If you’re a small business owner, accidents and mistakes are part of the job (but you don’t need me to tell you that). And while no one likes to think about the worst-case scenario all the time, you kind of have to if you own a business. Prepare for the worst, hope for the best, and all that.

Although getting insurance seems like a common-sense, must-have action item in any entrepreneur’s checklist, 44% of small businesses are uninsured.

Don’t be like them.

Small business insurance protects you in the event of a disaster and ensures your life isn’t, you know, ruined when something unexpected comes up. In this review, we’re going to take a look at an insurer that focuses solely on small businesses: Next Insurance.

What Is Next Insurance?

Next Insurance is an insurer providing coverage to small business owners and the self-employed.

With over 2,500 business categories and more than 30 insurance products to choose from, there’s really no type of small business Next Insurance doesn’t cover. After choosing your coverage, you can customize a policy to meet your needs and fit your budget.

Who Owns Next Insurance?

Next Insurance was co-founded in 2016 by Nissim Tapiro, Alon Huri, and Guy Goldstein, who serves as the CEO today. Before founding Next Insurance, Goldstein served as an executive with HP and Mercury Interactive. Previously, he founded the mobile payment company Check and sold it to Intuit for $360 million in 2014. Next is a private company.

How Does Next Insurance Work?

The first thing you need to know about Next Insurance is that everything you do is 100% digital. Insurtech companies like Next aim to make insurance more affordable and convenient by streamlining and digitizing processes like applying for coverage and filing a claim.

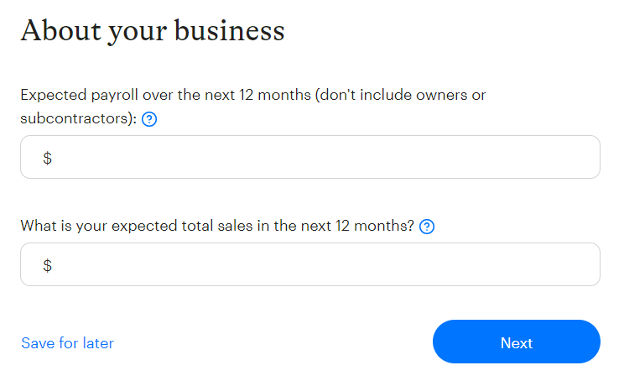

You’ll start by getting a quote for your small business insurance policy. Next claims this process takes seven minutes, so I set a stopwatch. From start to finish, it took me six minutes and 50 seconds to get a quote. Not too shabby.

Full disclosure: I don’t actually own a small business (yet), so I went ahead and made one up. My imaginary business is an Italian restaurant that serves the best penne alla vodka you’ve ever had (unless you’ve dined in Italy).

The application first asks what business you’re in to figure out what insurance coverage you need. I was recommended a business owner’s policy, which combines general liability insurance and property insurance.

Then, you’ll answer basic questions about your business, like who owns it, how many employees you have, if you have multiple properties, what it’s worth, etc.

I sped through the first six questions and then they got much more specific. For example, when I answered that “yes” I offer alcohol at my restaurant, I had to provide details about how I serve it. You don’t have to answer any questions that don’t apply to you.

Overall, going through the application was really easy. At the end of it, I received my quote, which I could then either move ahead with or keep shopping around.

Pricing for Next Insurance

Pricing depends on your business and policy. You can save by bundling, paying annually rather than monthly, and running a safe and low-risk business. Next Insurance claims their average customer saves up to 30% compared to traditional small business insurance. In my research I found this to be accurate.

When you get your quote, you choose from three coverage tiers. These are Basic, Pro, and Pro Plus. To give you a sense of how these compare, here were the coverage levels for general liability:

- Basic — $500K per incident, per year general liability and $500K per incident, per year professional liability

- Pro — $1M per incident, per year general liability and $1M per incident, per year professional liability

- Pro Plus — $1M per incident, $2M per year general liability; $1M per incident, $2M per year for professional liability

The price difference in my quote was surprisingly small. The Pro tier was less than 8% more than Basic for double the coverage. The Pro Plus tier was only 11% more than Basic.

