to $11,000 over a 30-year insurance policy.

The biggest way Health IQ helps to lower your insurance rate is by factoring all of the conditions, and not just looking at a generic number or rating. So, if you have a higher BMI because you are very muscular, Health IQ will get you a lower rate (while other insurance providers would just see the high number and rate you with a higher price rating).

Related: An Introductory Guide to How Life Insurance Works

2. Medicare supplement

Seniors are generally all grouped into a single category: old people. But that’s not a very accurate picture of your physical health. Living a healthier lifestyle can decrease your risk of early death, heart disease, and strokes.

Health IQ takes this into consideration, and it will even reward seniors for their level of health literacy, something that no other life insurance provider does.

3. Life insurance for well-managed diabetics

Diabetics are also lumped together unfairly. But according to Health IQ research, a healthy lifestyle can also decrease the mortality rate among diabetics.

So, this company offers a specialized plan that takes diabetes management into consideration as well.

4. Disability insurance

Disability insurance covers you if you’re unable to work because of an injury or illness (that’s covered by the policy). Using the health quiz, Health IQ takes various factors into consideration to get you a better rate.

What’s more, Health IQ runs your rates through its system to check with 30 of the top carriers in the country to see that you won’t find a better rate somewhere else.

Who is Health IQ ideal for?

Health IQ caters to the health-conscious folks, so if you are someone like the following, you’ll do well with this service:

Active and healthy individuals

As I said, Health IQ loves health-consciousness. As such, if you live an active lifestyle, you’re a prime candidate for discounted life insurance rates with Health IQ. And the company is extremely broad when it comes to this definition.

You can qualify for leading an active lifestyle by doing just about any physical activity, including running, swimming, cycling, weight lifting, high-intensity interval training (HIIT), competition training, and even yoga.

Healthy dieters

Additionally, Health IQ praises healthier food choices, particularly vegans and vegetarians. That’s because research has shown that plant-based dieters have lower risks of contracting things like cancer and other high mortality diseases.

Athletes

Even more than generally active people, athletes will benefit from Health IQ. That’s because the BMI count of a muscular person will be higher than that of an average individual.

High BMI counts negatively in your health report, even though muscle is a good thing. Health IQ takes this into consideration when calculating.

Know-it-alls

Well, not literally. But according to Health IQ research, people with higher levels of health literacy actually show a 36% lower risk of early death.

So, apparently, just knowing more about health will make you healthier, and that’s what Health IQ aims to reward.

Who shouldn’t use Health IQ?

Of course, Health IQ isn’t the ideal life insurance policy provider finder for everyone. If you’re one of these people, stick with your current plan or look at one of the competitors instead:

Couch potatoes

If your idea of a good Friday night involves sitting on the couch binging episodes of Game of Thrones while munching on your favorite artery-clogging snack foods, Health IQ probably won’t help you out much. That is unless you think scoring so low on a health quiz will scare you into action…

People who hate long forms

If you’re the type who despises long application processes, then Health IQ is not for you. Since there are more question and answer stages, this application process is more drawn out than others. If you can’t stand the idea of answering yet another question, skip Health IQ (and the discount that comes with it).

Pros & cons

Pros

- Takes a full picture scope — Rather than giving people a generic health status or rating, Health IQ takes many other important factors into consideration when generating an insurance policy quote for you.

- Better underwriting — Health IQ uses your activity status to boost your overall health status, so factors that might normally lower your health rating like a lower resting heart rate or higher BMI (due to muscle weight), will actually contribute to a better score with the Health IQ rating system.

- Comparison shopping — Health IQ actually compares your quoted rates with the top providers in the industry to ensure that you’re getting a discount using the system.

- Huge discounts — We’re talking up to 41% off your life insurance policy.

- Well-managed diabetes policies — Health IQ offers a separate plan specifically geared towards getting diabetics a lower policy rate. This is a great advantage considering the fact that most life insurance providers automatically give diabetics a significantly higher rate because of their condition.

- Disability insurance — Health IQ also offers a separate disability insurance plan. This is a great insurance policy that will cover you well beyond what your standard employer disability reimbursement will.

- Medicare plan — Catering to another group that receives higher rates across the board, Health IQ has a flexible seniors plan. This gives active, health-conscious seniors a chance to pay less despite their age (something normally held against them).

Cons

- Application form is longer than most — Health IQ asks a lot of questions about a lot of different health areas. As such, it’s going to take you longer to fill out this form than most life insurance policy applications.

- Limited choices — While Health IQ has more than 30 partner carriers, it isn’t an all-inclusive list. If you want to have the pick of the litter, you’ll have to apply to them individually and on your own.

Health IQ vs. Policygenius

Health IQ isn’t the only life insurance comparison tool.

Policygenius is also a great aggregator if you like to shop around. It allows you to compare life insurance quotes from multiple different providers and compare them online. Plus, Policygenius will help you apply directly to the lender of your choice, making the process exceedingly simple.

In addition to the comparison tool, Policygenius offers a wealth of information help you learn about life insurance before purchasing a policy for yourself.

| Health IQ | Policygenius | |

|---|---|---|

| Upfront costs | Free | Free |

| Types of insurance available | Life (whole and term) Disability Medicare Diabetes |

Term, whole, universal, quality of life, variable |

| Best features | Tailored underwriting Health-based rates discounts |

Fast, easy, online application for multiple providers |

| Coverage range | $100K-$3M+ | $10K-$10M+ |

Learn more about Policygenius or read our full Policygenius review.

My experience using Health IQ

Using Health IQ was an interesting experience. I’ve applied for life insurance policies before, so I thought I had a pretty good idea of how it would go. I didn’t. Health IQ is a singular experience, to say the least.

I started out by filling out the standard questionnaire. This includes questions like age, gender, weight, and height. Those are all normal, standard questions life insurance carriers will ask you during the application process.

Next, Health IQ ran my information through its system to find me a few rates. Health IQ has 30+ insurance carriers within its network.

From there, Health IQ will reach out to you to discuss rates. In the meantime, I took the health literacy quiz, so I could qualify for additional discounts on my life insurance policy. It turns out I’m a regular fitness geek! I earned the Elite status and a Health Conscious Badge. While that made me feel all warm and fuzzy inside, it also translates to a deeper discount from Health IQ partner carriers.

Additionally, you can take other quizzes, read interesting articles about health, and learn some cool tips contributed by other members of the Health IQ community.

All in all, it was a very positive experience, albeit a longer process than most life insurance applications. But for a savings of up to 41% on rates, I think anyone would be willing to spare a few more question-and-answer minutes to qualify.

Summary

If paying less on life insurance policies, thanks to a healthy lifestyle, sounds appealing, then Health IQ is a great fit for you.

You’ll be rewarded with lower rates thanks to things you’re already doing right. If this sounds like you, then Health IQ in my mind is an excellent option. Because in life, you don’t always get rewarded for ‘good behavior’ – and Health IQ is leading the way on that one.