H&R Block is a tax preparation software company that offers a wide array of tax services and tools. It provides options for both federal and state tax returns with prices that are roughly average across the market.

Compared to other online tax software programs, H&R Block puts more benefits out there for business owners and is better for complex tax returns than other more stripped-down platforms. In this review, we’ll get into the details about what H&R Block does well and what it could improve upon, and who would benefit from choosing this platform over others for tax season.

What is H&R Block?

H&R Block was founded in 1955 by two brothers, Richard and Henry Bloch. Today, H&R Block is one of the biggest, most well-known tax software providers in the country. In addition to operating a comprehensive suite of online preparation tools, this company employs tax professionals at in-person offices around the country. There are H&R Block office locations in every state, though fewer of these than there once were.

For many years, H&R Block was predominantly known for retail tax services including appointments and preparation by professionals. Now, H&R Block is just as much for DIY tax filers with online plans (including a free option) and software to accommodate any type of tax situation.

Pros & cons

Pros

- Small business support — H&R Block offers a number of tax filing options for self-employed filers and small business owners, from online plans and tax software to file yourself to tax preparation and bookkeeping services.

- Transparency — H&R Block stands out for being more transparent with customers about what they’re going to do for you before you even sign up. And with four different guarantees in writing, you’ll know they’ll keep their promises.

- Pricing — H&R Block doesn’t have the lowest prices out there, but you can often get better value with this provider than with others.

Cons

- Added fees for live support — You’ll need to pay extra for live support from a tax professional as this service is not included with plans or downloads.

- Added fees for state returns — State tax returns are not included in the price for most plans or downloads.

How does H&R Block work?

H&R Block gives you the tools you need to prepare your tax returns yourself with support from pros.

Think of this like a “choose your own adventure” service. If you just want the software, you can purchase the software. If you want to file your returns from start to finish, you can pay to use the online platform (or use the free version). And if you’d rather just hand your forms off to a tax preparer and let them deal with it, you can pay for that too.

H&R Block also has a few unique products including expat tax services and financial accounts. But let’s start with the online tax prep products.

H&R Block online tax preparation services

You have several different choices for filing your taxes with H&R Block, with options ranging from do-it-yourself online filing to full-service tax preparation. Here are the different types of online tax filing options you can choose from.

File online

If you’re planning to file your tax returns yourself, the H&R Block online tax software plans are just one way to do that.

This is the option for you if you’re looking to save money as you’ll pay less for do-it-yourself filing than you would for preparation services.

