Public is a investing platform that’s a great fit for beginning investors with low trade minimums and commission-free trades. Simple and valuable features, such as themes, a library of educational resources and fractional investing make buying, selling and owning stocks something that anyone can do and learn to understand.

With Public, you can invest in stocks, ETFs, options, bonds, Treasuries, crypto, music royalties and alternative assets—like vintage Pokémon cards and art from Banksy—all in one place.

Since 2006, our editorial team has taken the time to publish comprehensive reviews covering investment platforms to help our readers decide between investment accounts that align with their investment goals. Our methodology on the top brokers and investment apps includes factoring in account types offered, relevant minimums, account deposits and withdrawals, associated costs, level of investing features and an overall ranking of trading experience while keeping those new to investing in mind.

Key facts

- Public is a commission-free stock trading mobile app that works well for beginner investors.

- The range of investment offerings include stocks, ETFs, crypto and alternative investments.

- There’s a High-Yield Cash Account with no fees offering a competitive 5.1% APY with up to 5M FDIC insurance.

What is Public?

Public launched in 2019 as an investing platform with the highlight of commission-free, real-time fractional investing. But many of you may be familiar with its formerly-used title, Matador, one of the giant pioneers of investing products.

At its basis Public serves as a platform to invest in stocks and ETFs but beyond that there’s crypto, Treasuries, alternative assets and even music royalties. There’s a High-Yield Cash Account offering rates competitive with the top savings accounts and features like AI-powered insights.

The range of investment offerings and features from Public are plentiful, but it’s still pretty intuitive even to new investors. Part of that is because there’s a social feed with millions of active Public members sharing ideas and potential investment opportunities.

We’ll break it all down in our full Public App review.

Pros & cons

Pros

- Commission-free trading — You can trade U.S. stocks and ETFs commission-free during normal market hours and you won’t pay fees for ACH transfers or wire transfers to fund your account.

- Fractional trading — Public is built on the concept of commission-free fractional investing. Whether you’re interested in stocks, ETFs, crypto, or other offerings from Public, you’ll be able to purchase fractional shares to better diversify your portfolio.

- Plenty of support — Public offers both in-app chat support for technical and account questions as well as a few ways to engage with other investors in a community and even companies to help inform your strategy.

- Lots of information — Public provides a variety of resources that can be useful to investors of any experience level. From general best practices and basic terms to advanced trading techniques, there’s educational content for everybody.

Cons

- Does not include all account types — If you’re looking to save for retirement through a tax-advantaged account, like a Roth IRA, that’s not supported with Public. You’re limited to an individual taxable account.

- No mutual funds — You can buy ETFs with Public but there’s no mutual funds offered like you would find on a more traditional brokerage, like Schwab or Fidelity.

How do you open a Public account?

Opening an account with Public can be done relatively quickly with an experience offer that’s pretty easy-to-navigate, even for beginning investors.

Download the app

The Public app is available for both iOS and Android devices, and new and improved versions are constantly released. In my mind, that’s definitely good news for users. Public members can also manage their portfolio and participate in the social community from the web on their computer if that’s preferred.

Create your investor profile

Once you’ve download the app or are using Public with your browser, the next thing to do is answer a few basic questions to submit your application. This step involves filling out some information about yourself, like your age (18+ only), social security number, and bank information.

Fund your account

Once you’re all set up then it’s time to fund your account. Public uses the nation’s largest bank connection provider, Plaid, to enable you to connect your bank account to Public and make a deposit. That covers all major banks and financial institutions, but if your personal bank isn’t listed then you can connect through Micro Deposits.

One unique funding option with Public is that it lets you transfer funds using your linked debit card. You can deposit up to $2,500 with this method. And, though Public is an option for modern beginning investors, there are also some old-school options: mailing Public a check or initiating a wire transfer.

What does Public offer?

You expect stocks and ETFs (exchange-traded funds) but there are more investment offerings with Public. There’s also a high-yield cash account that earns interest. Here’s what Public offers.

Stocks

Public has thousands of stocks to choose from. Think Apple is the best stock to buy? You can do that with Public. This includes categorization into different categories called themes (more on those later) so you can discover new companies in terms that reflect how you actually experience the world.

You can pick a category, browse through the list, and select a company that looks interesting. Public has a lot of information on each company, including trends, comments, and company history.

