Tracking your net worth provides you with the big picture of your financial health, helping you make informed decisions and set financial goals.

Net worth is your assets minus your liabilities. It’s a calculation of how much you have in total (home value, investment, savings, etc.) minus how much you owe (student loans, mortgage, credit card debt, etc.). Knowing that, the best net worth tracking apps and calculators to use can automatically pull in data, sync accounts, and calculate your net worth while showing you how it’s changing over time.

Hands down, Empower is my favorite app for tracking net worth. It’s a powerful and free app that helps you track and calculate your net worth and investment portfolio. It can also track your spending and help you plan for retirement.

Overall: Best net worth trackers and calculators

These top net worth trackers keep tabs on your financial big picture while offering quite a bit more than that. These range from free to reasonable monthly/annual fees.

- Our Pick: Empower

- Best for forecasting cash flow: PocketSmith

- Best for managing your money: YNAB

- and some other net worth apps

Empower

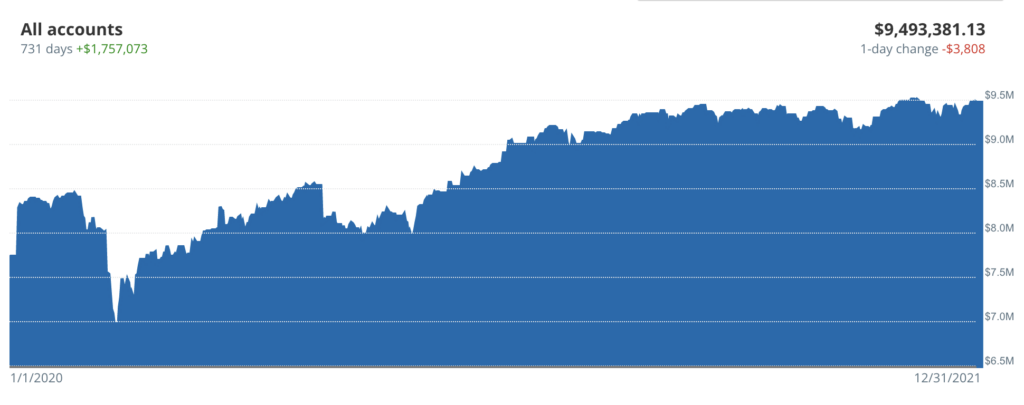

Empower, formerly Personal Capital, is a powerful free app with tools that focus on tracking your net worth, cash flow and investment performance. You can also keep an eye on your portfolio allocation and use a fairly robust retirement calculator. Empower’s personal dashboard is free because the company offers paid financial advisory and wealth management, if desired.

Empower is a hybrid digital wealth management company and powerful finance app. In addition to paid investment management and advisory services, Empower offers a number of free tools and calculators to help with everything from net worth tracking to saving and retirement planning.

- Easy-to-use app provides financial 'big picture'

- Tools and calculators are completely free to use

- Great security, including two-factor authentication

- Wealth management fees can be be high

- May be subject to upsells

The Empower Personal Dashboard™ provides all you need to get an overview of how your financials are doing from debt to how much you’re really saving. With Empower, you can link all of your accounts (your checking account, IRA, and 401k accounts, etc.) and see them all conveniently in one place, making this one of the best portfolio tracking tools.

This app is best for people that are already in good financial shape, but want to make sure they stay that way. Empower prides itself on doing the work for you in that regard. Once you link all your accounts, you just sit back and let the net worth app show you how you’re doing.

The report on net worth provided by Empower gives you an overall picture of your net worth and then breaks down each individual account in your portfolio so you can see how your investments add or subtract from your worth. Empower also includes tools similar to the famed budgeting app, Mint (may it RIP) that automatically aggregates your income and expenses, then displays your cash flow data in easy-to-read charts. The other powerful (and again, free) tools include:

The report on net worth provided by Empower gives you an overall picture of your net worth and then breaks down each individual account in your portfolio so you can see how your investments add or subtract from your worth. Empower also includes tools similar to the famed budgeting app, Mint (may it RIP) that automatically aggregates your income and expenses, then displays your cash flow data in easy-to-read charts. The other powerful (and again, free) tools include:

- Retirement planner

- Fee analyzer

- Emergency savings calculator

- College savings calculator

- Debt payoff calculator

There is one downside to the Empower app. Yes, the app is free, but if you have more than $100,000 in assets, chances are you’re going to get a sales pitch advocating that you try out their wealth management service. That may not be a con, however, if that interests you. There’s an annual fee of up to 0.89% associated with this service depending on the amount managed, scaling down for higher amounts. The upside to this is because Empower supports itself via those wealth management services your interface isn’t littered with cross-promotions.

