If you’ve ever been denied credit, you know how frustrating it can be to feel like you need what you can’t have. Building credit takes time, especially if you’re building it from scratch or working to fix your score after a mistake. What if you could speed up the process safely?

That’s where Self credit-building loans come in handy. These nontraditional loans help you add payment history to your credit report by essentially letting you make payments to yourself and reporting this activity to the major credit bureaus. They don’t require credit to qualify and you can choose from one of four payment plans.

The accompanying Self app is also easy to use. In this Self review, we’ll cover how Self Credit Builder Accounts can help you build credit and who might be a good fit for this product.

A Self Credit Builder Account can help you build your credit score and your savings with on-time monthly payments. This credit-builder loan does not require credit to qualify and gives you the money you’ve paid at the end of your term (minus interest rates and fees).

- Flexible credit requirements

- Low monthly payments

- Early payoff options

- Fee for debit card payments

- Negative reporting for late payments

Self Visa Credit Card Eligibility Disclosure: Card eligibility: Active Credit Builder Account in good standing, 3 on time payments, $100 or more in savings progress. Requirements subject to change.

Credit Builder Issuing Banks Disclosure: Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., SouthState Bank, N.A. each Member FDIC. Subject to credit approval.

What is Self?

Based in Austin, Texas, Self Financial, was founded in 2015 with the goal of helping consumers build their credit score. While most lenders only offer loans to those with great credit and reserve the best rates for those with the best credit, Self levels the playing field by offering affordable loans to customers who don’t have a strong credit history.

Self’s monthly payments start as low as $25* a month. Simply pay your loan on time each month and, at the end of a 24-month period, the money will be yours, minus a finance charge that includes interest and an administrative fee. Best of all, each payment is reported to all three credit bureaus to give you even more lending options.

With Self, your terms are determined by the amount of your monthly repayment.

Pros & cons

Pros

- Flexible credit requirements — Self is designed to help consumers build their credit, so you can qualify even if other lenders have turned you down.

- Low monthly payments — You’ll only have to pay the monthly amount you’ve chosen, which can be as low as $25*, with interest taken out of the money you’ve saved.

- Early payoff options — If you want access to your funds early, you can choose to cash out and get the amount you’ve already paid, minus interest and fees.

- Helpful resources — Self offers plenty of educational materials to help you learn how credit works.

Cons

- Fee for debit card payments — You can pay by ACH or debit card, but debit card transactions will incur a fee of between $1.20 and $4.75 each time depending on your payment plan.

- Negative reporting for late payments — Self reports activity to all three credit bureaus, so late payments will hurt your score.

How does Self work?

The Self Credit Builder Account is a credit-builder loan that lets you borrow money even if you have little to no credit history. There is no hard credit pull required to apply and you can start working on your credit right away. However, unlike traditional loans that pay you the money right away, Self does not give you your loan until you’ve made all your payments.

After you apply and are approved, Self deposits the money you intend to borrow into a certificate of deposit (CD) with an FDIC-insured partner bank. This is held in your name until your Credit Builder Account has reached the end of its term, which is 24 months. At this time, the CD matures and your loan should be paid off if you’ve been making your regular payments. At the end of the term, you’ll get the money minus fees and interest.

Your payment history while repaying your loan is reported to all three credit bureaus. With each monthly payment you make by the due date, you’ll be taking steps to build your credit.

