If you’re shopping for a new car, you’re probably browsing model reviews online, going on test drives, and consulting the resident car guy or gal in your friend group.

That’s the fun part.

The not-so-fun part is ensuring you get the best deal on insurance, negotiating the best price with dealers, and finding the best rate for an auto loan. But not to fear; I’ve got you covered.

In this article, I’m going to help you find the best auto loan. Because the stakes have never been higher; according to Experian the average auto loan amount was an eye-watering $39,540 in 2022 — up $4,000 from the prior year — and the average monthly payment noted as $648.

With prices so high, it’s never been more important to your bottom line to get the best possible deal on an auto loan.

Overview: Best auto loan rates

Best Overall: Consumers Credit Union

Best for Refinancing: LendingClub

Best for Convenience and Flexibility: LightStream

Best Big Bank: Bank of America

Best Overall: Consumers Credit Union

Lowest APR: 7.29% APR

Lowest APR: 7.29% APR

Loan amounts: $250 to $100,000

Term options: 12 to 84 months

Minimum credit score: None

The Kalamazoo, Michigan-based Consumers Credit Union is widely known for having friendly customer service, flexible terms, and above all: superb rates.

Admittedly, becoming a CCU member is a little tedious. You’ll need to upload a scan of your ID, two recent pay stubs, two recent tax returns, five references, two utility bills, and pay a one-time fee of *gasp* $5. But hey, at least you can do it entirely online.

And it’ll be worth it, since CCU offers incredibly flexible terms, with loan amounts ranging from $250 all the way to $100,000 (Porsche 911, anyone?). Heck, CCU doesn’t even charge a prepayment penalty, so you can pay off your balance and save some interest if you get a pay bump later.

Pros

- Some of the lowest APRs in the business

- Impressively flexible loan amounts and term options

- No minimum credit score

- Solid customer service

Cons

- Tedious membership application process for best rates

Best for Refinancing: LendingClub

Lowest APR (refinancing only): 4.99%

Loan amounts: $4,000 to $55,000

Term options: Up to 12 months extension on your existing loan term

Minimum credit score: ~600

LendingClub was originally best known as a peer-to-peer lending network that lets borrowers get their loans “funded” by investors.

LendingClub charges no prepayment penalty, offers a nice range of loan amounts, and offers a 15-day grace period for missed payments. Best of all, the minimum credit score to apply is just 600.

With above average rates and high origination fees, LendingClub is best for borrowers with fair credit who may otherwise have limited borrowing options.

- No prepayment penalty

- Range of loan amounts

- 15-day grace period on missed payments

- Restrictive loan terms

- Higher rates than some competitors

- Steep origination fee on loans

But LendingClub also offers direct refinancing for auto loans, meaning they originate and fund the loan themselves like a traditional financial institution. And its auto refinancing options are pretty slick.

First, you can choose to extend your existing loan term to buy more time or shrink it to pay it off sooner. And LendingClub claims that its borrowers average $86 a month savings over their initial loan.

As for drawbacks, LendingClub is a little picky about which cars they’ll refinance. Cars must be personal use, 10 years old or newer, under 120,000 miles, and your existing auto loan must have at least 24 months of payments remaining. Plus, they won’t refinance Oldsmobiles, Pontiacs, Nissan Leafs, or a few other makes.

Pros

- Excellent rates

- Flexible loan amounts and loan terms

Cons

- Refinancing only — no purchase loans

- Somewhat picky vehicle restrictions

Best for Convenience and Flexibility: LightStream

Lowest APR: from 8.99% APR with AutoPay and Excellent Credit

Loan amounts: $5,000 to $100,000

Term options: usually up to 84 months

Minimum credit score: 660

If you like the stability of borrowing from a big bank — but you don’t want to miss the rock-bottom rates of online-only lenders — LightStream might be a perfect fit.

LightStream is backed by Truist bank, the megabank formed by the merger of Suntrust and BB&T in 2019. So really, you’re getting the stability of borrowing from two giant banks.

LightStream one of the more flexible lenders. As they put it, “we’re all about getting rid of hassles and red tape” — and to back up that claim, they have no restrictions on age or mileage.

The only “downside” of borrowing from LightStream is that they have higher credit score expectations than some of their competitors. LightStream’s minimum score for loan approval is 660, but you’ll probably need a higher score than that to snag their lowest APR.

If you do qualify, LightStream is a sturdy, flexible, and generous lender backed by a very big bank. And if for some reason you’re unhappy with your loan, they’ll cut you a check for $100 under the LightStream Loan Guarantee. Nice.