» MORE: Sign up for Empower today or read our full Empower Review

PocketSmith

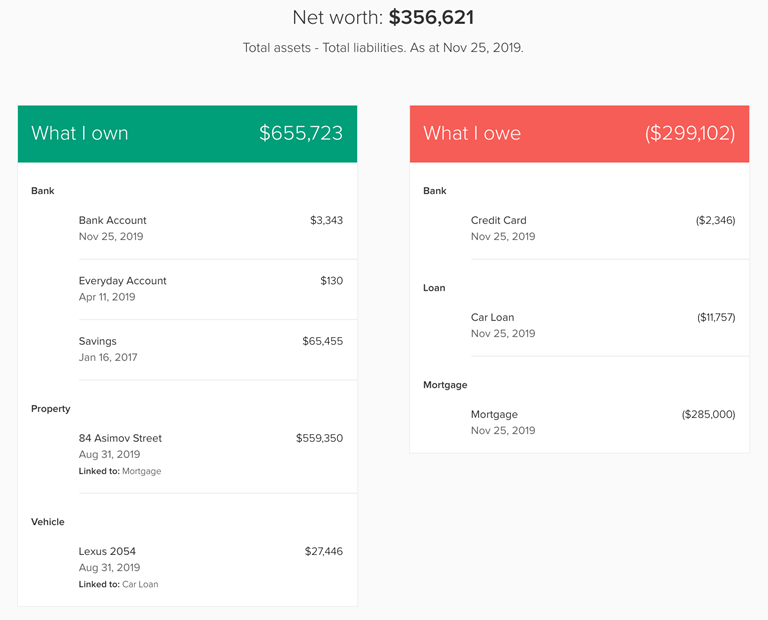

If you’re saving for your future, PocketSmith is an app that’ll works best if you’re at a stage where you’re paying down debt and/or building your emergency fund. Simply connect up your various bank accounts and let PocketSmith do the rest by tracking your finances.

PocketSmith is an app that acts somewhat like a financial personal assistant. It helps you manage and organize your expenses in a way that allows you to understand your complete financial picture.

You can understand where you spend and then create a financial plan to better organize your spending.

- Excellent budgeting features

- Comprehensive financial dashboard

- Links with multiple accounts

- Pricing can be expensive

PocketSmith offers a free plan, but with their paid plans (Foundation, Flourish, Fortune) starting at $9.99/month you’re provided automatic bank feeds. These connect to over 12,000 banks and financial services worldwide letting you track bank accounts, investment accounts, property, mortgages, loans and more to see your net worth as it stands today. Knowing the details of your financial big picture lets you focus on tasks like reducing credit card debt as you work towards achieving long-term financials goals.

I like that PocketSmith is useful not just for looking back or understand your current net worth, but also for projecting forward. With PocketSmith’s cash flow forecasting, you can see immediately how the decisions you make today will impact you up to 60 years down the road with the built-in forecast graph. You can see a visual representation of where your current path will lead if you stick to the budgets you’ve set and even test out various scenarios and glimpse how they’ll impact your future finances.

The visual nature of net worth tracking and budgeting with PocketSmith is what I find the most convenient. The budget calendar, for instance, shows your month’s spending in a calendar, making it easy to see, at a glance, when big bills are coming due. As you set up your budget, you can break it into chunks with up to unlimited budgets and separate visual dashboards that make it more manageable.

» MORE: Sign up for PocketSmith or read our full Pocketsmith Review

YNAB (You Need a Budget)

YNAB provides a Net Worth Report, but behind that there’s a philosophy to help you better your entire financial life. YNAB‘s four rules for less money stress starts with “give every dollar a job.”

You Need a Budget (YNAB) is more than a software program; it’s a lifestyle for budgeting.

Whether your goal is to get out of debt, break the paycheck-to-paycheck cycle, grow your savings accounts, or all of the above, YNAB’s theory is that giving every dollar “a job” can help.