You can edit or remove anything in your bundle. When you edit, click to expand “What’s Covered” and “What’s Not Covered” to see a detailed breakdown of your protection. You can also just pick recommended coverage — for me that was Pro Plus general liability and Pro property — or select “Basic” for minimum coverage on the whole bundle.

Types of Insurance

Here are a few of the most popular types of business insurance you can get through Next.

Small Business Insurance

For general liability insurance for any profession, start with a small business insurance policy and pick and choose the right coverage for your industry.

Restaurant Insurance

Own a business selling food? Next Insurance offers restaurant insurance for full-service restaurants, bakeries, coffee shops, food carts, grocery stores, personal chefs, and more.

Retail Insurance

Any type of retail business from eCommerce companies to convenience stores can be covered with a retail insurance policy.

Next Insurance Features

Choices and Customizable Coverage

With Next Insurance, there are a lot of insurance types to choose from. These include:

- General liability

- Professional liability (errors and omissions)

- Workers’ compensation

- Commercial auto

- Commercial property

- Tools and equipment

- And more

If you’re not sure exactly what you need, Next recommends what’s best for you. Coverage is also highly customizable. You get to pick and choose your protection before buying a policy.

User-Friendly Platform

Next Insurance has a fast and painless application and functional platform. You can file a claim in minutes, adjust your policy, or contact support from the site or app. Everything is nice to look at and equally nice to use.

Plainspeak

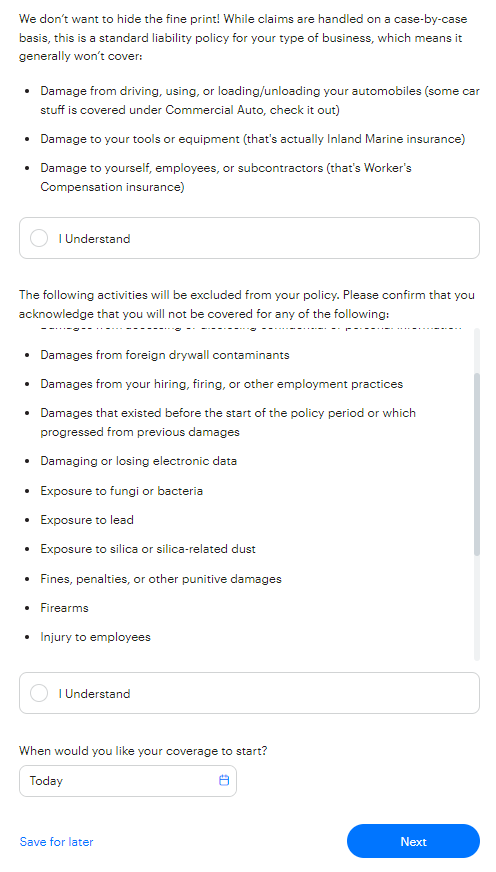

Next Insurance is better than most insurers at explaining what you’re signing up for. Pricing and coverage are laid out clearly with minimal insurance industry jargon. Plus, there are a lot of resources to help you understand your insurance needs, from their Business 101 eBook to their help center. I didn’t feel like I was being tricked at any point.

Customer Service and Support

The site has a chat function that’s available between 6:00 a.m. and 5:00 p.m. PT Monday through Friday. It starts as an automated system but you can also chat with an advisor. Alternatively, you can call 1-855-222-5919.

Business Insurance 101

If you want an eBook that basically spells out everything you need to know about business insurance, check out Next’s Business Insurance 101 (it’s free).

My Experience Researching Next Insurance

As a busy fictional restaurant owner, I definitely appreciated how speedy the process of getting a quote for small business insurance was. The questions were straightforward, clear, and quick to answer. I got my policy at the end of it without having to sign up for an account. That’s not a given with most insurance platforms.

