We all have to do our taxes. Every year. And especially in a post-pandemic world, you’re more likely to want to do them at home, independently.

TaxSlayer has skyrocketed up the ranks as one of the best (and most affordable) tax filing options in the past couple of years. And they’ve made significant enhancements to be competitive with more recognizable tax prep programs.

TaxSlayer is a great option for anyone who doesn’t need all the bells and whistles that other tax software programs offer.

There’s a free version for simple returns and for military members. Plus, there’s plenty of support for paid versions, including one that works well for freelancers and gig workers.

- Affordable pricing

- Plan for freelancers and gig workers

- Supports major IRS forms and schedules

- Limited tax education resources

- Mixed support options

Pros & cons

Pros

- File your state return for free — You can file both your federal and state return for free when you use TaxSlayer’s SimplyFree version. Some competitors offer a free federal return but charge for a state return.

- Good user experience — While it’s not the most sophisticated tax platform, TaxSlayer is at least easy to use.

- Helpful tools — Critical features, such as the Tax Refund Calculator, are very helpful.

- Great customer service — Phone support reps are responsive and friendly.

Cons

- Poor email support — Email support reps can take a long time to hear back from (up to two days) if you haven’t paid for priority support.

- Limited tax education resources — The blog and knowledge base content isn’t as deep as competitors.

- Simply Free version is limited — While there is a free version, it’s applicable only to very simple returns.

- No old-school downloading — TaxSlayer is all online, so you’ll need to look elsewhere if you like to download your software.

- Mixed support options — You can’t get live chat support with all paid versions.

What is TaxSlayer?

TaxSlayer was created in 1998 back when the company used to offer traditional tax filing services. Today, with over 200 year-round employees and headquartered in Augusta, Georgia, TaxSlayer is one of the most affordable and easy-to-use tax planning services, facilitating millions of tax returns every year.

With good user experience and innovation being at the core of TaxSlayer’s service delivery, the company promises great software and reliable technical support to its customers.

Regardless of the package you choose, TaxSlayer is remarkably flexible. The program lets you file the required forms with very little help. If you prefer, wizard mode gives you more hands-on advice. You can also use the wizard only for the trickier parts.

More importantly, TaxSlayer outshines many other competing programs with accuracy, which is why they guarantee unlimited refunds if you’re hit with a state or federal interest or penalty charge due to TaxSlayer’s software errors in calculations.

How TaxSlayer works

TaxSlayer is like most other online tax preparation software in that it walks you through your return step-by-step. You have the option to use its wizard tool, which will help you respond to questions if you aren’t sure what to say.

I personally found TaxSlayer’s interface to be less annoying, cluttered, and in-your-face than some of the others (such as TurboTax). This is good for some, but not for others who may want a ton of extra information right at their fingertips.

I like to think TaxSlayer allows you to take the wheel and helps you when you need it, versus force-feeding you information.