ETFs

Public does not offer mutual funds (which are priced once a day at close) but does offer ETFs on the Public platform during regular market hours and during extended-hour trading. Rather than buy a basket of individual stocks, you can diversify your portfolio with entire sectors with one ETF.

Investing tools for ETFs with Public include helpful fund information, automated recurring purchases, price alerts and the passive reinvestment of dividends back into the fund that paid them out.

Treasuries

Treasury bills or T-bills offer another way to invest that has advantages over both savings accounts and riskier assets. With a Treasury Account on Public, you can potentially earn higher yield than you would in a high-yield savings account. As of January 29, 2024, you can earn a 5.2% yield.

Another benefit of these over savings accounts is that your rate is locked in after you sign up, but you still maintain access to your money and can sell your bill if you need the cash. Plus, you don’t have to pay state or local taxes on the income you generate from Treasury bills.

Accounts are held in the custody of The Bank of New York Mellon—the world’s largest custodian bank and securities services company. Treasury bills are backed by the full faith and credit of the U.S. government. For this reason, they’re generally considered to be very safe investments. Balances below $500k with the custodied bank are covered by SIPC insurance.

Short-term debt securities like this can give investors cash access with a very low risk of depreciation. They don’t offer as much earning potential as assets like stocks and ETFs, but they’re also much less likely to decrease in value. You’ll pay a flat management fee of .05% (5 basis points if you’re feeling fancy) on your balance every month to Jiko Bank, which manages Treasury accounts for Public. Fees are deducted automatically from your account.

Bonds

With Public, you can buy corporate, Treasury, and municipal bonds. The Bond Screener lets you explore options based on highest yield, highest coupon, shortest term or just see which ones at the most popular at any given time. Public also includes key financial metrics on every corporate bond page including free cash flow and debt-to-equity ratio.

So, if you’re looking to add bonds to your portfolio to counter the potential volatility of stocks, then diversifying a small percentage in bonds through Public to round off your investment portfolio may be right.

Crypto

You’re able to buy, sell, and hold crypto 24/7 through the Public app in fractions of coins on a secure platform. For crypto beginners especially, there’s some added context in the way of stats and news to help guide your way. Those with Public Premium get more customized crypto price alerts and access to advanced metrics.

Check out the assets directory if you’re looking for anything in particular but cryptocurrencies include Bitcoin, Dogecoin, Litecoin, Ethereum Classic and Ether. Order sizes range from a minimum of $1 to a maximum $100k with an order limit of $200k on multiple orders.

There is a fee Public is pretty transparent about that’s charged by the service provider, Bakkt Crypto, includes a flat fee schedule for amounts under $500 and then goes to max transaction fee of 1.25% of the order amount for anything over $500. You’ll need an account directly with Bakkt Crypto (since they handle the execution and hold your assets) but you can review your holds and submit orders on Public.

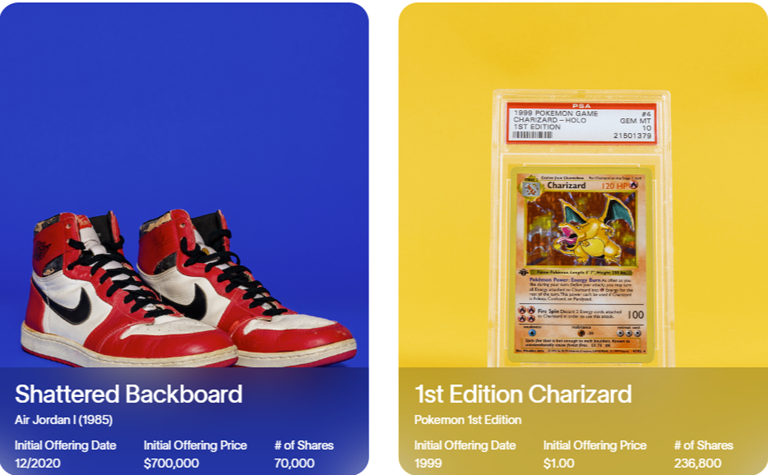

Alternative investments

- Buy shares in a new IPO of an alternative asset or purchase shares of assets that are already active from existing Public members.

- Manage these as you do stocks, ETFs and your crypto holdings with Public.