- Easy to get started with free trial

- Track spending and saving goals

- Both automatic and manual account linking

- No spammy advertising or upsells

- Learning curve for best use

- Ongoing fee applies

YNAB helps make sure you only spend allotted amounts on certain categories like your living expenses, gifts, clothing, internet, etc. Any category you can think of, they have it (or you can create it). The other steps are: embrace your true expenses, roll with the punches, and age your money, resulting in budgeting to potentially help you save.

But, despite how much we love YNAB for budgeting, back more to discussing it for net worth. The Net Worth Report provides a comprehensive view of your finances, showing you how your spending vs. saving impacts your associated accounts. This lets you track your net worth over time. There’s a ‘debt bar’ and an ‘asset bar’ along with a net worth trend line, options to customize and filter accounts, snapshots of your account balances, and an option to export all this information.

There is a cost for YNAB, but they offer a free 34-day trial (and a free year for qualifying students!). After this trial is up the cost goes up to $14.99 a month, or $99 a year (saving you $80) when paid annually. The return on said annual subscription, according to YNAB survey responses, is $600 saved by new budgeters by their second month using YNAB and $6,000 saved by new budgeters in their first year. Quite a potential ROI!

» MORE: Open a YNAB account or read our full You Need A Budget Review

Also great

We recommend sticking to our top three since they’re pretty comprehensive and powerful, providing just about all your net worth tracking and net worth calculator needs (along with budgeting tools), but knowing your finances is a crowded space in the financial world.

These are some also great options if you want to make sure you’re using the best app to track and calculate your net worth and included portfolio for your own personal financial situation.

Vyzer

Vyzer is a very slick startup that offers similar functionality to Empower with the added benefit of allowing users to track private investments including real estate and business interests. You can sign up for free, but the free version is fairly limited without paying for a subscription, which is pricey.

Vyzer is smart, data-driven investment portfolio tracking and financial planning.

Vyzer offers a comprehensive digital solution that combines performance tracking for both public and private investments, advanced financial planning tools, and personalized account management.

- Track all investments, including real estate & private companies

- First 3 accounts are free

- Handles even the most sophisticated portfolios

- May be overkill for average investors

Learn more in our Vyzer review.

Kubera

Kubera advertises itself as the “time machine for your net worth.” It offers the ability to track your current net worth, compare it versus previous points, and get insight on where it’s going, like PocketSmith provides. All on a fully customizable dashboard with charting, diversification and rebalancing.

Connectivity includes banks, brokerages and nearly any investment account from thousands of institutions around the world. You even even track latest balances from major crypto wallets and exchanges, even your NFTs.

It also covers other assets as well, like your value of your home using latest market data, the value of your vehicle, and spot prices for precious metals.

Ultimately, we find it’s not as powerful or comprehensive as our top overall pick that’s free, Empower, and does come at a hefty price that starts at $150/year following a 14-day trial for $1 (with more options for family/businesses).

Simplifi

Simplifi connects to your bank accounts and automatically pulls in all of your transactions for easy categorization. The result is a Net Worth Report designed to start tracking your balances once they’re connected available with an intuitive interface both on desktop and on your smartphone.

Simplifi by Quicken delivers a fresh personal finance app from an undeniably trustworthy brand to keep up with all of your money in one easy-to-use interface.

You won’t have to spend time bopping from account to account just to see where your finances stand. Instead, you can log into Simplifi to see the big picture at a moment’s notice.

- Provides extensive financial reports

- User friendly experience

- No ads

- No free version

- No credit score insights

Simplifi was created by Quicken which is a powerhouse in the world of financial software. The Quicken products have been trusted for over 40 years and used by over 20+ million people over four decades.

You can set goals and see your progress as you work towards them. It also allows you to pull reports so you can see exactly how you’ve spent your money. This can be a real eye-opener. In addition to your bank accounts, it can also connect to your loans, savings, and investment accounts so you can see your whole financial picture and net worth at a glance.