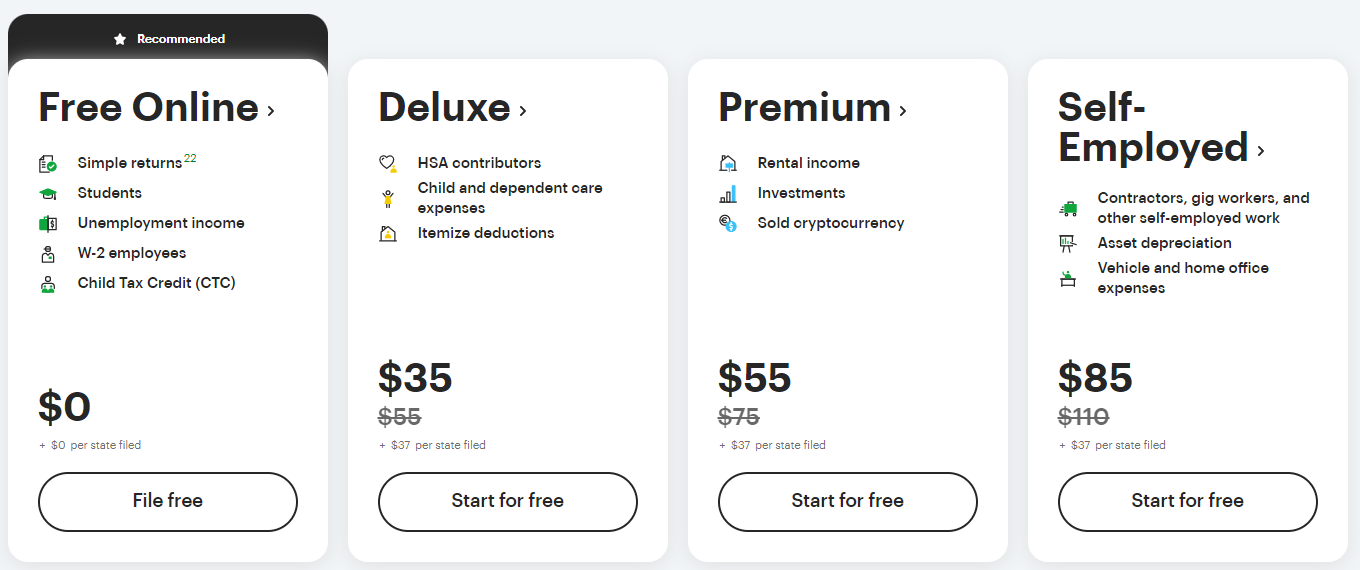

There are four different H&R Block online plans: Free, Deluxe, Premium, and Self-Employed. All of these plans allow for both the Earned Income Tax Credit and the Child Tax Credit and include real-time refund tracking.

H&R Block Free Online

The H&R Block Free Online plan is a free plan for filing simple tax returns. This plan can be used to report W-2, retirement, and unemployment income and claim basic deductions including the Earned Income Tax Credit and the Child Tax Credit if you qualify for these tax breaks. It also lets you deduct college expenses and student loan interest.

You can use it to file both federal and state tax returns and easily upload your tax returns from last tax season (even if you used a different provider).

But beyond these options, the free plan with H&R Block can’t accommodate much. This plan is primarily for filing IRS Form 1040 for federal returns and straightforward state returns. The Free Online plan is best for students, young adults, and some families.

H&R Block Deluxe Online

The H&R Block Deluxe Online plan is for filing moderately complex tax returns. If you need to claim itemized deductions, claim deductions for contributions to your Health Savings Accounts (HSAs), or organize income from any freelancing or side hustles, you can do that with this plan.

This is also the plan you would choose if you own a home and need to deduct property taxes and the interest you pay toward your mortgage. And with the Deluxe plan, you can store up to six years’ worth of tax forms in one place.

The Deluxe Online plan is going to be a good fit for a lot of families and homeowners.

» MORE: Why property taxes matter when buying a home

H&R Block Premium Online

The H&R Block Premium Online plan is for filing complex tax returns. You can use this plan to report passive income you earn from rental properties; investing income from selling stocks, bonds, and crypto; and capital gains. You can easily import your reports from different investment accounts. So far, this is the only plan that can handle income from selling your investments.

Another perk of the Premium Online plan is that you can use it to determine how much you owe in taxes following the sale of a home and earnings on gifted or inherited (taxable) assets.

If you own real estate that earns income or you invest, this is going to be the plan for you.

H&R Block Self-Employed Online

Finally, the H&R Block Self-Employed Online plan is for filing self-employed tax returns for people with freelance income, contract income, small business earnings, or pay from gig work and side hustles. You can claim business expenses and deductions for asset depreciation.

Self-employed tax filing software is always more expensive than others due to the complexity of taxes for people who work for themselves and need to juggle various streams of income. But compared to other providers, H&R Block’s product is reasonably priced for how much you can do with it and how easy it is to use.