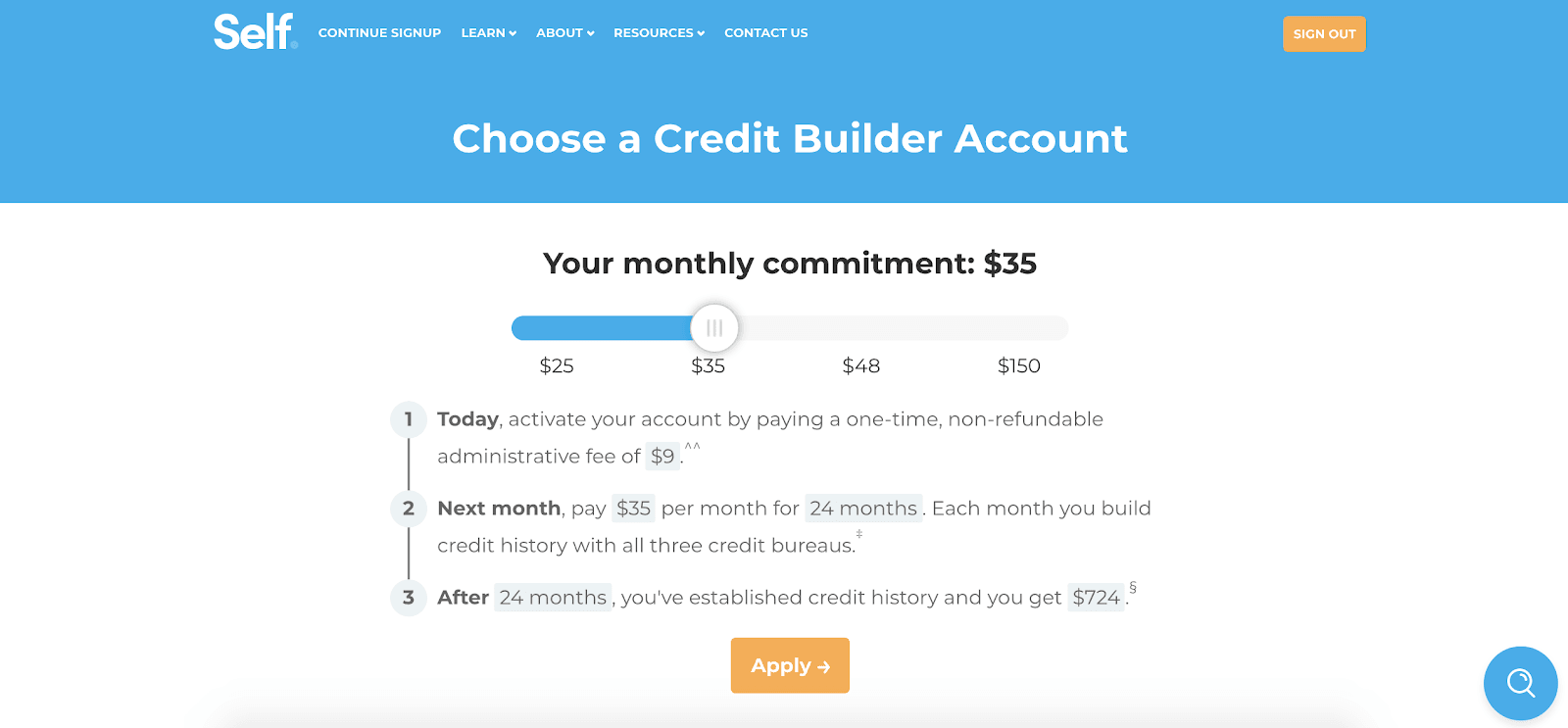

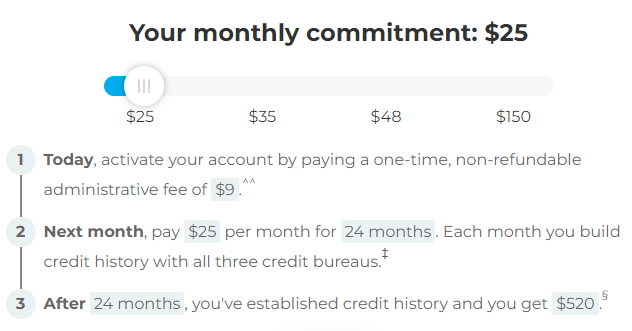

You can choose from four different repayment terms for a 24-month period:

- a monthly payment of $25* and a payout of $520

- a monthly payment of $35* and a payout of $724

- a monthly payment of $48* and a payout of $992

- a monthly payment of $150* and a payout of $3,076

How to get started

To set up an account, go to the Self website and click “Start building today” or download the Self app. Then, enter your email address and click “Join Self.”