Pros

- No age or mileage restrictions

- LightStream Loan Guarantee = $100 if you’re dissatisfied

Cons

- High minimum credit score

Best Big Bank: Bank of America

Lowest APR: 6.09% (discounts available)

Lowest APR: 6.09% (discounts available)

Loan amounts: $7,500+

Term options: 48, 60, and 72 months

Minimum credit score: Undisclosed

On the surface, Bank of America’s terms may not look super competitive — especially when compared to its rivals on this list. Having just three term options (48, 60, and 72 months) is oddly restrictive, and a minimum loan amount of $7,500 is higher than average.

But bear with me, because borrowing from BofA becomes much more appealing once you factor a few things in.

First, BofA offers a nice discount on auto loan rates to its Preferred Rewards members. Here’s a breakdown:

| Preferred Rewards Level | Combined BofA and Merrill Accounts Balance | Auto Loan APR Discount |

|---|---|---|

| Gold | $20,000+ | 0.25% |

| Platinum | $50,000+ | 0.35% |

| Platinum Honors | $100,000+ | 0.50% |

Now, I don’t think it’s worth changing banks or brokers to knock a bit off your auto loan — but if you’re already with BofA and/or Merrill and you’re close to one of these tiers, it might be worth reaching it since a 0.25% lower APR can save you a few hundred bucks of interest.

Pros

- 0.25% to 0.50% off for Preferred Rewards members

- Big bank stability

- Good customer service

Cons

- High minimum loan amount

- Undisclosed minimum credit score

Why Did I Choose These Lenders?

Out of the two dozen lenders I surveyed, I chose these four because they offered the best combination of:

- Low rates

- Flexible terms

- Transparency

- Customer service and support

- Loan options, and

- Overall borrower satisfaction

Most of the lenders I disqualified either had bad rates, bad customer service, or both. I got the sense that they offered auto loans begrudgingly, and used unattractive rates to nudge borrowers away (or towards their more focused products).

But the lenders on this list seem smooth, experienced, and eager to win your business with incredible rates and good service.

How Do Auto Loans Work?

Auto loans are comprised of three numbers:

Loan principal — the amount you’re borrowing. If you’re buying a $20,000 car and can afford a $5,000 down payment, your principal is $15,000 (not including taxes and fees).

Term length — the total time the lender gives you to pay back the loan, typically measured in months for auto loans (e.g., 24 months, 36, 60, etc.)

APR — Annual Percentage Rate is the interest rate plus lender fees rolled into one percentage. This is the overall “fee” you pay for the service of borrowing money, spread across each of your monthly payments.

Types of Auto Loans

New Car Loans vs. Used Car Loans

Auto lenders tend to offer lower interest rates on new cars, because they see new cars as less risky overall. Why?

- New cars all come in predictable, factory condition, whereas the condition of used cars can be all over the place.

- New cars depreciate in value on a curve that lenders can predict, whereas used cars depreciate, again, unpredictably.

- New cars often last longer than used cars (not always).

- Lenders earn more income via interest payments on more expensive new cars over the course of the larger/longer loan.

Does the lower interest rate mean it’s better to buy a new car?

Not really. Keep in mind that new cars tend to cost much more and lose 20% of their value in year one, so the marginal savings in interest rates don’t make up for the heavy depreciation and higher upfront cost.

To determine whether a new or used car is best for you and your budget, check out When to Buy a New Car (or a New Used Car).

Unsecured and Secured Loans

A secured loan is one where the lender can legally repossess something of value from the borrower if they don’t pay back their loan. The thing the lender can repossess — whether it’s your car or equity in your house — is known as “collateral” on the loan.

An unsecured loan doesn’t involve collateral. A prime example of an unsecured loan is credit card debt. If you don’t pay off your card, the lender can’t immediately take your car.

Naturally, lenders prefer the security of secured loans. As a result, secured loans have better terms and interest rates.

Most auto loans are secured loans using the vehicle purchased as collateral. But in some cases, you might apply for an unsecured personal loan, and use that money to buy a car.

There are pros and cons to that approach:

Pros

- Less restrictive. Auto lenders may restrict you to certain brands and dealership networks. Personal loans can be used any time you like on any car.

- No immediate repossession. Default on a personal loan and your lender could pursue you in court. But they can’t legally repo your car right away.

- Flexible terms. Personal loans have terms starting at just 12 months and you can borrow as little as a few thousand bucks. Many auto loans start at 36 months and $7,000+.

Cons

- High interest rates. According to the Federal Reserve, in Q1 2022 the average interest rate on a 24-month personal loan used to buy a car was 8.73%. For new car loans it was just 4.4%.

Direct vs. Indirect Financing

Direct financing is borrowing money straight from a lender, like a bank or a credit union.