- Sell your shares when you believe it’s time, potentially earning a profit. You can also potentially profit if Public sells the underlying asset.

Investing in alternative assets or “alts” differs slightly from investing in traditional assets like stocks. Instead of buying a share of a company or putting money into an index fund, you could be investing in a limited-edition pair of shoes or a trading card. The idea behind investing in alts is that they have reduced correlation with the stock market and therefore not as vulnerable to some of the risks of traditional investing, providing diversification. They may also be viewed a hedge against inflation.

All alternative assets on Public are pre-selected by experts. Recent alts include a PSA 10 Gem Mint 1st Edition Charizard, an autographed rookie card of Lebron James from SP Authentic and the original “Shattered Backboard” dual-signed Air Jordans photo-matched to the time Michael Jordan went to Italy and shattered a backboard in an exhibition game. They’re items cool to consider investing in or even just taking a look at. Like stocks, you can purchase fractional shares, so you don’t need to have a lot of money to get started.

Royalties

Royalties are probably an asset class you don’t normally run across on investing apps. These are the payments received from the use of intellectual property, like popular music. These IPO on Public similar to how their alternative assets do and can be traded on their secondary market. They’re advertised as passive investments, delivering any income from royalties back to investors on a quarterly basis.

The headlined offering through Public was Shrek Franchise Original Music with historical earnings sources that includes streaming audio and video.

Options

Options are one of Public’s more recent additions. Those who activate a lifetime rebate by March 31, 2024 will get a rebate per contract traded (along with no commission fees or per-contract fees).

Public features an Options Hub specifically to monitor all your options positions and a comprehensive strategy builder to plan trades. This includes interactive profit and loss charts to weigh risk versus reward on the potential outcomes.

Public High-Yield Cash Account

Public offers another way to earn aside from returns on your investments. You can earn 5.1% APY with the Public High-Yield Cash Account. This counts as a secondary brokerage account where you can store your funds and earn interest with zero fees. There’s no subscription required for this, no minimum balance to keep (or maximum to limit earning), unlimited transfers and unlimited withdrawals with this account.

I’ve got to say, that’s another huge game-changer for most of us at a very high rate that competes with some of the best high-yield savings accounts available today. This account also provides 20x the $250,000 of FDIC coverage a savings account does because Public partners with 20 banks to provide combined coverage of up to $5M.

And the best part? You can move funds from your high-yield cash account to your brokerage account with Public and trade instantly.

Public features

Obviously, the biggest selling point for Public is the ability to buy stock in any company regardless of the share price. But there are some pretty neat features (some more revolutionary, others common nowadays) that stood out while I was researching and reviewing this company.

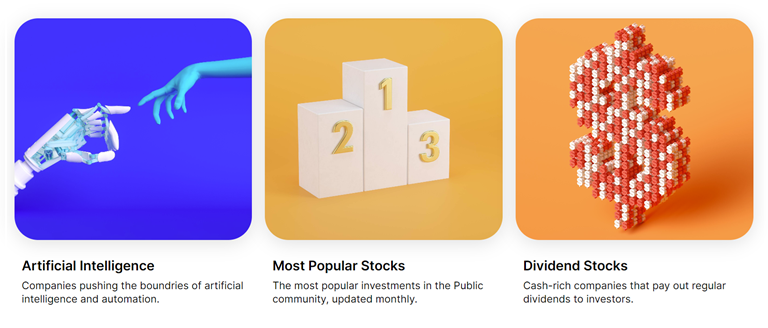

Themes

Public has done something that I personally really like — it organizes stocks into themes that are basically more user-friendly categories. So, if you are passionate about companies with female CEOs or Artificial Intelligence, for example, you can browse these sections and invest in a company that is meaningful to you according to the theme.

To just give you a ‘taste’ of some of Public’s themes, these include: Space Exploration, Tech Giants, Fighting Disease, Media & Entertainment, Gaming & eSports, Food Delivery, Sports and Dividend Stocks. The last of these includes companies that pay a dividend like Johnson & Johnson and Verizon.

Social aspect

True to its name, Public has a large community forum where traders can comment and ask questions about all things trade-related; people can weigh in on their own experiences, or ask questions of others with direct experience in the category. For sure, the social aspect/layer helps investors, new and veteran alike, get more info, feedback, and insight into smart trading.