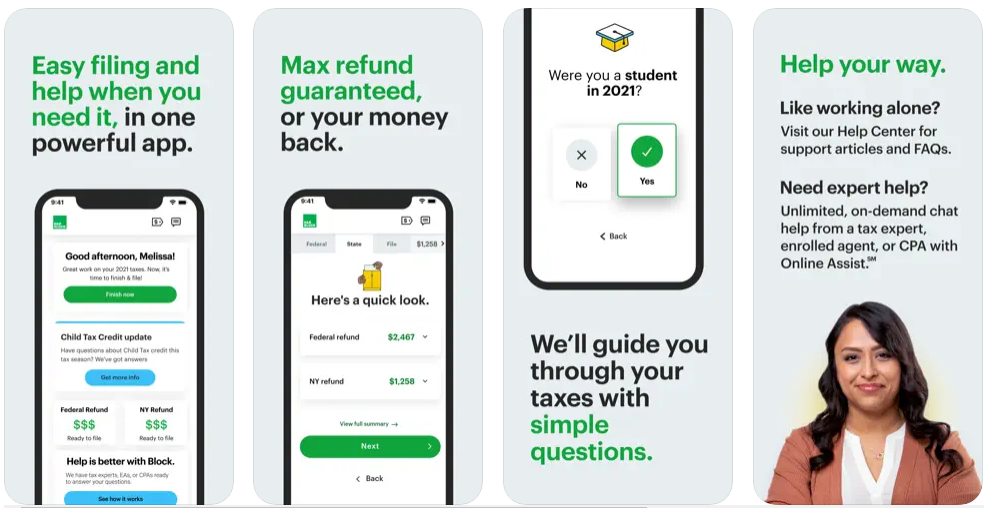

The online platform and mobile app both simplify the process of organizing your income and ask a lot of questions to understand your needs and help you maximize your deductions. This plan does a lot of the categorizing for you and really guides you through each step to find adjustments you might not have even known you qualified for. If you’ve ever earned self-employed income, you know how valuable this can be.

If you own a business or work for yourself, even if it’s not the majority of your income, you will likely need the Self-Employed Online plan.

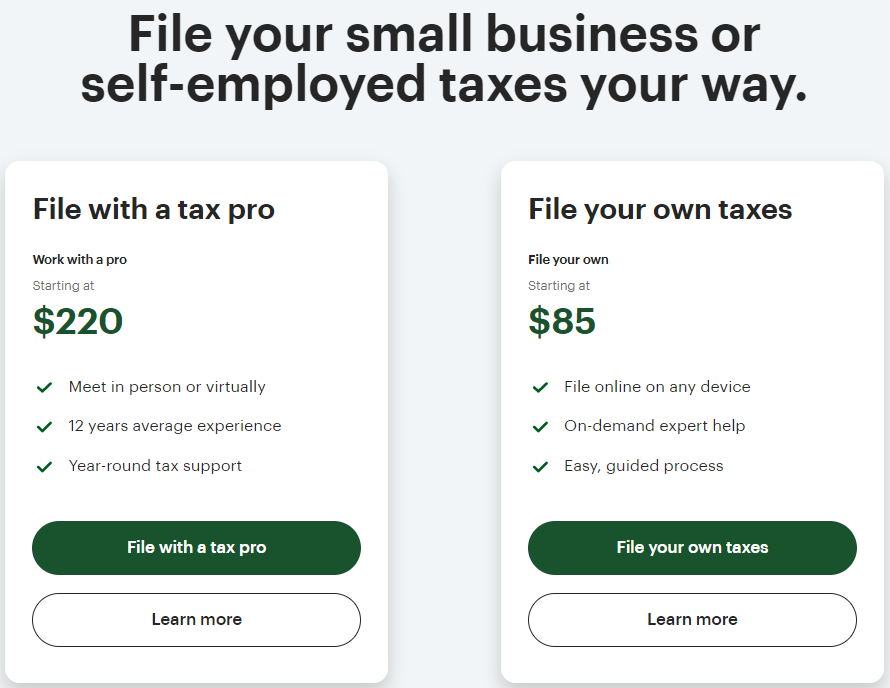

File with a tax pro

This is a paid tax service that lets you recruit the help of a tax professional to get your taxes done correctly. If you choose this plan, you’ll pay one of H&R Block’s 60,000 tax professionals to fill out your tax returns for you either virtually, in person at an office location, or by dropping off your tax documents at an office. If you want to be part of the process, visiting an office might be your best option because this will allow you to sit with an expert to get your forms filled.

Otherwise, filing online or dropping off your tax forms and letting the tax pros take over will save you a ton of time. You’ll only need to meet with them if they have questions and you’ll be able to review your returns when they’re done.

You can file individual income taxes or small business taxes with a tax pro.