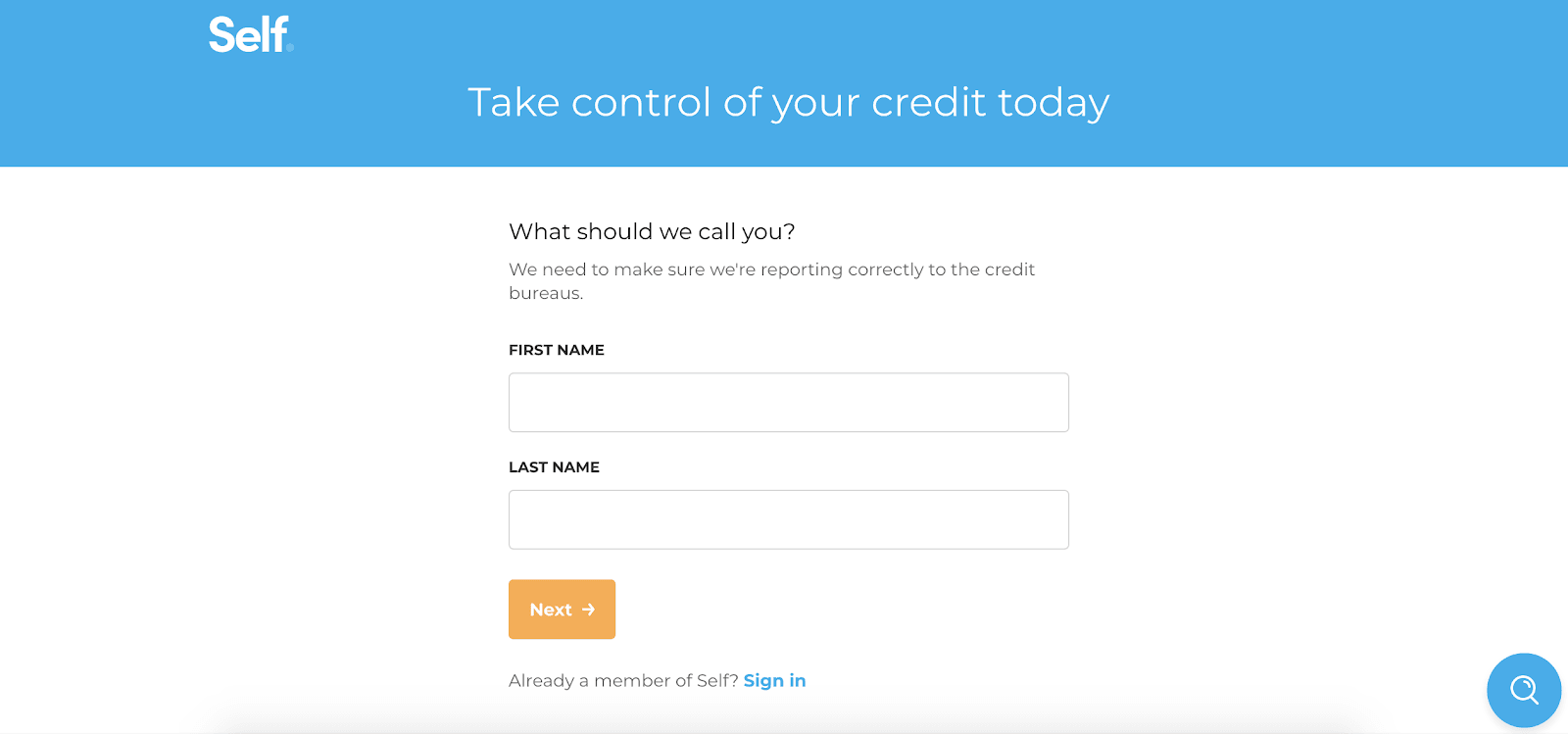

You’ll be prompted to provide your first and last name on the next screen.