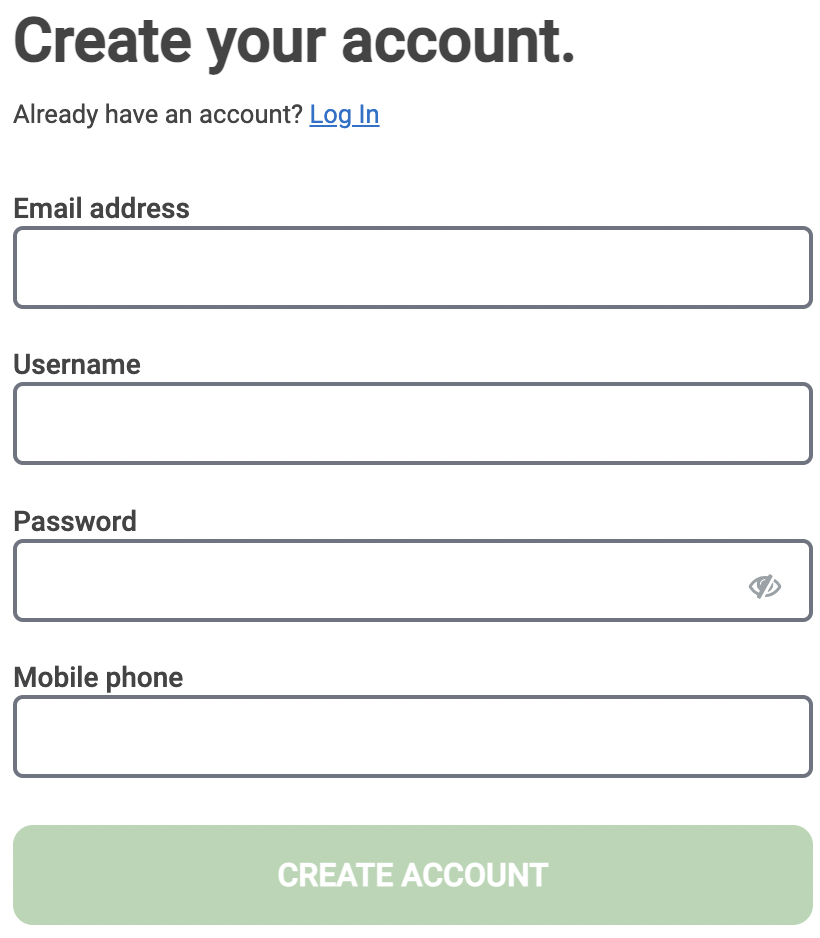

Signing up for TaxSlayer was super easy. It took me all of ten seconds to get registered and into my account. From the home page, just click “Start for Free”:

Enter your email, username, password, and phone number, then create your account:

And, boom! You’re in:

From there, you can get started filing your taxes.

Pricing, plans, and features

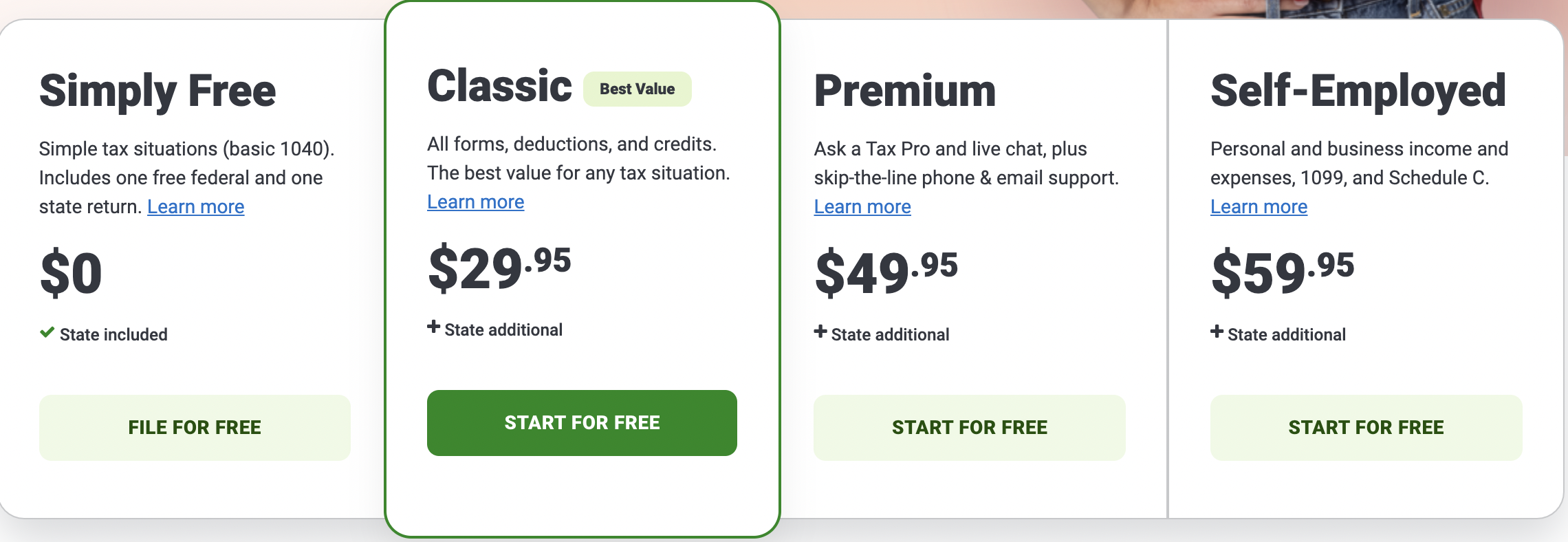

TaxSlayer has four primary plans to choose from, as shown in the image above. It also offers a totally-free Military package for filers on active duty who have an Employer Identification Number related to the department of defense or military. The free military version is essentially the Classic package offered for free.

If you’re a new client, you will have an option to choose your package once you start the filing process. The program will prompt you to upgrade if you attempt to do anything that is not included in your current plan. The final pricing is often set once you’re done with your e-filing, so plan accordingly.

Each package offered by TaxSlayer gives you the option of either using the guided wizard-style filing where the system guides you through the tax filing process step-by-step or a self-guided option where you choose the type of forms to complete. You can bounce back and forth between both modules, which is a useful option if you know what you’re doing but want some help from other people.

Now let’s break down each of the main plans.