Another thing I really liked was the transparency. Even before signing up for coverage, Next Insurance let me know exactly what would and wouldn’t be covered in my policy.

Then once I got to my quote, my standard liability policy outlined examples of common incidents in my industry that wouldn’t be covered.

Any time you’re dealing with an online platform, functionality is key. I intentionally tried to get lost on the Next site and couldn’t manage. Every page was pretty helpful and there are a variety of ways to get a quote, whether you start by searching your profession, choosing your coverage, or just clicking the big blue “Get Instant Quote” button at the top.

Who Is Next Insurance Best For?

Budget-Minded Business Owners

You won’t pay for anything you don’t need with Next Insurance. If you’re on a tight budget, you can choose basic coverage to make sure you’re protected but not overpaying.

Those Who Want the Convenience of Digital Insurance

If you’re a fan of technology and see the advent of digital insurance as a good thing, you’ll like what Next Insurance is about.

People Who Want to Bundle

You can save up to 10% by bundling two or more types of insurance coverage together, so Next is a great choice if you’re looking for a business owner’s policy (general liability and property insurance) or other combination of policies.

Who Shouldn’t Use Next Insurance?

You Want to Get Insurance the Old-Fashioned Way

If you prefer paper insurance certificates and working directly with an agent dedicated to your small business insurance needs, look into other options.

People With Larger Businesses

Next Insurance is best for small businesses. If you employ a lot of people, own multiple properties, or have complicated risk factors, this provider may not be for you.

Pros and Cons of Next Insurance

Pros

- Flexibility — You can customize your coverage and change or cancel it at any time.

- Convenience — File a claim, change your plan, and get support from your phone or computer.

- Affordability — Save on most policies and score more discounts by bundling and/or paying annually.

Cons

- Fully digital — This could either be an advantage or disadvantage for you depending on your comfort level with technology.

- Long processing times — Claims can take a while to resolve if there’s a lot of damage to cover.

Next Insurance vs. Competitors

If Next Insurance doesn’t feel like a good fit for you, check out some other small business insurance providers.

| Next Insurance | Progressive | Nationwide | |

|---|---|---|---|

| Application | Quick and easy, takes less than seven minutes | Fairly simple, takes about 15 minutes | Simple, takes about 10 minutes |

| Customization options | Add, remove, or modify coverage in your bundle after receiving your quote | Quotes from multiple insurance providers but cannot customize your liability or deductible | Quotes from multiple insurance providers but cannot customize your liability or deductible |

| Features | 100% online, bundle discounts, fast signup | 24/7 service, bundle discounts | Coverage for small and large businesses |

Progressive

To get a quote from Progressive, you start by choosing the type of coverage you need (general liability, professional liability, workers’ compensation, and business owners policy). You can’t select multiple options at this stage. The process is a bit more complicated than Next, with a lot of the questions being short-answer style rather than multiple choice, but it’s still pretty easy and took me about 15 minutes.

Insurance is provided through a Progressive partner agency. In my case, Insureon was recommended and I was taken to another website to select a policy. Once I got through the application, I received quotes from three different insurance providers but could not customize my coverage. I just had to choose one.

Nationwide

With Nationwide you start your application by selecting a businessowners policy, commercial auto, general liability, professional liability, workers’ compensation, or umbrella coverage. The application could be more broken up; some of the pages are pretty long and you can’t save until you’ve answered every question. But overall, it’s pretty similar to Progressive’s sign-up process.

I received two different quotes, one from Nationwide and State Auto and one from Nationwide and Markel American Insurance Company. I could not adjust the coverage for either policy.

Unlike Next Insurance, with Nationwide you can’t handle everything digitally; in order to buy your policy you have to call a representative and provide your quote number. That said, Nationwide Commercial could be a good fit for medium and large businesses, which Next doesn’t cater to.

Final Thoughts

Next Insurance offers convenient and affordable insurance for small business owners in a lot of different industries. Overall, it’s a great choice if you want to get affordable coverage for your business quickly and you’re comfortable handling everything online.