For me, Public’s social feed has been a real game-changer because financial institutions have historically seemed to be closed off when it comes to the free flow of information on companies and investment approaches. The fact that you can follow people to see their portfolios and what they’ve invested in recently is great because several of the members are industry experts. So you can really get some good information from these forums.

What I really like about this angle of investing is that you’re not going it alone. As I’m sure you know, investing can be somewhat of a no-man’s land – a jungle where it’s every person for themselves. This is great for aggressive investors who know the ropes, but it can be intimidating for newbies and scare people from even trying to invest. But I’d definitely say learn who is reliable before you make any major investments based on a “tip.”

Public’s Town Hall

If you want a chance to engage directly with executives of the companies you are investing in, Public offers Town Halls where you can submit questions via Public and get answers as leaders respond to investor questions via live, text-based events. These are insights and opinions, not direct investment advice.

Investment Plans

An Investment Plan with Public allows you to automatically contribute on a recurring basis. There’s a wide variety of plans for different investing styles and risk tolerances. And, if you don’t find one for you, then you can personalize your own Investment Plan with up to 20 stocks, ETFs and crypto.

Why automate your investments? It helps take the emotion out so you consistently keep buying while spreading your investment over time. This is a form of dollar-cost averaging, an alternative to lump-sum investing. Take note: there’s a fee per symbol for this more-passive plan with Public unless you have Public Premium (which saves the fee on stocks & ETFs).

Alpha

Meet Alpha by Public, their AI powered tool, allows you to ask any question about a stock, analyze assets and get real-time context on investments. This plugin for ChatGPT provides the latest in market data and analysis (not advice) that Public offers.

Here are some ways you can use this tool (currently still in prototype):

- Find the top movers, gainers and losers on the market on any given day.

- Have a stock’s recent daily headlines summarized.

- Have an earnings call summarized for you right after it’s released.

- Get insight on historical earnings data, plus the current positives and negatives of a stock.

The main goal with this AI tool from Public is to be able to get insight on financial information in real-time to aid your investing journey.

Fractional investing

The traditional stock market model works like this: To buy a share in a company, you pay the full amount of a share (or however many shares you want) and receive that percentage of the company as your own.

Public, as an app designed for beginners, came out swinging in 2019 and offers commission-free real-time fractional investing for stocks and ETFs. That means you invest what you can afford, rather than how much the total share is quoted to cost. So, if you have $100 to invest (or as little as $5), then you can buy a slice, or piece, of one share in Google. This way, you are investing in the stocks of companies and ETFs you want without the limitation of a high entry barrier.

The Public app offers automated dividend reinvesting (DRIP) meaning dividends you receive from a company or as an investment in an ETF can be passively invested back into the shares of the same investment. The big plus for those that invest fractionally is that this also applies to you as dividends will just pay out and re-invest relative to the partial portion.

Referral program

One of my favorite things about Public is the generous referral program. Public rewards you when you refer your direct family/friends via your Public referral code and they deposit at least $1,000. And the reward? $20 in an asset of your choice (subject of course to relevant terms and conditions).

International availability

A long negative since launch of Public was that it was for users in the United States only. That changed when Public launched in the United Kingdom with 5,000+ U.S. listed equities and no commissions during regular trading hours. This included the same commission-free trading (with no foreign exchange fees) during regular hours but a reasonable 0.30% fee on deposits and withdrawals.

Educational resources

The “Learn” section from Public includes a number of articles that can provide educational content on the essentials of investing. Here are some recently published pages:

- Penny Stocks: What are they and do they make good investments?

- What Is a SPAC Stock? Special Purpose Acquisition Companies Explained

- PSA Grading & BGS Grading: A Guide

Outside of the newest and top articles, there’s information on the stock market, options, fixed income, retirement, IPOs, crypto, alternative investments and investing in general. Each stock also has a news feed so you can keep tabs on the latest financial information or see what others are discussing about it.

In-app chat support

In-app chat support might not seem like a big deal at first but wait until the first time you hit a bump in the road on your investing journey. Then, you’ll definitely be glad that Public has this feature. Chat support is available to answer all of your investing questions as well as manage technical hiccups for you.

You can also contact Public through web chat, email, their social media accounts and through the mail.

Fees and other costs with Public

Public as an app to download and use is a totally free investing tool with no account minimums and no fee for account maintenance, which is great if you’re just starting out investing or have a little bit of cash to spare.

