The other day, a dear friend of mine in her mid-20s told me she was saving up to buy a house in her 30s.

Her plan for amassing a down payment was to simply make a big withdrawal from her 401(k) when the time was right.

When I reminded her that the combined taxes and penalties could be as much as 30% (meaning she’d lose $15,000 out of a $50,000 withdrawal), she frowned.

“Well, I can’t just put the money in a savings account. Interest rates suck these days – the highest I’ve seen is 1%, and that doesn’t even cover inflation!”

She had a point. So why not invest the money, I asked?

“Well, I don’t know much about stocks, I don’t have the patience for real estate, and crypto scares me.”

That’s when I told her she was the perfect candidate for a lazy portfolio.

“A what? Look, buster…”

Once I backpedaled and explained the concept, she understood that I wasn’t calling her a bum, but rather, keying her into a lesser-known but highly effective investment strategy.

In this piece, I’m going to clue you in, too!

What is a “lazy portfolio”?

A lazy portfolio is a bundle of stock market investments that requires little to no active maintenance by you. They’re most commonly made up of between one and five index funds, which are like big bundles of stocks, bonds, and other investments that you can buy just like shares of a regular stock (more on those later).

Aside from the occasional deposit or gentle asset reallocation, lazy portfolios don’t require any work.

You can buy $5,000 or $10,000 worth of index funds today and literally do nothing but watch them for 10 years. Doing this means you’ll have a successful lazy portfolio that will, hopefully, generate good rates of return.

But wait – don’t you have to be constantly buying and selling stocks to make money in the stock market?

Not at all – in fact, it’s better if you don’t. Unlike with day trading, you don’t mess with your lazy portfolio – through thick and thin, you let it sit and generate compound interest for years.

You can think of a lazy portfolio like a baby 401(k) that you design yourself and withdraw from much earlier.

Here’s why being “lazy” is a good thing

I love the movie The Wolf of Wall Street and the investing madhouse r/WallStreetBets, but both entities continue to perpetuate a common myth about the stock market: that you need to day trade to make money.

Nothing could be further from the truth.

In truth, multiple academic studies have found that the overwhelming majority of retail investors end up losing money.

“Don’t be misled with false claims of easy profits from day trading,” Burton Malkiel, Princeton professor and Chief Investment Officer of Wealthfront, told CNBC.

The harsh reality of investing in the stock market is that unless you’re a highly trained wealth manager with decades of experience and a team of analysts, you’re probably going to lose money day trading (and even they tend to struggle to pick winning stocks).

That’s why it’s better not to day trade, and be lazy instead. Rather than researching, buying, and selling stocks every day for the next 10 years, you’ll be better off buying index funds in the next 30 minutes and going about your day (or decade).

What are lazy portfolios made up of?

Lazy portfolios are most commonly made up of a small mix of index funds. Here’s a breakdown of what those are and why they’re so effective for passive investing.

Index funds: the building block of lazy portfolios

Index funds are a form of ETF, or exchange-traded fund, which are like big bundles of stock and other investable assets. When you buy shares of an ETF, you’re effectively buying up shares of dozens or hundreds of companies at once.

Each ETF must be individually approved by the SEC and have an appealing “theme” to it. For example, there are blockchain ETFs; ETFs that track the oil industry; and even quirky, unique ETFs that contain shares of companies trying to appeal to Millennials.

So, while stocks let you invest in a company, ETFs let you invest in an entire industry, concept, or strategy.

Now, what makes index funds as unique as ETFs is that they’re designed to reflect the performance of an entire market index, such as the S&P 500 or the U.S. bond market. To illustrate, here are two of the most popular index funds for building lazy portfolios:

- The Vanguard Total Bond Market Index Fund (BND), which reflects the performance of the total U.S. bond market.

- The Vanguard Total Stock Market ETF (VTI), which, big surprise, reflects the performance of the overall stock market.

So by buying shares of VTI and BND, you’re essentially investing in “the stock market” and “the bond market.” I know – the idea of investing in the whole stock market all at once sounds meta and maybe a little ridiculous, but bear with me.

Index funds are extremely popular for one simple reason

If you’re new to the stock market, you should know that pretty much every investor dabbles in index funds. Everyone from Warren Buffet to your grandparents has a stake in them – in fact, here’s how Mr. Buffet himself feels about index funds:

“In my view, for most people, the best thing to do is owning the S&P 500 index fund,” he told CNBC.

Index funds are popular among amateurs and pros alike for one simple reason: they reliably produce around 3% to 10% APY year after year. Index funds that track the S&P 500 are particularly high-performing, which is why many actively-managed mutual funds will say they “beat the S&P 500” as a benchmark for success.

Between 3% and 10% APY may not sound like a ton of interest but lemme tell ya, it’s plenty. Compound interest is a powerful ally, after all. Take a look at MU30’s Compound Interest calculator below to get a sense for yourself:

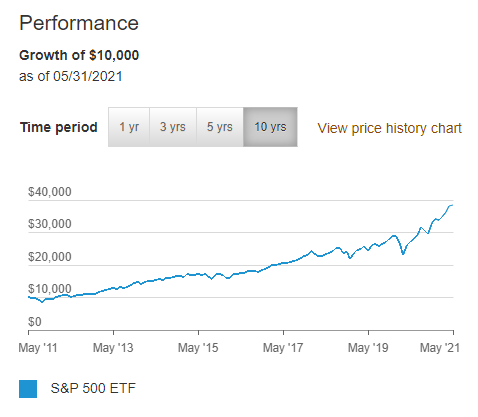

So to illustrate, let’s take a look at what happens if you opened a “one-fund lazy portfolio” today by buying $10,000 shares of the Vanguard S&P 500 ETF (VOO).

