Shopping for life insurance can be confusing and complicated, but it doesn’t have to be. There are lots of insurance companies that have simplified the process of purchasing life insurance with online applications, no-medical-exam policies, and helpful resources. Ethos is one of those companies.

Ethos is a relatively new life insurance company, so I did some research to figure out whether their offerings are worth it. Spoiler: Ethos is a great insurer if you’re looking for term life insurance, but I wouldn’t suggest it for permanent coverage.

What is Ethos Life Insurance?

Ethos Life Insurance was established in 2016 after the founders decided that life insurance needed to be more affordable and accessible. Since its inception, Ethos has raised more than $400 million from reputable investors, like Goldman Sachs and SoftBank.

Ethos operates as a life insurance broker, meaning it doesn’t underwrite its own policies. When you purchase a policy through Ethos, the policy is issued by a licensed life insurance company. Currently, the only policies available through Ethos are term life and whole life.

Pros & cons

Pros

- No-medical-exam policies — Many customers can get term life insurance or whole life insurance without taking a medical exam.

- Affordable coverage — Ethos advertises affordable life insurance policies, with rates starting at just $7 per month.

- Instant approvals — You can apply for an Ethos policy online, and most customers can get coverage on the same day.

Cons

- Age restrictions — Ethos sells term life policies to applicants ages 20 to 65 and whole life policies to applicants over age 66.

- Quote ranges — Rather than being given a specific monthly cost, prospective policyholders are given a potential price range during the quoting process.

Who wwns Ethos Life Insurance?

Ethos is a self-owned life insurance broker. Unlike some other life insurance providers, it doesn’t operate under a parent company.

Who underwrites Ethos Life Insurance?

One of the benefits of Ethos is that it works with a variety of reputable underwriters, like Legal & General America, Munich Re, Ameritas Life Insurance, and TruStage® Financial Group.

These providers are all financially stable, with an ‘A’ rating or higher from the credit rating agency AM Best. That means Ethos’ underwriters have demonstrated their ability to pay claims and meet other policyholder obligations.

How does Ethos Life Insurance work?

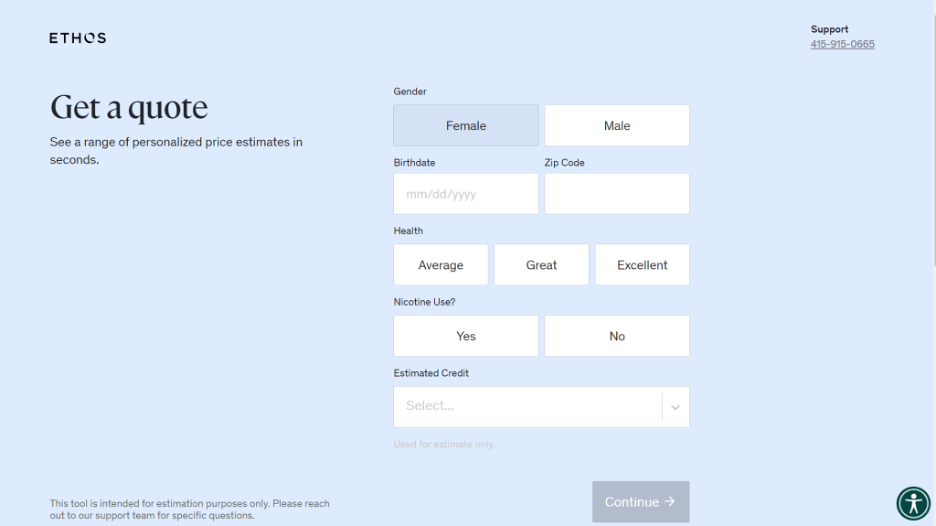

During my review of Ethos, I went through the online quote process to get a better sense of the user experience. Overall, I was satisfied with how easy it was.