» MORE: Try Simplifi

Tiller

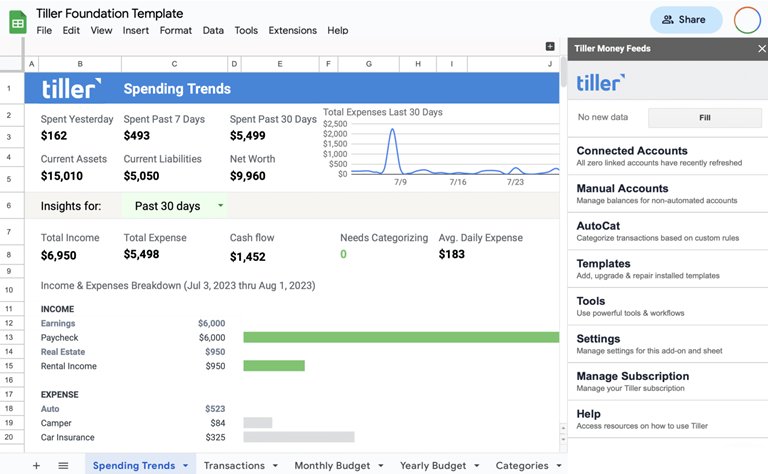

If you’ve fallen in love with spreadsheets at work (who hasn’t?), then Tiller may be a beloved option to consider. It’s a financial tracker that operates out of a spreadsheet, tracking your money with customized templates that update each day.

And if you’re not a spreadsheet wizard, then selected templates that are already pre-built can be auto-filled using your connected accounts. The Foundation Template for Google Sheets and Microsoft Excel, for example, tracks your spending, budgets, and net worth, allowing you to use as-is or customize fields as you see fit.

There’s certainly a level of control that’s offered here if that’s your preference, but it ultimately may not be something you want to use across the board. Tiller starts with a 30-day free trial, then moves over to a fee of $79/year. You can cancel before the conclusion of the free trial if you don’t want to continue, and there’s a satisfaction guarantee.

Quicken

We mentioned Simplifi by Quicken, but there’s also still one of the originals as an option in Quicken. It’s a personal finance product that serves as a budgeting tool and a net worth tracker, showing you how your net worth changes over time.

You may be asking, but what’s the difference? Simplifi is a standalone product that Quicken offers allowing you to set savings goal and mange financial accounts. It’s entirely web-based through your browser or mobile app. Quicken classic offers similar net worth tracking and budgeting tools but requires you to be an existing desktop user (windows/mac) to access any companion apps. An immediate downside of a legacy service is that the interface isn’t that best out there if the visual aspect of your net worth is something you care deeply about.

There are premier and deluxe versions that range from $3.74 to $6.99 a month depending on billing frequency and level selected. We would call that pricey given some of the other options we’ve already broken down in comparison with more powerful tools that start at free.

» MORE: Compare Empower vs Quicken

The competition

These are some other outside options for keeping tabs on your net worth, including a retirement planning tool and passive investment account.

Betterment

Betterment is known as one of the best robo-advisors, allowing you to automatically invest based on risk tolerance, but if you’re in need of net worth tracking it can also provide a solution there.

Betterment features an all-in-one financial dashboard that allows you to connect outside accounts, track savings progress, view your performance, and get a bird’s eye view of your finances to track your net worth. On the net worth screen, you’ll see the value of your internal Betterment accounts and any external accounts you’ve added.

NewRetirement

The NewRetirement retirement planning tool lets you organize all your finances in one place and highlights key parts, including potential optimizations. How much more would you need to pay on your mortgage each month so it’s paid off before you retire? How much would a conversion strategy from a traditional IRA to Roth IRA potentially save you in taxes?

With that, the NewRetirement Planner will show you your current net worth as well as a reliable projection for your net worth in every future year. Kind of like PocketSmith again. You can see your projected net worth for the next year, 10 years, at retirement age, when you’ll potentially peak, and more.

Monarch Money

Monarch Money is another all-in-one type net worth tracking tool that lets you synch all your bank accounts and display your net worth over time, allowing you to chart progress on a user-friendly customizable dashboard.

Tracking works for real estate (through Zillow Zestimates), investments, bank accounts, credit cards, loans, and more. You can even manually add alternative investment valuables, like art or collectibles, so you always have the complete picture. Pricing comes in at $14.99/month or $99/year on the annual option, which comes to $8.33 a month. That includes unlimited synced connections, monthly and annual budgets you can customize, and unlimited goals you can track your progress of.

Are the net worth trackers secure?

Given that you’re sharing or even syncing financial data you may be rightfully curious. The good news is that net worth trackers prioritize the security of your information and in most cases cannot initiate transactions since you’re sharing an outside view.

YNAB, for instance, notes their team does not access or interact with the data of customers as part of their normal operations. The data sent between your computer and YNAB is under bank-grade or better encryption.