Small business

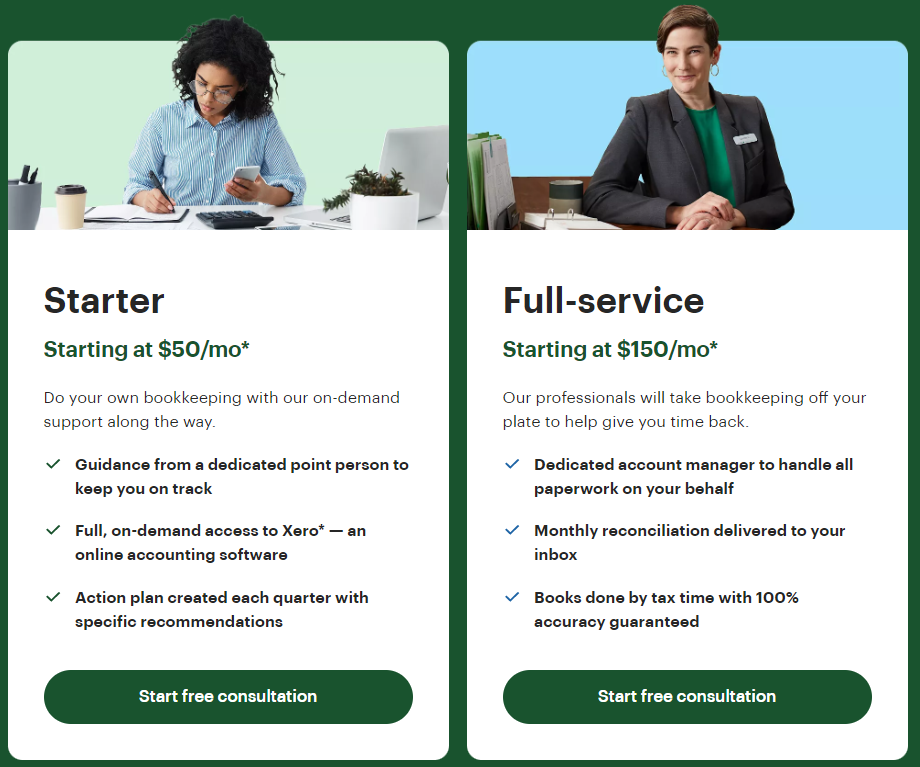

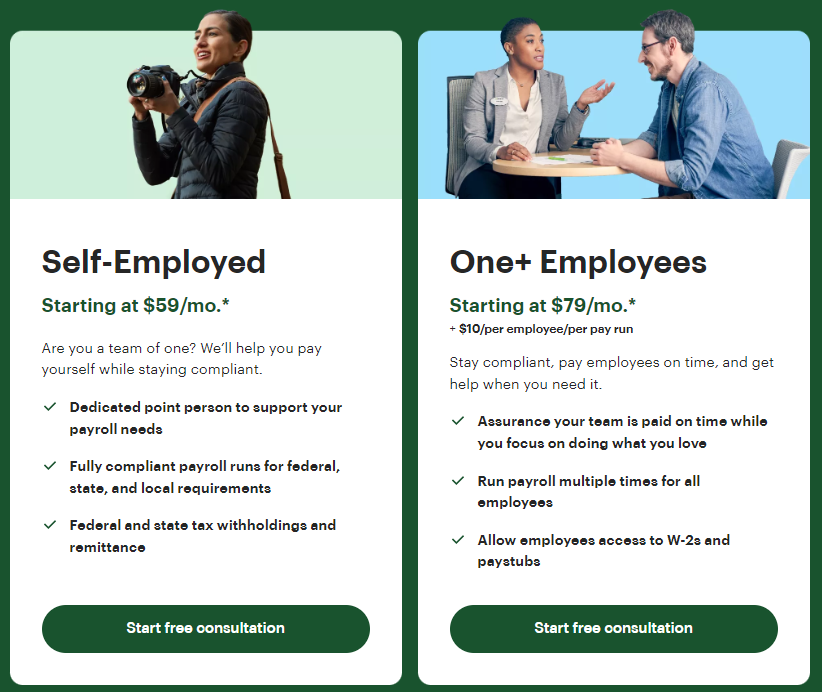

H&R Block offers a variety of tax solutions for small business owners besides online plans and downloads for filing returns. They also provide small business tax preparation, bookkeeping, and payroll services.

Small business tax preparation lets you pay a pro to file your taxes. You’ll pay a one-time fee for this while bookkeeping and payroll services are charged monthly.

Small business bookkeeping includes professional help with consolidating your business transactions and reviewing your books. The starter plan for this service costs $50 a month and the full-service plan costs $150 a month. The full-service plan comes with more ongoing support and quarterly check-ins leading up to tax season.