Indirect financing is when you apply for financing through a car dealership.

Most of the time, the only positive aspect of indirect financing is convenience. You can walk in, choose a car, and get a loan all in one place.

But dealerships often charge inflated interest rates — sometimes double what you’d pay with a lender on this list. Now, in exceptionally rare cases a dealer might actually offer you a decent interest rate. But the only way to get it is to:

- Negotiate the out-the-door price of the car before any mention of financing, and

- Bring a preapproval letter from an outside lender as a starting point.

But overall, there are too many dishonest, borderline predatory auto dealerships out there to go in totally unarmed.

So before you enter the dealership, be sure to check out: how to negotiate car price with tips from an ex-car salesman.

Refinancing

Refinancing is when you pay off your old loan with a new one that has better terms. Refinancing might be a smart move if one or more of the following have changed since you originally took out your loan:

- Your credit has improved.

- Interest rates have dropped across the board.

- You’ve simply found a better rate.

- You initially financed through the dealer.

How to Get a Car Loan

We’ve published a full guide on auto financing for smart people, but here are the condensed steps:

1. Check Your Credit Score

You’ll want to know your credit score before applying for any kind of loan since it’ll dictate your approval chances and terms. See our page on how to get your free credit reports and scores, and if necessary, bump up your numbers using our guide on how to improve your credit score.

2. Apply with at Least Four Lenders

Some say three is enough, but in my experience, four is the magic number to get that “wow” rate you weren’t expecting. Oh, and since they’re all the same loan type, all four applications only count as one hard pull against your credit (as long as you apply for all four within 14 days). Lastly, you can save yourself a bunch of time by using a loan aggregator that pulls quotes from multiple lenders at once, like Prosper.

3. Take Your Best Preapproval Letter to the Dealer

A preapproval letter from an outside lender signals to the dealer that you’re prepared, and not so easy to manipulate. They may even try to beat your offer but bake in last-minute costs. Just watch the bottom line carefully (and purchase gap insurance elsewhere for much less).

4. Finalize Funding

Whether you take the dealer’s offer or your third-party lender’s, the dealer may need up to an hour to finalize the transfer of funds and set everything up. A private seller will ask for a check or instant transfer, in which case you’ll just call up your lender to get that taken care of for them.

5. Don’t Miss a Payment!

Finally, do everything you can in the front end to ensure you don’t miss a payment. Set up autopay or calendar reminders. Missing a payment on an auto loan can seriously ding your credit score.

What Are the Recent Auto Loan Rates?

Here are some recent average rates on auto loans these days, courtesy of Experian’s State of the Automotive Finance Market – Q1 2022 report.

| Borrower Credit Score | Average Used APR | Average New APR |

|---|---|---|

| Super Prime (781 to 850) | 3.71% | 2.40% |

| Prime (661 to 780) | 5.58% | 3.56% |

| Non-Prime (601 to 660) | 10.48% | 6.70% |

| Subprime (501 to 600) | 17.29% | 10.87% |

| Deep Subprime (300 to 500) | 20.99% | 14.76% |

Notice how raising your credit score from 650 to 700 can cut your interest rates in half? That’s why credit scores are so important and why I can’t shut up about them.

Car Loan Length

Throughout this article you’ve seen the words “term length” and “terms” used quite often, but not interchangeably. Confusing, I know, so let me clear it up:

- Terms are the key aspects of the loan, like the principal, interest rate, etc.

- Term length is the amount of time the lender gives you to pay back your loan, e.g., 24, 36, or 48 months, etc.

As a general rule of thumb, longer terms have lower monthly payments — but you’ll pay more overall.