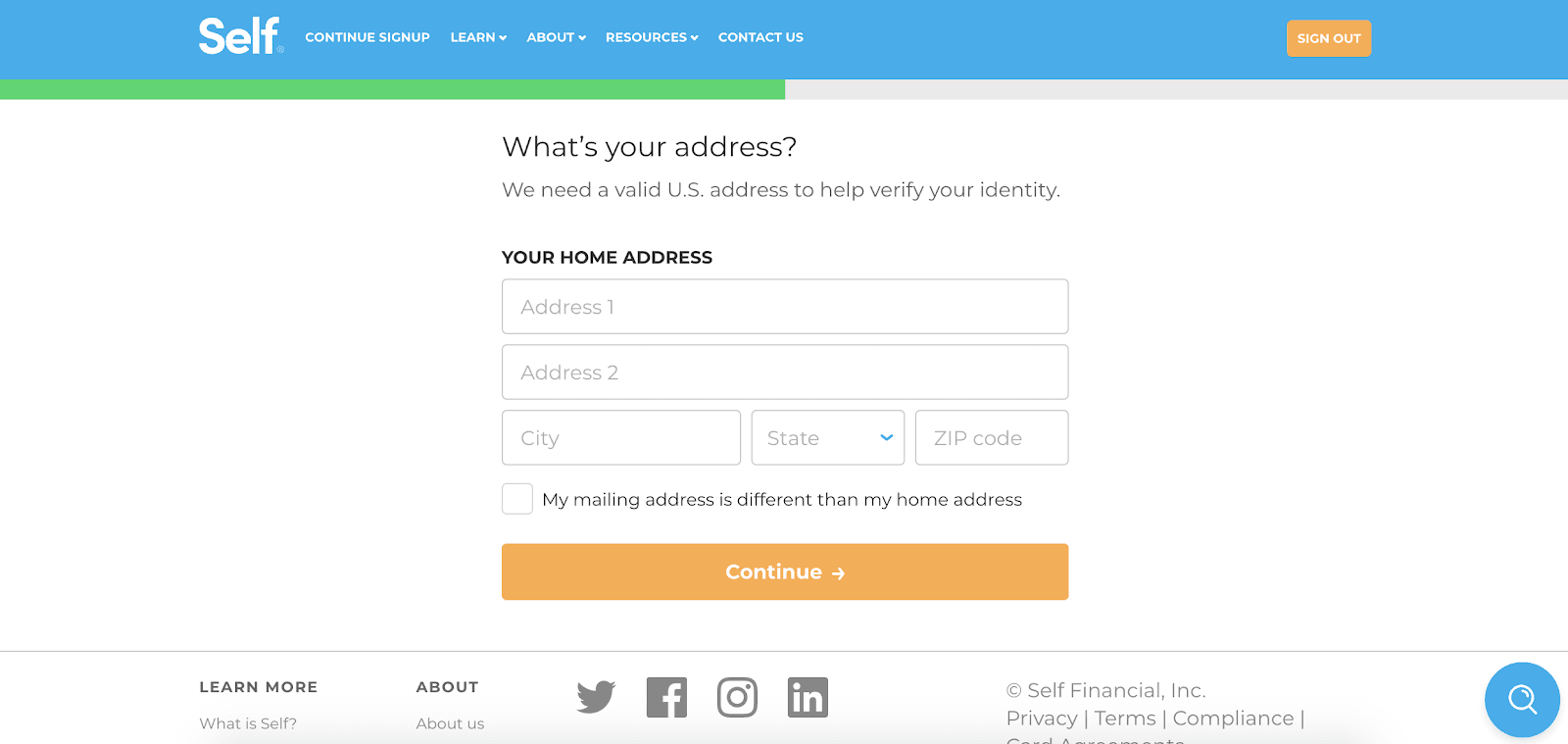

Then, set up a password and provide a mobile phone number. You’ll also need to enter your street address.

