Have you ever wished there was a way to earn more interest on your money than a high yield savings account pays, without investing in stocks? Bonds are a middle ground that sometimes provide better returns on your investment, but they come with risk.

If you’re willing to take a bit of additional risk, bonds may be just what you’re looking for. Today, we’ll be talking specifically about investing through Worthy Bonds.

What is Worthy Bonds?

Worthy Bonds is technically an offering of Worthy Peer Capital, Inc. It’s important to note that Worthy Peer Capital is not a bank and money invested with Worthy Peer Capital is not FDIC insured. This means that the money you invest could be lost if the investment fails. They are not an investment adviser, either.

Now that you know what Worthy Bonds aren’t, what are they exactly?

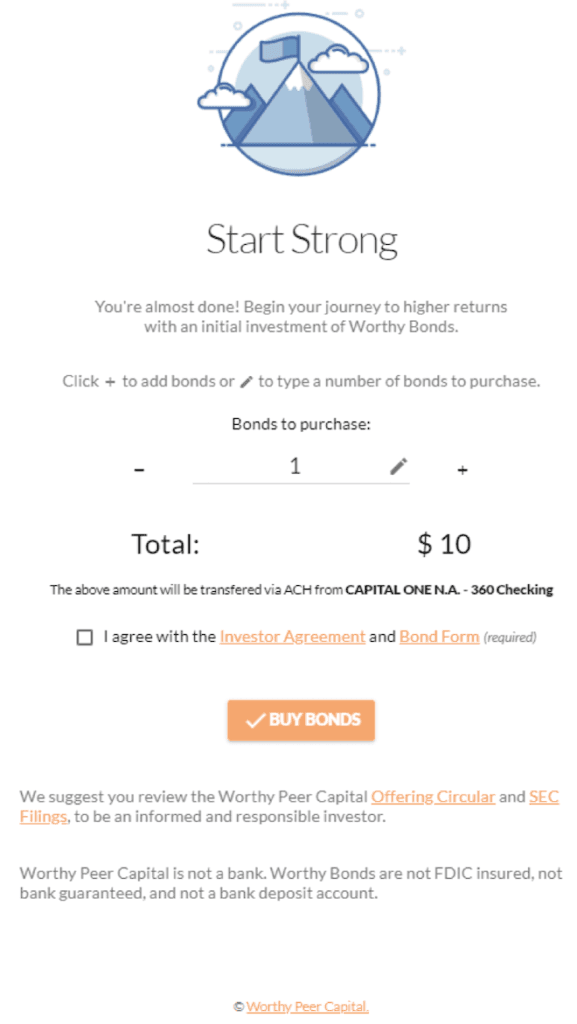

Worthy Bonds are paying 7% interest to investors. The bonds cost $10 each, which gives easy access to anyone that wants to invest in them.

Pros & cons

Pros

- Low initial investment — There’s a low initial investment of $10 to buy each bond. This allows almost anyone to invest in the Worthy Bond’s offering.

- High interest rates — Higher interest rate than you’d get in a savings account. Earning more interest on your money is always a nice benefit.

- You don’t have to be an accredited investor to invest — Many similar types of investments, such as real estate loan investing, requires you to be an accredited investor.

Cons

- Risk of loss — Since Worthy Bond’s aren’t a bank account, they aren’t FDIC insured or risk free which means you could lose money.

- Reports of paused withdrawals — Worthy Bonds has put out notices pausing redemptions on certain bond offerings in recent time. Users have occasionally reported trouble withdrawing their investments.

- Non-accredited investors are limited — Non-accredited investors have limits to how much they can purchase. While you can buy some bonds, you may not be able to buy as much as you’d like if you’re a non-accredited investor.

How does Worthy Bonds work?

So how exactly does the process work with Worthy Bonds and how can they pay 7% interest when high yield savings accounts do not even match that?

First, what is a bond?

