How to see your saved credit cards on iPhone

Viewing your saved debit and credit cards on your iPhone is quite easy. Follow these steps:

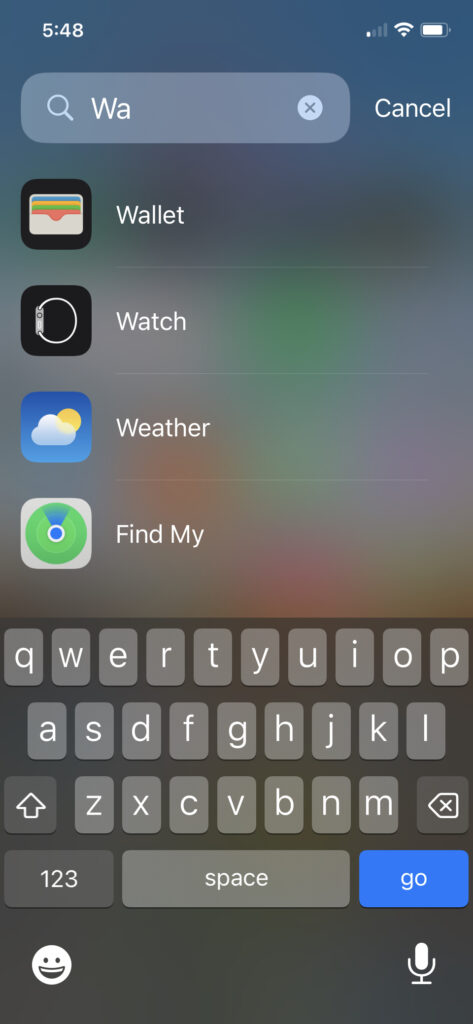

1. Open the Wallet app on your iPhone

Open the Wallet app on your iPhone and scroll until you see your saved credit and debit cards.

2. Tap on the card that you want to see

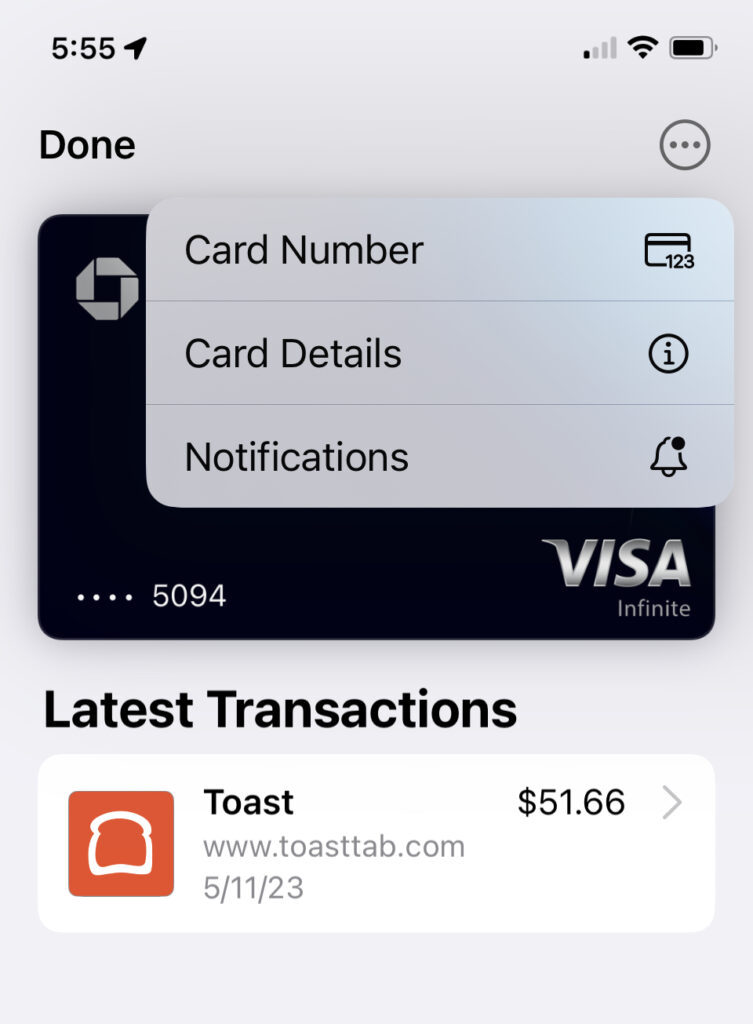

Tapping an individual card will display that card’s latest transactions.