An account with Empower comes with multiple layers of security, ensuring your information and money is kept private and secure. This includes alerts when changes are made to your account, AES-256 with multilayer key management for your data, and no selling of your data.

Why track your net worth?

Why should you track your net worth, especially if you don’t have many assets? Well, even if you don’t feel like you’re at that point of life yet the tracking of your net worth helps keep your finances healthy. Calculating your net worth also gives you perspective on your financial picture.

For the same reason that you go to the doctor or save for retirement—you have to prepare now for what comes later. Knowing your net worth lets you know what you really have—beyond just your checking account balance and what you owe on those snowballing credit card statements.

Basing your financial health just on your ongoing income alone can be dangerous. If you’re living paycheck to paycheck as a great number of Americans tend to do and you lose your job, life is going to be significantly more difficult if you don’t have an emergency fund or funds among other savings/investments to fall back on. Knowing your net worth and working towards a positive (and growing) net worth makes sure your financial security is not just tied up in your current and expected income—it gives you a cushion for when life happens as it tends to do.

Tips to increase your net worth

How do you go about building your net worth? Work hard, save, budget. It can partly be as easy as looking at your phone—literally.

Top personal finance apps can help you track your spending, investments, and debt in order to help you develop healthy spending habits that ultimately increase your net worth over time.

There are two elements to building your net worth: Increasing your assets (i.e. cash, investments, real estate) and decreasing your liabilities (credit card debt, student and auto loans, a mortgage). Aside from net worth tracking, there are different apps to help with each of these, including the best investment accounts and useful budget apps.

Average net worth by age

Wondering how your net worth compares to others? Here’s both the median and average American net worth by age, according to the Fed’s Survey of Consumer Finances.

| Age of head of family | Median net worth | Average net worth |

|---|---|---|

| Less than 35 | $39,000 | $183,500 |

| 35-44 | $135,600 | $549,600 |

| 45-54 | $247,200 | $975,800 |

| 55-64 | $364,500 | $1,566,900 |

| 65-74 | $409,900 | $1,794,600 |

| 75+ | $335,600 | $1,624,100 |

You may be wondering about the discrepancy between the median and the average and that’s because very high net worth individuals have the ability to skew the average much higher. If you don’t know yours, and you’re curious, check out some of the best net worth trackers we reviewed above or our free net worth spreadsheet.

Don’t, however, stare at these figures and dwell on it or even become discouraged if you’re not stacking up right now.

Summary

It’s important to think about your net worth if you ever want to go far (or anywhere, really) in the financial world securely, but it doesn’t to be such a headache.

Net worth apps, calculators, and websites give you a choice of being actively involved in tracking your net worth, or, if you like to spend your time doing other things besides thinking about your personal finances, do the work for you! Synching with a powerful free app, like our top overall pick, Empower, can make keep you updated on your net worth across all your accounts with ease.

FAQs about net worth

What is net worth?

Net worth is assets minus liabilities. It’s a calculation of your total financial picture, showing you what you would have left if you put everything together, meaning what you own minus what you owe. It’s different than just income, which is what you’re currently bringing in.

Net Worth = Total Assets – Total Liabilities

Assets include home value, investments, savings, art, jewelry, vehicles, additional real estate. You get it — anything you own that’s cash or has value. Liabilities and debts include what you owe on student loans, for your car, remaining on your mortgage, pesky credit card debt, and more of the stuff that potentially keeps you up at night.

Does net worth matter?

A calculation of your net worth matters and is very important for understanding your finances and building wealth. A snapshot of your total finances allows you to map out your financial future and make financial plans.

A positive net worth that’s growing may mean you are working in the right direction while a negative net worth may mean you need to improve or make changes. It’s part of the budgeting process, both for short-term and long-term goals.

What’s the difference between income and net worth?

Income is what you earn while net worth is your total value of assets minus any debts. Net worth is the more important figure when understanding your financial health while salary is just one part of the puzzle.

How can you change your net worth?

Increase your assets while decreasing your liabilities to positively change your net worth. Besides investing, you can increase your net worth with the help of a side hustle for additional income, saving by cutting costs on your usual spend, like groceries, and/or negotiating a higher salary. Increase what you’re bringing home while ultimately retaining more of it while paying off debt that may be growing. You can also consider talking to a financial advisor if you believe you’re at that stage and would like guidance.