First, a bond is a type of investment that has risk. If something bad were to happen, the bonds could decrease in value or become worthless. While this isn’t what usually happens, it is possible depending on a variety of circumstances.

How Worthy pays 7%

With that out of the way, here’s how Worthy Bonds manages to pay 7% interest. When you invest money in a Worthy Bond, the company takes the money you lend them and loans it to other companies. These other companies secure the loans with inventory or other assets, which means should a company default on their payments, Worthy Bonds could technically seize the assets to recoup their investment.

Worthy Bonds can pay 7% interest because they lend the money you invest in the bonds to other companies at higher interest rates. In an ideal world, if everything works right, Worthy Bonds makes a profit and you earn 7% interest on your money.

Features of Worthy Bonds

Round up purchases

Once you’ve successfully signed up for an account and made your first bond purchase, you can access a neat feature that helps you automatically invest. You can connect monitoring accounts, which are debit or credit cards.

Each day, Worthy Bonds grabs a list of your transactions from the account and rounds each purchase up to the nearest dollar. Purchases that end in $.00 will be rounded up one whole dollar. Once the rounded up balance reaches $10, Worthy Bonds will take $10 from your linked bank account and purchase a Worthy Bond.

The money doesn’t come from your monitoring account, though, so you’ll need to make sure you have enough money in your linked bank account to cover the round up transactions.

Withdraw at any time

After you’ve invested in Worthy Bonds, you should be able to withdraw your investment at any time with no penalties even though you may have purchased bonds on certain terms of time.

That said, withdrawals of more than $50,000 may take up to 30 days to process payment. Plus, at various times in recent years, many investors have reported a pause or delay in their withdrawals.

Fees

Worthy Bonds doesn’t charge any fees or penalties at all. They don’t charge transfer fees, reinvestment fees, early withdrawal fees, or any other fees you might see with another type of investment. That said, Worthy Bonds is still making money.

Of course, you will still have to pay any applicable state or federal income taxes you may owe on the interest earned from your Worthy Bonds investments.

Customer service

If you have any questions or run into problems while signing up for an account, Worthy Bond’s customer service team may help. While it appears they have a live chat functionality, it states their average response time is a few hours which is a bit disappointing.

However, if you aren’t afraid of picking up a phone, you can call 1-833-967-8491 with any questions you have.

Alternatively, you can email hello@worthybonds.com.

My experience signing up for a Worthy Bonds account

To sign up for a Worthy account, visit WorthyBonds.com and click “Get Started”.

Next, click “Get Started” again.

Start the sign up process by entering your email and setting a password for your account. Click that you agree to the terms of use and privacy policy.

Finally, click “Sign Up”. You’ll have to verify your email with a code.

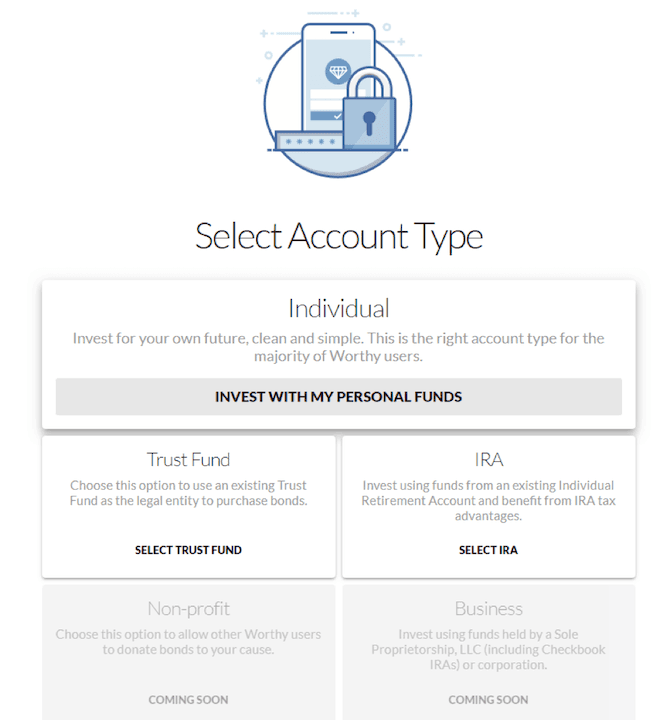

Next, pick the account type you want to open. You can choose from individual, trust fund, or IRA.