All users receive commission-free trading on stocks and ETFs during normal market hours. Trades during extended hours are charged $2.99 per trade (but free for Premium members).

They do have fees for other investing services:

- Cryptocurrency – 1.25% or a max flat transaction fee depending on order amount.

- Alts – 2.5% commission per transaction with additional fees noted in offerings.

- Investment Plans – $0.49 to $1.99 transaction fee (stock symbols free for Premium), above crypto fees apply.

- Treasury Account fees – 0.05% per month based on the average daily balance.

- Bond transaction fees – $0.1 to $0.5/per $100 depending on type of bond and time until maturity.

And there are a few other fees, including some advanced services:

- Inactivity fee – $5 every 6 months if inactive by Public standards.

- Domestic wire transfer out of Public – $25.

- Domestic overnight check delivery – $35.

- Returned check, ACH, Wire or recalled/stop payments – $30.

- ACAT outgoing – $75.

- Paper statements/confirmations/check requests – $2 to $5.

You’re not charged for ACH of money to or from your Public account, e-delivery of account statements or tax forms or confirmation of every trade you submit delivered electronically.

Here’s the full Public fee schedule to get insight on other fees you may be charged. What I found to be very generous was Public’s transfer policy when transferring funds from another brokerage. Public doesn’t charge a fee for this service, and what’s more, if the original brokerage does, Public will probably cover the costs for you.

Public Premium

For those looking for more support with their investing strategy and additional options to customize and manage their portfolio, Public Premium might be the way to go. The basic version of Public is free to use, but the paid membership tier version gives you access to everything Public has to offer as an investing platform. This includes (but is not limited to):

- Advanced stock and ETF reports to help inform your strategy.

- Unlimited, fee-free trades pre-market and after-hours, totally five and a half extra hours.

- Advanced portfolio management and comparison tools.

- Morningstar market reports and ratings, including bull and bear cases.

- Subscriber-only content including timely earnings breakdowns, Public Live content and editorial reports.

- White glove VIP treatment from Public Premium support team.

Public Premium costs $10 a month or $96 annually for most users but is free if you have a balance of $20,000 market value or more when signing up (terms and conditions of course apply). Your Public Premium subscription can be cancelled at any time if you decide it isn’t for you.

My experience using Public

Here was my first-hand personal experience using the Public app.

The interface was easy to use

Using Public was a dream compared to some investment apps I’ve used. To begin with, the user interface is clean and uncluttered. Unlike a lot of other apps that have so much going on that you get overwhelmed just by logging on.

Public had a ton of useful information

I also really enjoyed that Public loads up the app with tons of useful information. For example, I went to the themes section and scrolled down until I found a company I liked. I’m a shopaholic, so I browsed the eCommerce Theme to discover new companies that I didn’t even know traded publicly. Of course, Amazon was right there too.

I could’ve just invested my $10 into Amazon and walked away, but I like to know a little more about what’s going on behind the scenes. Public fuels that type of healthy curiosity by providing lots of background information.

I clicked on Amazon and read up on the latest market activity. Amazon’s doing well, and I was able to invest with more knowledge than I had before. Win-win.

Who is Public best for?

I’ve found that Public is an excellent tool that I strongly recommend for several types of investors. These are groups that the Public app is best for:

Beginners new to investing

If you’re new to investing then Public then the easy user-experience and themes for stocks is likely attractive. The social element, where you can read about other experiences and ask questions, can also be comforting as you start your own investing journey.

Those who want to invest with little money

Potential investors looking price per share of some stocks out there who want a piece can look into fractional investing with Public. You invest in a slice, or a portion, of a stock, ETF, Treasuries and/or corporate bonds. Members can also buy membership interests, or shares that provide partial ownership, in a range of alts including art, sports cards, entertainment collectibles and more.

Investors who want a multi-asset portfolio in one platform

Music royalties? Apple stock? A Stephen Curry Rookie Card? Bitcoin? A Hermes Birkin? Mike Tyson’s Punch-Out?! Investors looking to build a diversified portfolio they can track of multiple types of assets can consider Public as a top option.

With Public, you can invest in stocks, bonds, Treasuries, crypto, ETFs, music royalties and alternative assets all in one place. There’s also a high-yield cash account that earns a competitive APY while protecting your cash.