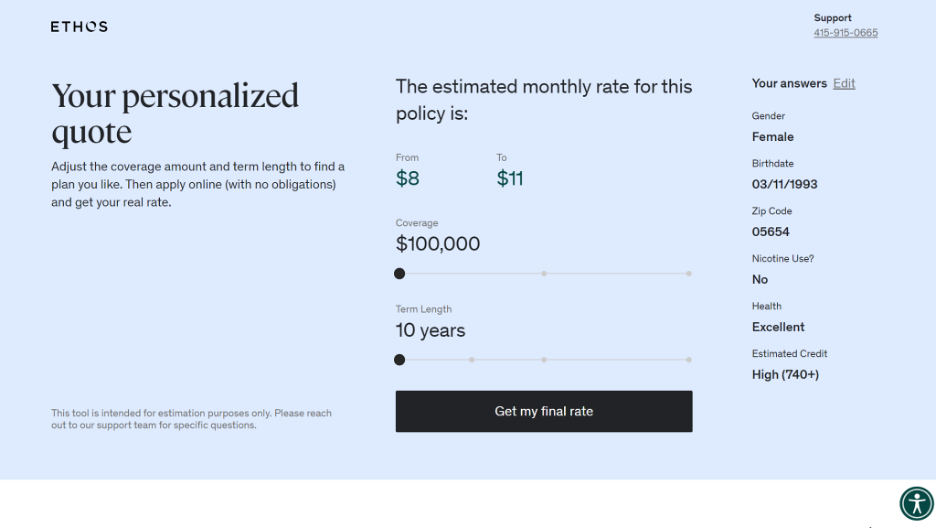

To start, I had to submit some basic details about myself, like my birthday, estimated credit score, and overall health. Using that information, Ethos gave me a preliminary quote. It was really easy to adjust the coverage limits and term lengths to see how those factors would impact my rate.

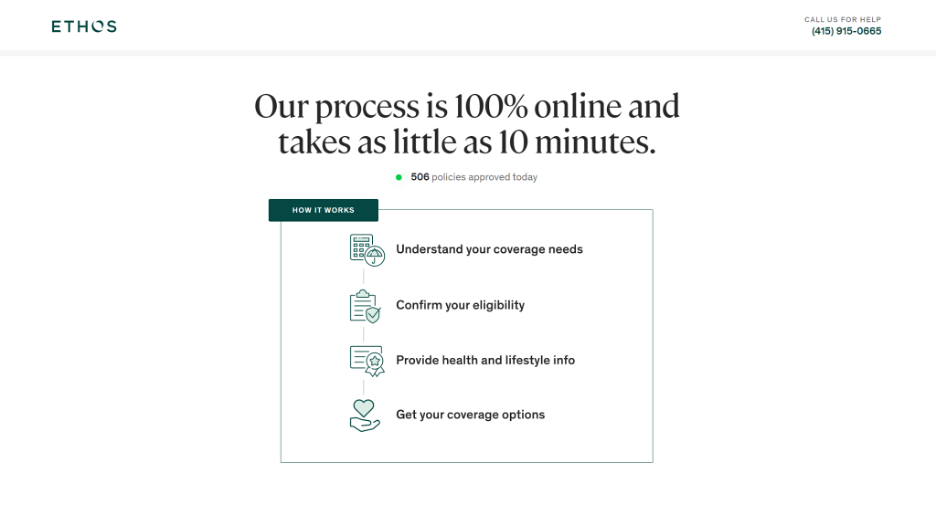

The last step was to submit the application, which is completely digital. During the application, I was asked some additional questions, like how many kids I have and my annual income. Ethos also asked about my goals for life insurance so that they could recommend an appropriate policy.

Based on your responses to the health and lifestyle questions, Ethos’ algorithm determines if you are eligible for coverage. And if you’re in good overall health, you can probably purchase a policy without taking a medical exam.

However, one important thing to know about Ethos is that there are age requirements. To apply for a term life insurance policy, you must be between the ages of 20 and 65. However, you can only apply for whole life insurance after age 66.

How much does Ethos Life Insurance cost?

The cost of a life insurance policy from Ethos depends on a variety of different factors, like your location, age, credit score, and health.

When I applied for a quote, my rate estimate was between $8 and $11 per month for a 10-year term life policy with $100,000 in coverage. When I changed it to a 20-year policy with $1 million in coverage, the rate was between $26 to $55 per month.

Ethos’ rates seem comparable to its competitors. As an experiment, I got the same quotes from Bestow. My Bestow quote for a 10-year term life policy with $100,000 in coverage was about $9 per month. For a 20-year policy with $1 million in coverage, my rate was $39 per month.