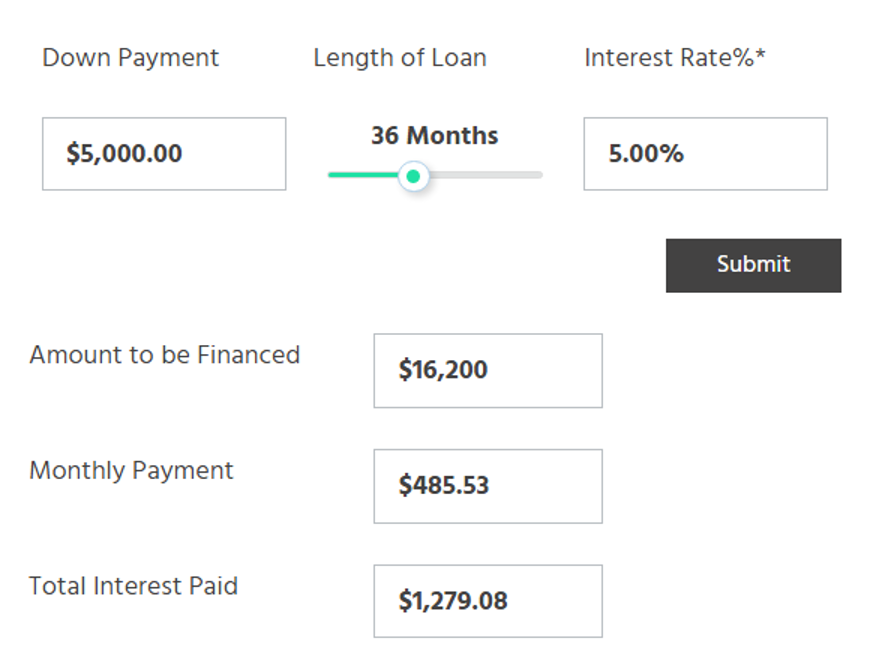

To illustrate, here’s an example from our Auto Loan Calculator. If you borrow around $16,000 at 5% for a short term of 36 months, you’ll pay roughly $485 a month — but only ~$1,280 in interest overall.

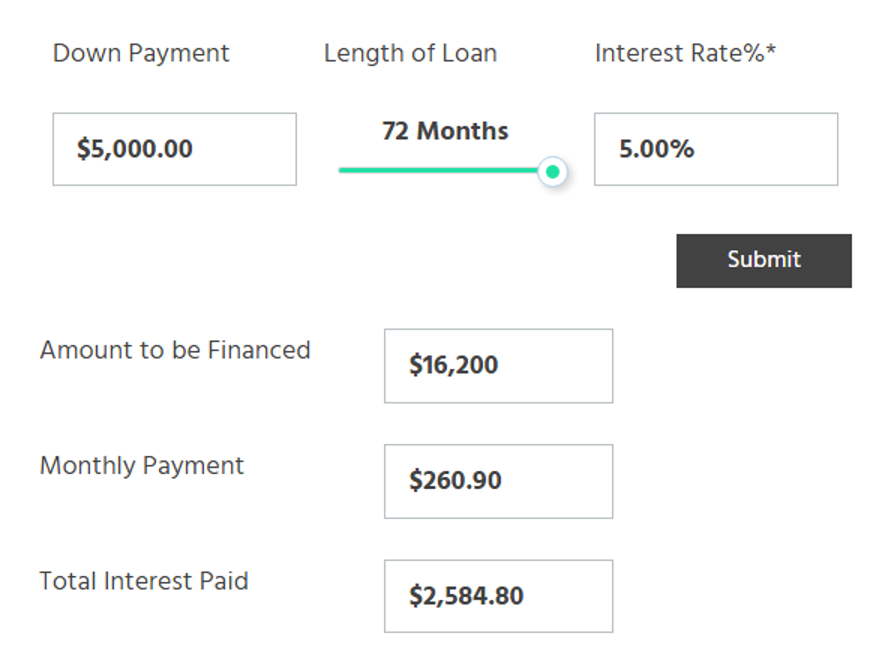

Conversely, if you stretch that term to 72 months, you’ll reduce your monthly payment to just $261 a month — but you’ll be paying that amount for twice as long, and you’ll pay double the amount of interest.

That’s why we I recommend you stick to terms of 48 months or less. If you can’t afford the monthly payments for a 48-month term, then you can’t afford the car.

Does that mean you have to drive a clunker? No way! The key is just to find a better deal on a good car. Check out my full Car Buying Guide: How to Buy a Car and Save Big on Your Ride.

What Is the Best Time of Year to Buy a Car?

There’s a commonly held belief that the fourth quarter is the best time to buy a car since that’s when dealers are trying to get rid of excess inventory and make way for next year’s models.

I’ve never subscribed to that theory, and in fact, I’d submit that Q4 is one of the worst times to buy a car.

Sure, you can get a current year model for $2,500 off in December — but that’s only because that car is literally weeks away from becoming last year’s model and plummeting $6,000 in value. The dealer is hoping that you’ll take that depreciation hit, not them.

In my years of experience brokering cars, there isn’t a best time of year, but rather, a best year. I strongly encourage clients to buy cars that are precisely three years old, since:

- They’ll save up to 50% versus buying new (and spare themselves 50% depreciation).

- They have plenty of life left (most even have factory warranties left).

- There’s a glut of inventory from expiring leases.

Best of all, buying gently pre-owned means you can skip the dealership experience entirely and buy a car online from a no-nonsense vendor like Carmax.

Summary

Getting the best deal on an auto loan isn’t necessarily quick or easy, but it definitely pays off. Because there’s no feeling quite like getting the keys to a cool new whip — and an awesome interest rate — in the same day.