Finally, small business payroll services focus on helping you stay compliant and make sure everyone gets paid on time. You’ll use the Self-Employed payroll plan if you work for yourself and the One+ Employees plan if you run a business with employees on your payroll. The Self-Employed plan costs $59 a month while the One+ Employees plan costs $79 a month plus an additional $10 per employee.

Expat tax services

If you’re a U.S. citizen living permanently or temporarily overseas or you are a non-citizen with a Green Card, you can use H&R Block to file your U.S. expat taxes internationally. It’ll cost you $99+ to file on your own (plus $49 for each FBAR report) and $199+ to pay for a tax professional to file for you (plus $99 for each FBAR report).

It’s worth noting that not many tax software providers offer so much support to internationally-based filers.

H&R Block software downloads

Another route for using H&R Block to get your taxes done is with just the software. Many people choose to purchase software downloads instead of paying to use an online filing platform either because they’re not comfortable filing through an online platform or because they find software downloads to be more convenient or affordable.

Here are the downloads available with H&R Block.

Basic – For simple tax returns, ideal for W-2 employees and families. $29.95 full price for federal filing plus an additional $39.95 for each state program (download needed to file for one state) and $19.95 for each state e-file (individual state tax return).

Deluxe – For tax returns with itemized deductions, mortgage interest and property taxes, and investment income. $54.95 full price for federal filing plus an additional $39.95 for each state program and $19.95 for each state e-file.

Premium – For tax returns with rental property income, investments, and self-employed income. $74.95 full price for federal filing with one free state program included and an additional $19.95 for each state e-file.

Premium & Business – For complex tax returns with business expenses and more. $89.95 full price for federal filing with unlimited business returns and one free state program included, and an additional $19.95 for each state e-file.

Features and benefits

H&R Block offers a variety of other services and tools for filing taxes, some of which are free to everybody and some of which cost extra.

More services

On top of software and professional preparation, H&R Block also offers a few optional benefits you can add to your tax package or purchase on their own for extra review, protection, and support with your taxes. Here are a few of these.

Tax Identity Shield – Identity protection and restoration for those filing taxes online.

Second Look Review – This service lets you have a tax professional look over your past three tax returns to identify missed opportunities for deductions and credits.

Peace of Mind – Extended protection for your tax return for guaranteed support from H&R Block if the IRS requests adjustments or additional info.

Audit & Tax Notice Help – Resolution services for help with IRS audits and more.

Live help

Free help from H&R Block tax professionals is not included with software downloads or online plans. You’ll need to pay at least $70 extra for this.

Online Assist lets you make unlimited calls to a tax professional and share your screen as you work so they can help you in real-time. There is no additional fee for help with state filing.

Live help is included for free by some tax software platforms.

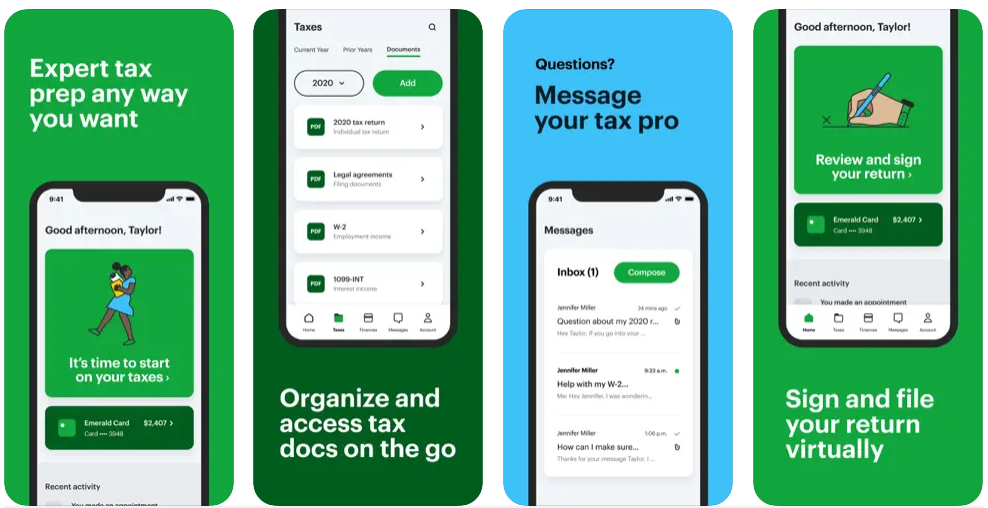

Mobile apps

The main H&R Block mobile app is called MyBlock and it’s available to both Apple and Android users. The overwhelming majority of user reviews for this app are positive, with many people praising its functionality and preferring this app to other tax prep apps. You can use MyBlock to schedule meetings with tax pros and upload your tax forms. This app is mostly for beginning the process of doing your taxes and choosing products and services.