1. Simply Free

This plan offers you a free first state return and free federal return. If you need an additional state return where necessary, it will also be covered.

The Simply Free version is only suitable for people who primarily earn money from regular employment, and it lacks many of the features supported by paid plans. It’s not a good fit for small business owners, solopreneurs, freelancers, and those earning foreign income.

Simply Free includes:

- Prior-year PDF importing. You can import previous-year tax returns from other tax filing programs, saved in PDF format. You can also keep your current tax returns in PDF format.

- Deduction finder. This module prompts you to find and enter all deductions where applicable. This ensures that you don’t miss any chance to save.

- Free phone and email support. You will get complimentary email and phone support during tax season. Email support is much more readily available than phone support due to the increasing number of customers.

2. Classic

This package will cost you $34.95 for a federal return filing and $39.95 for every state return. The plan comes with support for major IRS forms, which means it can handle all types of complex tax situations, including rental property owners, investors, and small business owners.

The Classic package contains all the features in the free package, plus:

- Prior-year comparisons. As you file your current year return, TaxSlayer will show you the relevant entries such as deductions, credits, and income from the previous years. This allows you to compare and see if you’re accurately filling out the entries in your current year’s filing.

- W-2 importing. This plan allows you to import W-2s in PDF.

- Maximum refund guarantee. You get a maximum refund guarantee. So should any errors in calculation arise because of using TaxSlayer, you will get a full refund of your tax preparation fees.

3. Premium

The premium plan costs $54.95 for filing your federal return and $39.95 for filing each state return. It comes with added support features that are much more robust compared to lower-priced packages. So it’s probably the best choice for those who don’t have the knowledge or confidence to navigate complicated tax situations on their own.

The premium package comes with all the features in the lower packages, plus:

- Live chat support. During intensive tax season (January 2 to April 18) support is usually available from 9 a.m. to 9 p.m. Monday through Friday and 9 a.m. to 5 p.m. Saturday. Available hours are reduced outside of tax season.

- Priority email and phone support. You also get priority support for called-in questions and emailed questions. All your communication will be pushed ahead of the lower-priced plans. This reduces the wait times considerably.

- Ask a tax professional. If you have questions, you can ask the in-house tax professionals at TaxSlayer for free. You might not always get an instant answer, in which case you will call in and leave your question, and they will call you back within 24 to 48 hours. This option comes in handy if you encounter a complex issue you can’t resolve on your own or using TaxSlayer’s wizards. TaxSlayer, however, insists that all the information and answers they provide are often general and shouldn’t be taken as infallible tax advice.

- Federal audit assistance. The premium package comes with free federal audit assistance. This is, however, free for three years from the time of filing. Note that this does not include support issues relating to Schedule C, K-1, or Form 2555.

4. Self-Employed

The Self-Employed plan will cost you $64.95 to file federal returns and $39.95 to file each state return. It has even more impressive support features than the premium plan — they (metaphorically) hold your hand and offer added support for solopreneurs and self-employed filers.

This package includes all that’s included in the Premium package, plus:

- Access to self-employment tax pros. The company has tax professionals for the self-employed. So if you have questions relating to Schedule C tax filing or any doubts about business tax deductions you qualify for, this version offers the help you need.

- Self-employment tax reminders and tips. With this plan, you get tips and reminders for the self-employed, so you don’t have to go hunting for help from online forums and the help database.

Additional features

Other additional features available in all packages include:

- Pay preparation fees with your refund.

- Refund calculator

- Mobile app access

- Knowledge base access

My experience using TaxSlayer

Getting signed up and into the TaxSlayer system was a breeze, and TaxSlayer makes it very intuitive for you to get going with your return right away. This was honestly one of the best sign-up processes I’ve ever experienced (with any type of financial product).

I also found their options and layout very clean. For example, check out their income section:

Even for the cheapest version, I found this to be pretty robust. Look at all those forms and schedules! This is a tax nerd’s dream.

Another thing I really liked was the simple wizard tool included. A product like TurboTax will hold your hand a lot more, but with TaxSlayer, you simply click the button and the wizard will ask you a series of questions to determine your filing needs.

Watch as I figure out how to file from a marital status perspective:

The “My Account” tab was also helpful, allowing me to access (if I had them in there) my prior year’s returns, my current return, and quickly modify my personal information. Once again, the interface was clean and easy to use:

Who is TaxSlayer best for?

TaxSlayer is a great product that can help most people file their taxes quickly and efficiently. Here are those who will benefit most:

Those who want an uncomplicated experience

If you want to do your taxes in an uncomplicated way (as most of us do), you will like TaxSlayer. Its interface is clean and easy to use, and they have dramatically improved navigation and usability compared to their early years.