Fill out the requested contact information, Social Security Number, and Date of Birth fields.

Also agree to the terms of service and privacy policy of Dwolla, Worthy’s banking partner. Once done, click “Continue”.

Next, add a bank account so you can start investing. You can either use instant verification or microdeposit verification.

The instant verification option allows you to log into your bank account using your online banking credentials. This is a secure process and is the fastest way to verify your bank account.

If you’d rather not log in to verify your account, you can give Worthy Bonds your account number and routing number. Worthy Bonds will then make microdeposits in your account sometime over the next few days. Once you see the deposits, log in to your Worthy Bonds account and enter the amount of the microdeposits to verify the bank account with Worthy Bonds.

After you connect and verify your account (if necessary), you can make your first bond purchase.

Who can use Worthy Bonds?

Technically, anyone can invest using Worthy Bonds. That said, there are limitations for non-accredited investors.

Technically, an accredited investor is a person that meets at least one of the two following guidelines:

- Has a net worth of $1,000,000 excluding your primary residence

- Has an income of $200,000 ($300,000 for married couples) with the expectation of making the same or greater income this year

If you’re an accredited investor, you can buy as many Worthy Bonds as you’d like. If you aren’t, you can buy up to 10% of your annual income or net worth.

Who shouldn’t use Worthy Bonds?

Since Worthy Bonds are investments, you shouldn’t use the service if you can’t afford the risk of losing money. These bonds are not insured. While they state you can get your money out at any time, if the investment fails you could receive nothing.

This point about risk brings is especially concerned given some recent events with Worthy Bonds.

Paused redemptions with Worthy Bonds

Worthy Bonds put out a statement in mid-2022 they had to pause redemptions on Peer Capital I bonds. Worthy Bonds then put out another statement in mid-2023 about a pause on their Peer Capital II offering. This is somewhat worrying given the lack of initial communication and the repeat of events.

Users of various times as a result have seen a pause or delay with their withdrawals.

Competition to Worthy Bonds

Worthy Bonds doesn’t have a ton of direct competition at this time.

There are some real estate backed loan sites, but they aren’t the same thing. Instead, here’s how Worthy Bonds stacks up to two other types of investments.

Worthy Bonds vs high-yield savings accounts

The top high-yield savings accounts offer an FDIC insured place to stash your cash giving you more piece of mind in what you’re earning over Worthy Bonds. You have no risk of loss as long as you keep your balance below FDIC insurance limits (250K per depositor, per bank).

Unfortunately, that means you may get less of a return, as well. That trade-off is worth it for most people.

Worthy Bonds vs peer-to-peer lending

Peer-to-peer lending is another (riskier) option. Peer to peer lenders, such as Lending Club, allow investors to invest in personal loans made to individuals.

The return can be higher than the 7% return offered by Worthy Bonds, but unsecured loans to individuals are typically considered much riskier than asset-backed loans.

Worthy Bonds vs an investment account

Opening up one of the top investment accounts is not without risk but learning how to invest can be one of the best choices you can make to build wealth long-term. In the long run, a well-diversified stock portfolio should provide average annual returns between 5% and 8%.

Summary

If Worthy Bond’s $10 bonds that pay 7% interest sound interesting to you, definitely sign up for an account to learn more. Since the bonds are just $10 each, you can buy a couple of bonds easily to see if you’re comfortable with the investment and platform.

If you don’t like what you see, aren’t comfortable with the risk or seeing they’ve paused withdrawals at times, then consider some of the (safer) alternatives to Worthy Bonds instead.