But H&R Block has another mobile app as well called the H&R Block Tax Prep app. This app is similarly well-rated and designed for checking on your refund status and actually preparing your tax return. It’s mainly for organizing your documents and filing your taxes.

Emerald accounts

You might not have known this, but H&R Block offers a few banking products called Emerald accounts too. These are the Emerald Card, Emerald Advance, and Emerald Savings accounts. You’ll use the MyBlock app to manage these.

Emerald Card

The H&R Block Emerald Prepaid Mastercard is a prepaid debit card with all the functionality of a regular prepaid card that you can use to receive your tax refund and more. You can reload it as many times as you want with direct deposits, checks, transfers, etc. but there is a $4.95 cash reload fee.

This card is required for the Emerald Advance account and can be linked with the Emerald Savings account.

Read more: Best prepaid cards

Emerald Advance

Get a line of credit of up to $1,000 with an H&R Block Emerald Advance account. If approved, your money will be loaded onto an H&R Block Emerald Prepaid Mastercard for easy access and you can borrow up to the maximum limit of your line of credit and continuously pay it off.

You do not need to use H&R Block tax software to be approved for this account, but if you do file with H&R block, you can elect to use your tax refund to pay off your Emerald Advance balance. Alternatively, you can use another payment method such as a debit card transaction or ACH transfer.

The minimum payment for this is the greater of $25 or 4% and there is a $45 fee for all accounts. The current APR is 35.9%.

Emerald Savings

The H&R Block Emerald Savings account is a savings account that requires a minimum opening deposit of $25. You need to visit an office to apply.

This is a pretty lackluster savings account all-in-all. Check out the link below for great alternatives.

Read more: Best online savings accounts

Max Refund Guarantee

H&R Block will work to save you money by helping you to get the greatest tax refund possible and lower your tax obligation, whether you do your own taxes or pay someone to do them.

A lot of tax preparation platforms and software offer this, but the fine print can be a little different for each.

For H&R Block, if you find out after filing that you were entitled to a greater refund than you received using their tools, you can request to be reimbursed for any fees you paid to purchase software downloads and then use their tax software at no cost to re-file. H&R Block will not refund you if the reason you didn’t get your full refund was a result of your own doing, such as a mistake you made on one of your tax documents or a deduction you forgot to claim.

That said, you may be eligible for reimbursement of up to $10,000 if you’re penalized by the IRS due to a calculation error made by H&R Block’s software.

Other guarantees

H&R Block uses a number of other guarantees to build consumers’ trust in its products and services.

Audit Support Guarantee – This guarantees support with any requests made by the IRS after filing so you understand what’s being asked of you.

100% Accuracy Guarantee – If you file with a pro, this guarantee promises reimbursement of any and all penalties or interest you’re charged for errors. If you file online, this guarantee promises reimbursement of up to $10,000 for penalties and interest.

100% Satisfaction Guarantee – This guarantees your satisfaction or your money back for any purchases you made or preparation services you paid for.

No surprise Guarantee — This guarantee means that you won’t pay hidden fees when you file with H&R Block. Specifically, it promises four things: Transparent Pricing, Transparent Process, Free Audit Assistance, and a Free Midyear Tax Check-In. If you feel that you missed out on any of these, you’ll get a discount of 20% off on next year’s tax filing.

Who is it best for?

H&R Block is a good choice for a lot of different types of tax filers, especially those who want flexibility in how they file and lots of choices for add-ons and extras. Here are four types of people who should consider using H&R Block to file this year’s taxes.

Small business owners

H&R Block is a good choice for freelancers, business owners, and people with side hustles because you can get help with your taxes and even just general business management. All self-employed services are reasonably priced for how much support you can do and surprisingly easy to use.

Online filers

H&R Block’s online platform is intuitive and user-friendly, making it perfect for first-timers and people who have used other providers in the past. The applications take you through questions to get to know your tax situation and help you understand what credits you might qualify for.