How much money would your lazy portfolio be worth in 10 years?

The answer is about $40,000. As I said, it literally pays to be lazy!

Now, most investors choose to put multiple index funds in their lazy portfolios for added diversity, but even one-fund lazy portfolios like 100% VOO are common and highly effective (clearly).

Why index funds are better than mutual funds or robo-advisors for building lazy portfolios

To start, mutual funds and robo-advisors are both excellent tools for smart investing. I’m not knocking them, but there’s a reason many investors don’t use them for lazy portfolios.

For the uninitiated, mutual funds are like ETFs, but they’re actively managed – there’s a team of professionals constantly mixing up the assets in the fund in an attempt to maximize returns for investors.

Similarly, robo-advisors are AI programs that take your money and build a portfolio for you, which, depending on your risk parameters, may contain a mix of ETFs, mutual funds, stocks, bonds, and more.

But lazy portfolio builders tend not to use either resource for one simple reason: fees.

Both mutual funds and robo-advisors will charge you a fee of between 0.25% and 2% to cover their costs of managing the fund – and since lazy portfolios are fire-and-forget, many passive investors would rather pick the index funds themselves and just avoid the fees.

To be clear, index funds and ETFs in general charge fees as well, but they’re typically less than a fifth of what a mutual fund charges (usually under 0.40%).

How to Build The Right Portfoilio – 3 popular lazy portfolios to consider

There’s a saying in the personal fitness community that there are 100,000 personal trainers with 100,000 “perfect” workout regimens.

The same applies to lazy portfolios in the investing world – there are (at least) 100,000 institutional investors with 100,000+ ideas on how to build the right lazy portfolio. After all, there’s a lot of flexibility in designing lazy portfolios – they may only contain a few index funds at most, but there are over 1,700 index funds to choose from!

Before you get overwhelmed, here are three solid examples to consider:

1. The basics: Rick Ferri’s Lazy Three Fund Portfolio

Author and CFA Rick Ferri literally wrote the book on index funds and publishes simple, yet effective, lazy portfolios for amateur investors to use. Here’s his bread-and-butter, the Lazy Three Fund Portfolio:

- 40% Vanguard Total Bond Market Index Fund (BND).

- 40% Vanguard Total Stock Market Index Fund (VTI).

- 20% Vanguard Total International Stock Index Fund (VXUS).

2. For a little more diversity: David Weliver’s Fidelity Portfolio

For a little added diversity, MU30’s very own David Weliver designed an everything-but-the-kitchen-sink portfolio for DIY index investors touching four different markets:

- 20% iShares Core S&P Total US Stock Market (ITOT).

- 20% iShares S&P Small Cap 600 Value (IJS).

- 40% iShares Core MSCI Total International Stock (IXUS).

- 20% iShares Core US Aggregate Bond (AGG).

3. If it ain’t broke: Warren Buffet’s 90/10 Portfolio

For maximum gains and minimum effort (you know, the very essence of a lazy portfolio) you really can’t go wrong copying the best. Warren Buffet’s 90/10 portfolio is one of the highest-performing, yet simplest, lazy portfolios in existence.

But perhaps the best part of the 90/10 portfolio is that Buffet specifically designed it to stick it to fund managers who charge high management fees.

According to author and investor Rob Berger, Buffet claimed this fund…

“will be superior to those attained by most investors – whether pension funds, institutions, or individuals – who employ high-fee managers.”

And the portfolio has outperformed those actively managed funds, year after year. If you need any final endorsements, Buffet advised his trustees to place his and his wife’s money into this portfolio after his death.

- 90% Vanguard S&P 500 ETF (VOO).

- 10% Vanguard Short-Term Treasury Index Fund ETF (VGSH).

What platform should I use to build a lazy portfolio?

You can build and monitor a lazy portfolio on pretty much any trading platform that lets you buy ETFs, but some are better suited for hosting lazy portfolios than others.

Here are just two options:

M1

Unlike most popular trading apps, M1 is tailor-made for passive investing. It’s easy to buy a few ETFs, build a lazy portfolio, and monitor it over time without the temptation of selling or day trading. If you choose to lean on robo-advisor support, it’s also available.

But the best part about M1 is the community. There are thousands of passive investors on the M1 subreddit ready to lend their strategies and support.

Webull

Many investors like to keep their active and passive investing portfolios on separate apps so they don’t accidentally or impulsively sell their index fund holdings – but if you’re confident you can juggle both on one platform, check out Webull.

Unlike its rivals, Webull offers an advanced trading dashboard and detailed analytics for free. Plus, you’ll get complimentary shares just for joining, making it a great landing pad for short- and long-term investors.

Summary

Lazy portfolios are made up of a handful of index funds that you buy once and let sit and mature for at least 10 years. The healthy and consistent annual performance of index funds like Vanguard S&P 500 ETF (VOO) makes lazy portfolios a 100% viable investing strategy, one used by amateur and institutional investors alike.

If you’re looking for a way to invest money so you can buy a house or pay off your student loans in 10 years, don’t overthink it: get lazy.