Those who want to save money

If you want to save money, TaxSlayer’s pricing is extremely competitive. As I noted earlier, they blow most of their competitors out of the water with pricing.

Those who want to use their phones

Some of us don’t want to sit down at our computers and do taxes. Maybe you want to do your taxes with your mobile phone in smaller spurts of time. That’s fine, because TaxSlayer has a newly-redesigned mobile app that makes the tax-filing experience simple.

Who shouldn’t use TaxSlayer?

TaxSlayer isn’t for everyone. Here is who probably won’t benefit from this software:

Those who have complex tax situations

TaxSlayer’s paid versions can generally handle most tax scenarios thrown at them, but those with really complex tax situations might want to seek the advice of an accountant. For example, if you run a large corporation, have multiple rental properties, deal with off-shore investments, or anything else that’s not super-common, you might find it to be a better experience being able to work directly with an accountant instead of self-guided software.

Those who just want their taxes done for them

You will have to do some work with TaxSlayer. Unlike dropping your taxes off at an accountant’s office, TaxSlayer does require you to go through the steps and enter all the information yourself. Many of us don’t have the time (or desire) to do our taxes — guided or not. So, if you don’t want to spend the time punching in your information and filing on your own, look elsewhere.

The competition

TaxSlayer has some serious competition in the online tax software space. Still, it remains highly competitive given its pricing and features. Here are brief summaries of some of TaxSlayer’s chief competitors.

TaxSlayer vs TurboTax

For a long time, TurboTax has been the leader in the tax software market. It’s definitely not going to be your cheapest option, yet it’s still the most popular. In terms of value, TurboTax offers a ton of features and a streamlined approach that most other tax software just can’t match up with.

Backed by a strong reputation, TurboTax is the most popular tax software offering the gold standard of tax filing with a wide range of plans and various levels of support.

- Clear user experience

- Quick and easy importing

- Offers different levels of expert help

- Tax Return Lifetime Guarantee

- Pricing can be more transparent

- Cost more than some alternatives

TurboTax also helps solve the issue of more complex tax situations by offering detailed advice on just about everything. And if you have used TurboTax in the past, it saves your complete history from previous years. Most people will find this helpful to be able to carry over their information, especially if not a lot changes.

I find TurboTax to be the best fit for those with more intricate tax situations, a large number of investments, rental properties, and other more uncommon use-cases. If you’re willing to pay a bit more, the software can be worth it, as its clean interface makes it simple to go through each step of your taxes, bit-by-bit.

TaxSlayer vs H&R Block

H&R Block is another good option for those looking to file online, but it also has a massive office footprint with thousands of locations across the country. So if you want to get your taxes done in person, you can. You’ll also notice that H&R Block’s pricing is a bit cheaper than TurboTax.

And like most other tax software, H&R Block has a plan dedicated to small business owners. H&R Block is probably closer to TaxSlayer than TurboTax in terms of user experience, too. Its design and features are geared toward those who have more common tax situations.

For instance, if you do not have investment income, you can get away with its Deluxe version. The Premium version, on the other hand, will cover things like investment income and rental income. Its support is fairly strong, as well. One thing I like is the ability to chat with a tax expert for free (I personally hate calling). Also, you can purchase the add-on Tax Pro Review to have a trained professional check your work (highly recommended for freelancers and small business owners).

TaxSlayer vs TaxAct

Many people consider TaxAct to simply be one of the “cheap options” in the tax software game. And for its online products, its pricing is fairly low. But even though the pricing is low end, the quality of the product isn’t. And to prove it, TaxAct offers an Accuracy Guarantee. This ensures your tax return is 100% accurate and that you’re getting the maximum refund possible.

TaxAct makes it easy and affordable to file your federal and state tax returns online.

The simplest federal returns are free to file (state returns cost $39.99 each) with premium options available if you have itemized deductions, capital gains, or self-employment income.

- Easier to use than competitors

- $100k accuracy guarantee

- Optional live tax advice ($59.99)

- State returns are pricey

- Most users can't file via mobile app

Like other software I’ve mentioned, you can quickly import your tax returns from previous years. Additionally, TaxAct allows you to access up to seven years of prior tax returns that were processed by TaxAct.

TaxAct is a lower-cost competitor but stacks up pretty well in terms of features and support.

Summary

Few people enjoy the preparation and filing of taxes. In fact, not everyone has a cozy relationship with the IRS or state revenue authorities. While TaxSlayer has some flaws, it does offer features for you to file your taxes faster, more conveniently, and at one of the lowest costs in the industry.

If you’ve struggled with other high-priced or overly-complicated tax programs in the past, it might be time to give TaxSlayer a roll of the dice.