In-person filers

If you like the idea of making an appointment to talk through your taxes with a professional, H&R Block is going to be one of your best options. Check to see if there is an office location near you.

Expats

For people filing U.S. taxes internationally, H&R Block offers solid services at fair prices. This is unique for a do-it-yourself tax software provider.

Who is it not ideal for?

H&R Block isn’t a good fit for everyone who needs to do their taxes. Here are a couple of people we don’t think would prefer this provider over others.

People who want live support

If you know you can handle filing your tax return without help, not having access to free live support won’t be an issue. But if your tax situation is complicated and you want one-on-one help the moment you need it, you can find it priced better elsewhere. H&R Block tax pros also won’t be able to provide accounting support or legal counsel.

Budget filers

H&R Block’s prices are generally competitive and fair, but they’re not the lowest you can possibly find. If you’re used to filing your taxes for free, you might think H&R Block is too expensive. Especially if you need to add on additional services or file multiple state tax returns, you’ll find yourself paying more with this provider than you might like to.

Just keep in mind that the more complicated your tax situation is, the more any tax software provider will charge you.

How much does H&R Block cost?

H&R Block is not the cheapest software out there and it’s also not the most expensive, with middle-of-the-road pricing that falls somewhere around average for a good balance of value and features.

For e-filing online, you’ll pay anywhere from $0 to $110.

H&R Block Free Online – $0 for federal returns with no added cost for state returns

H&R Block Deluxe – $55 full price for federal returns and $37 for each state return

H&R Block Premium – $75 full price for federal returns and $37 for each state return

H&R Block Self-Employed – $110 full price for federal returns and $37 for each state return

Software – For software downloads that include federal filing, prices range from $29.95 to $89.95 for base packages and may cost an additional $39.95 for each state download and $19.95 for each state e-file

Live support – Unlimited online expert help starts at $70 full price

Tax preparation – Prices start at $80 for individual full-service preparation and $220 for small business self-employed preparation

H&R Block almost always runs promotions a few months in advance of Tax Day discounting software, online services, and extras. On average, you can save around 30% to 40% during sales.

The competition

Even if H&R Block is sounding like a good fit, you might want to know how it stacks up against its most similar competitors. See how H&R Block compares to TurboTax and Cash App Taxes below.

H&R Block vs TurboTax

TurboTax and H&R Block are similar in a lot of ways, but you might prefer one over the other depending on your budget and tax situation.

Backed by a strong reputation, TurboTax is the most popular tax software offering the gold standard of tax filing with a wide range of plans and various levels of support.

- Clear user experience

- Quick and easy importing

- Offers different levels of expert help

- Tax Return Lifetime Guarantee

- Pricing can be more transparent

- Cost more than some alternatives

When you compare just the platforms and mobile apps, the user experience is much the same between the two, and likewise for customer satisfaction. But when you compare all products side-by-side, H&R Block has slightly lower prices and packs just a little more coverage into its free plans.

If you have a lot of deductions, you might prefer TurboTax’s platform for itemizing and claiming these. But otherwise, H&R Block has excellent free and paid options for filing your taxes with confidence.

H&R Block vs Cash App Taxes

Another popular choice for e-filing, Cash App Taxes is known for being free for filing state and federal taxes. But compared to H&R Block, the Cash App Taxes platform is incredibly simplistic.

Cash App Taxes, formerly Credit Karma Tax, has a unique competitive niche. It’s the rare online tax service that lets you file simple and complex returns fast and easy for free — no paid tiers and no surprise fees.

- Free for multiple tax forms and schedules

- Great mobile app access

- Simple interface, layout, and navigation

- Limited customer support

- No multiple state returns

The simplicity with Cash App Taxes could be a good thing if you’re trying to get your taxes done as quickly as possible, but it can make it more difficult to maximize your refund and get support.

If your tax situation is very simple and straightforward, you might be able to use Cash App Taxes, but everyone else will probably require a more robust platform like H&R Block.

Summary

H&R Block is an all-around great tax preparation provider with a lot to offer those with simple and complicated tax situations alike. But especially for small business owners, investors, and expats, this software service is better than most. H&R Block also stands out for giving tax filers more options in terms of how they file and how much they pay, with a superior free online plan that’s comprehensive and easy to use.