Buy Now Pay Later (BNPL) services like Affirm, AfterPay, and Klarna have become a ubiquitous part of modern online shopping. Cushion.ai is a service that organizes your BNPL payments while helping you enhance your credit profile.

While BNPL services make it easy to spread the cost of a purchase out over several months without the need for a credit card, they have drawbacks. For one, BNPL companies do not typically report payments to the credit bureaus, particularly for the traditional “pay in 4” installments. In addition, if you’re a frequent user of BNPL, juggling multiple payments can be difficult and – if you’re not careful – lead to tight financial situations (or even late fees/overdraft fees).

Cushion.ai aims to help you address these types of issues.*

What does Cushion.ai do, and who is it for?

Cushion.ai caters to a specific demographic – those who frequently utilize Buy Now, Pay Later services. It’s a perfect fit for consumers who wish to streamline their BNPL payments while simultaneously building their credit profile.

Cushion.ai is more than just a payment organizer; it’s a bridge between BNPL services and credit bureaus. Here’s how it works:

Payment organization

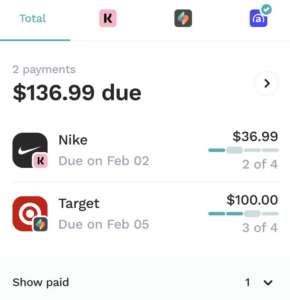

Cushion.ai links to your email and bank account, allowing it to automatically organize and aggregate all your BNPL payments and recurring bills into a single, user-friendly dashboard. This consolidation simplifies tracking and managing due dates and amounts, which are all displayed on the app’s interface.

Virtual payment card

Cushion.ai users receive a virtual payment card that has a unique card number and expiration date, just like a physical debit or credit card. To maximize the benefits of using Cushion.ai, your BNPL payments must flow through this virtual card. When your Cushion card is the payment method on file, Cushion.ai makes the payment on your behalf to the BNPL companies and withdraws the amount from your bank account.

Every month you make BNPL payments using your virtual Cushion card, Cushion reports your positive payments to the credit bureaus, which can help build credit over time.

Subscription packages

Upon signing up, users are given a choice between two subscription packages – Builder or Pro. Both offer several features to help streamline your finances and the virtual cards included in these packages are fundamental to the platform’s functionality.

Cushion card

Users must use the Cushion Card for their BNPL payments for those payments to be reported to the credit bureaus.

Credit reporting

One of the defining features of Cushion.ai is its ability to report your BNPL payments to credit bureaus. This process can potentially lead to an increase in your credit score over time.

The app’s user interface deserves special mention. It is intuitively designed, making navigation a breeze, even for those who are not tech-savvy. The calendar view option is a standout feature, providing a visually appealing way to keep track of your BNPL payments alongside your other recurring bills.

Pricing structure

Cushion.ai is not a free service, which might be a deterrent for some. It offers two distinct pricing tiers:

- Cushion Builder: At $4.99 per month, this plan focuses on managing, paying and building credit with your BNPL payments.

- Cushion Pro: Priced at $12.99 per month, this plan extends the benefits to all types of payments, including regular bills, subscriptions and BNPL.

Advantages and disadvantages

Pros:

- Simplified Payment Management: Consolidating BNPL payments into one platform is a major convenience.

- Credit Profile Improvement: By reporting positive payments to credit bureaus, users may see a gradual improvement over time in their credit scores.

- Ease of Use: The platform’s straightforward and appealing user interface has received positive reviews.

Cons:

- Monthly Fee: The service is not free, which might be a drawback for budget-conscious users.

- Bank Account Syncing: Users are required to link their bank accounts to Cushion.ai, a step that might cause discomfort for some due to privacy concerns.

- Dependence on Cushion Card: The necessity to use the Cushion Card for all BNPL payments could be seen as restrictive.

Conclusion

Cushion.ai is a creative and — so far — unique solution for frequent users of BNPL. Being able to organize all of your BNPL payments in one place is nice, but I’m not convinced it’s worth a monthly fee.

Cushion’s ability to help you build credit by paying your BNPL installments and other bills, however, is pretty neat. I hear from a lot of people who want to build credit but either can’t get approved for a credit card or simply don’t want to carry one. If that sounds like you, Cushion’s product is a compelling option and likely worth the monthly fee (at least for a year or two) for how it will help you organize your finances while building credit history on payments that typically go unreported.

» Learn more or sign up for Cushion.ai