Who shouldn’t use Public?

But I will say that Public is not for everyone; I wouldn’t necessarily blindly recommend Public as the best online investor option for you.

Those looking for certain account types, like tax-advanced retirement accounts

Public does not offer joint accounts, margin accounts, or retirement accounts, such as traditional or Roth IRAs. You would be limited to an individual taxable brokerage account.

Passive investors

Despite the automation of Public’s Investment Plan, investors looking for passive investing may prefer one of the top robo-advisors. Robo-advisors invest passively based on your shared risk tolerance and investing goals. Acorns, a spare-change investing app, is a great example of how passive these can be as it rounds off your purchases and invests the difference.

Day traders

Public historically has not allowed the day trading of stocks. The platform limits the activities of accounts that engage in day trading or the same day purchase and sale of a security. Active traders who day trade should consider other investment platforms.

The competition

Far from a lone wolf, Public has a lot of competition in the online brokerage industry. Here are a few alternatives if Public isn’t the right fit for you:

Public vs Robinhood

One of the best mobile-friendly stock trading apps in recent years for new investors is Robinhood. There’s commission-free trading, no minimum deposit required and an offering of stocks, crypto, ETFs, and even IPOs.

Robinhood is a popular stock trading and investing app that offers zero-commission trades on thousands of investments, including stocks, starting with as little as $1.

With beginner-friendly features and easy-to-read charts, Robinhood is great for new investors and there's advanced features even more seasoned investors can appreciate.

- Commission-free trading

- Easy to use, well-displayed dashboard

- No obligation or minimum account balance

- No bonds or mutual funds

Robinhood lacks the social aspect Public does but overall we rank it as a better investment app across the board for all levels of investors. It’s approachable for beginning investors with its simplified trading experience, great for casual investors with the information it offers and works for advanced traders with access to margin trading and options.

You can open an account with Robinhood for as little as $1 and with their easy to use app begin trading right from your phone, including fractional shares, which are partial shares instead of whole shares.

Public vs Webull

Webull, a Robinhood alternative, is another popular brokerage that operates very similar to Public, offering crypto, interest on uninvested cash and skips over mutual funds.

There is a draw for beginner investors with Webull, but we believe it’s more for active trading or intermediate investors. There’s in-depth charting, advanced order types, detailed market data but if you’re a beginner just looking to buy and sell stocks, then all the widgets and screeners may just provide confusion.

Unlike Public, Webull does accept payment for order flow (PFOF), which means your orders can be executed slightly slower, resulting in possibly worse pricing (though likely negligible) than other brokers would provide.

Summary

Public makes investing a reality for everyone by combining commission-free stock trading, no account minimums and fractional shares into one intuitive app.

If you’re new to investing, have hesitated about investing because of the high price barrier, or are just looking for a simpler and (commission-free) way to invest with social elements, then you’ll definitely do well by opening an account with Public. Not every investing platform will let you connect with friends and experts.

Those looking for tax-advantaged retirement accounts or mutual funds should consider a more traditional online brokerage.

FAQs about the Public App

Is the Public App safe?

Yes, the Public App is safe. Public uses safe, legitimate and secure tools to protect your account and your data, including bank-grade security. Public (a registered broker-dealer with FINRA) is a member of the SIPC, automatically qualifying you for SIPC coverage to protect your assets up to a total of $500,000, of which $250,000 applies for cash. The High-Yield Cash Account provides 20x the normal $250,000 FDIC coverage with combined coverage of up to $5,000,000..

There are two caveats to note: These assurances don’t provide protection against loss of market value if you make an unwise investment and alternative assets may not be covered by the SIPC, depending on the asset.

How does Public make money?

In 2021, Public stopped accepting payment for order flow (PFOF), a previous source for revenue. This change means the potential better pricing on orders executed for Public customers They replaced this with optional tipping, which is presented as an option when submitting an order. Tipping is not required with Public.

Public also makes money through other methods, including their Public Premium membership, interest on uninvested cash balances and securities lending.

Should I open an account with Public.com?

Public.com offers much of what interests a typical beginner investor, including commission-free trading of stocks and ETFs. If you’re seeking to open an individual taxable account and would like access to other offerings that include a high-yield cash account, alternative investments, bonds and Treasuries then you may want to open a Public account.