3. Click the three dots icon to see card details

Tap on the three dots icon and you’ll see all the details, including the card number, expiration date, and security code.

That’s it! Now you know how to see your saved credit cards on your iPhone.

Why you might want to view your saved credit cards on iPhone

If you manage your finances with your iPhone, you will likely have saved your credit cards in the Wallet app. While it’s not necessary to view your saved credit cards on your iPhone all the time, there are some advantages to doing so.

For one thing, it can help you keep track of your spending. When you view your credit card balances in the Wallet app, you can see at a glance how much you’ve spent and how much is available to you.

This can be helpful if you’re trying to stick to a budget. Another advantage of viewing your saved credit cards on an iPhone is that it can help you spot fraudulent charges.

If you see a charge on your credit card that you don’t recognize, you can immediately report it to your credit card company. This can help you avoid paying for something that you didn’t purchase.

Finally, viewing your saved credit cards on your iPhone can help you remember to pay your bill on time. If you have multiple credit cards, it can be easy to forget about one of them.

But if you see your credit card balances in the Wallet app, you can quickly check to ensure you’re current on your payments. Overall, there are several advantages to viewing your saved credit cards on your iPhone.

If you manage your finances with your iPhone, it’s worth looking at your credit card balances from time to time.

Key Takeaway: Viewing your saved credit cards on your iPhone can help you keep track of spending, spot fraudulent charges, and remember to pay your bill on time.

Get the most out of using credit cards

Credit cards can be a great tool to help manage your finances and make purchases. However, it is important to use them responsibly to avoid debt and financial problems.

Here are some tips to help you get the most out of using credit cards:

1. Use Credit Cards for Convenience, Not for Credit.

Credit cards should be used as a convenient way to pay for purchases, not as a way to borrow money. If you use your credit card to make a purchase, be sure that you can afford to pay off the balance in full when the bill comes due.

2. Avoid Using Your Credit Card for Cash Advances.

Cash advances from credit cards are expensive and can quickly lead to debt problems. If you need cash, it is better to withdraw it from a bank account or take out a personal loan.

3. Pay Off Your Balance in Full Each Month.

If you carry a balance on your credit card from month to month, you will be charged interest on the outstanding balance. To avoid paying interest, make sure to pay off your balance in full each month.

4. Use Credit Cards Wisely.

Some people use credit cards irresponsibly by making impulse purchases or charging more than they can afford to pay back. If you use credit cards wisely, they can be a great financial tool.

However, if you use them recklessly, they can lead to debt problems.

5. Monitor Your Credit Card Statements.

Keeping track of your credit card spending is important to ensure you are not overspending. Review your credit card statements carefully, and dispute any charges you do not recognize.

6. Be Aware of Fraud.

Credit card fraud is a problem that is all too common. Be sure to protect your credit card information, and never give your credit card number to anyone unless you are sure they are legitimate.

7. Do Not Use Your Credit Card to Gamble.

Gambling with credit cards is a sure way to get into financial trouble. If you are tempted to gamble with your credit card, it is better to use cash or a debit card.

8. Use Your Credit Card Rewards.

Many credit cards offer rewards, such as cash back or points that can be redeemed for merchandise. If you use your credit card wisely, you can earn rewards that can save you money.

9. Keep Your Credit Card Information Safe.

It is important to keep your credit card information safe. Be sure to shred any documents that contain your credit card number, and never give your credit card number to anyone over the phone or online.

10. Check Your Credit Report.

It is important to monitor your credit report, to ensure that there are no errors. You are entitled to a free credit report from each of the three major credit reporting agencies annually.

Key Takeaway: Credit cards can be a great tool if used responsibly.

Summary

If you need to view or manage your saved credit cards for any reason, don’t worry – it’s easy to do on your iPhone! Just follow the steps in this article, and you’ll be able to see your stored credit card information in no time.