Key features

Term lengths and coverage limits

Ethos offers standard term lengths for its term life policies. You can choose term lengths of 10, 15, 20, and 30 years, with between $20,000 and $2 million in coverage. For whole life, you can get between $1,000 and $30,000 in guaranteed coverage without a medical exam, but you must be over age 66.

Riders

Ethos offers a handful of optional policies. You can add an accelerated death benefit rider for terminal illness on a term life insurance policy, or an accidental death rider on a term life or whole life policy. In general, online life insurance providers tend to offer fewer riders than traditional life insurance companies.

Application

Ethos’ life insurance application is completely digital, so you never have to pick up the phone or talk to an agent. Plus, it’s easy to get a quote in just a few steps. If you have questions or prefer to speak to a live person, Ethos’ phone number is right at the top of the page.

Policy types

The only types of life insurance available through Ethos are term life insurance and whole life insurance. If you want another form of permanent coverage, like universal life insurance or variable life insurance, Ethos isn’t the right provider for you.

My experience with Ethos

I’ve reviewed a lot of life insurance providers, and overall, I found Ethos’ application process to be one of the better ones.

I only had to answer a few questions to get a quote and it was easy to play around with the term lengths and coverage limits to see how my rate would change. The application itself took about 10 minutes to complete, which is standard compared to other online life insurance companies.

However, one thing I didn’t like is that Ethos provides estimated quotes within a range. For example, my quote for a 30-year, $1 million policy was between $48 and $99 per month, which is a big difference. I would have preferred a single quote.

Who should get an Ethos policy?

If you’re in the market for a basic term life insurance policy, Ethos isn’t a bad option. You can get up to $2 million in coverage, and many applicants aren’t required to take a medical exam. Plus, everything is done online — you don’t have to work with an agent unless you want to.

Who shouldn’t get an Ethos policy?

I wouldn’t recommend Ethos if you want whole life insurance. The policies are geared toward older adults, as you must be at least 66 years old to qualify. If you want whole life insurance, there are lots of other companies that offer coverage to younger people.

The competition: Other life insurance

Here’s some competition from the best life insurance picks.

Ethos vs Ladder

- Coverage limits: $100,000 to $8 million

- Term lengths: 10, 15, 20, 25, and 30 years

- Policy types: Term life insurance

- My quote: $32/month (20-year, $1 million term policy)

Ladder offers addorbable term lengths between 10 and 30 years with a coverage minimum of $100,000 and a maximum of $8 million. The company is unique in that it gives you the option to “ladder” your coverage, which allows you to adjust your death benefit as your family’s financial needs evolve.

- Affordable term life coverage

- Easy application

- Option to “ladder” your coverage

- Only sells term life policies

- No riders available

Ladder is a solid life insurance company. You can get a quote and apply online, and you can often qualify for coverage without a medical exam. Everything is digital, and Ladder has live chat, which allows you to connect to an agent if you have questions.

The only type of coverage that Ladder offers is term life insurance, but the company is unique in that it gives you the option to “ladder” your coverage. Laddering allows you to increase or decrease your coverage limits based on your financial needs at any point in life.

Ladder’s policies are underwritten by several reputable and financially secure companies, like Allianz Life Insurance Company of North America.

Ethos vs Bestow

- Coverage limits: $50,000 to $1.5 million

- Term lengths: 10, 15, 20, 25, and 30 years

- Policy types: Term life insurance

- My quote: $39/month (20-year, $1 million term policy)

Bestow is another fairly new life insurance provider that operates entirely online. It exclusively sells term life insurance policies.

Like Ethos, Bestow doesn’t underwrite its own policies. Instead, it relies on the North American Company for Life and Health Insurance to issue its term life policies. That issuer has an A+ financial strength rating from AM Best.

With Bestow, you can get term life insurance without a medical exam, and many applicants can get coverage on the same day they apply. However, there are no riders available, so you don’t have any options to customize your policy.

Final thoughts: Is Ethos Life Insurance legit?

Ethos Life Insurance is a pretty good provider for Millennials who want term life insurance, and don’t want to pick up the phone or work with an agent. It’s also nice that you can potentially skip the medical exam.

However, young adults can’t qualify for Ethos’ whole life policies, so if you want permanent coverage, I recommend looking for a different provider.