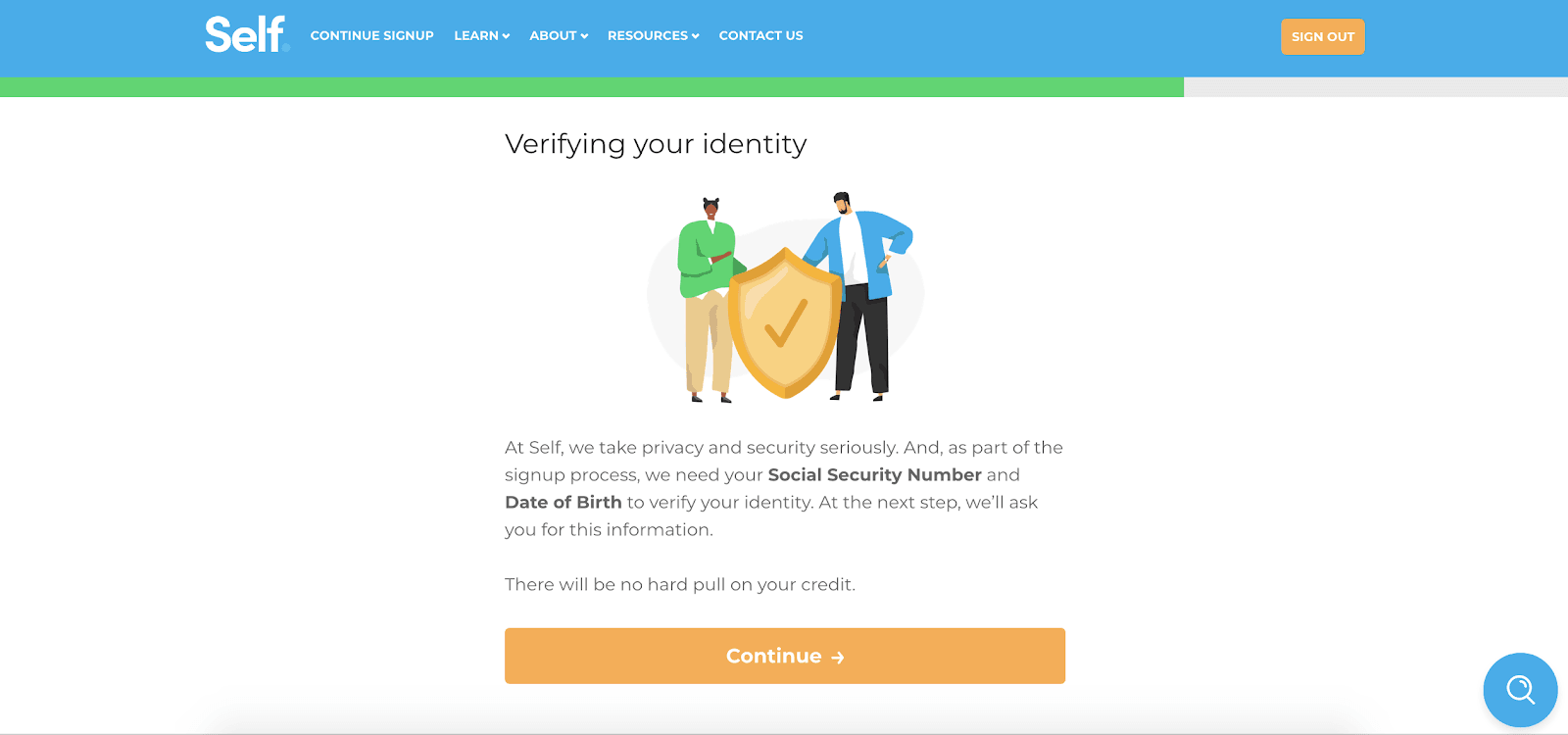

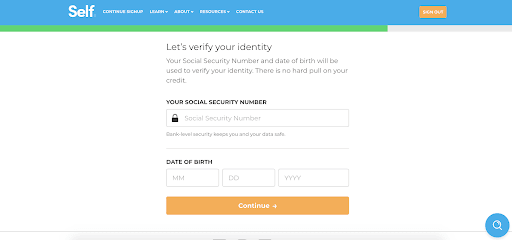

The next step is to verify your identity by providing your Social Security number and birthdate. Self doesn’t pull your credit report to approve you for an account, but you will need to confirm that you are who you say you are. This allows them to report your payments and help you build credit.

Now you choose how much you want to pay each month. You’ll pay a one-time $9 administrative fee to activate your account after signing up. In the second month, you’ll start making payments. You can move the slider to adjust the amount, but $25* is the minimum and $150* is the maximum. All terms are 24 months.

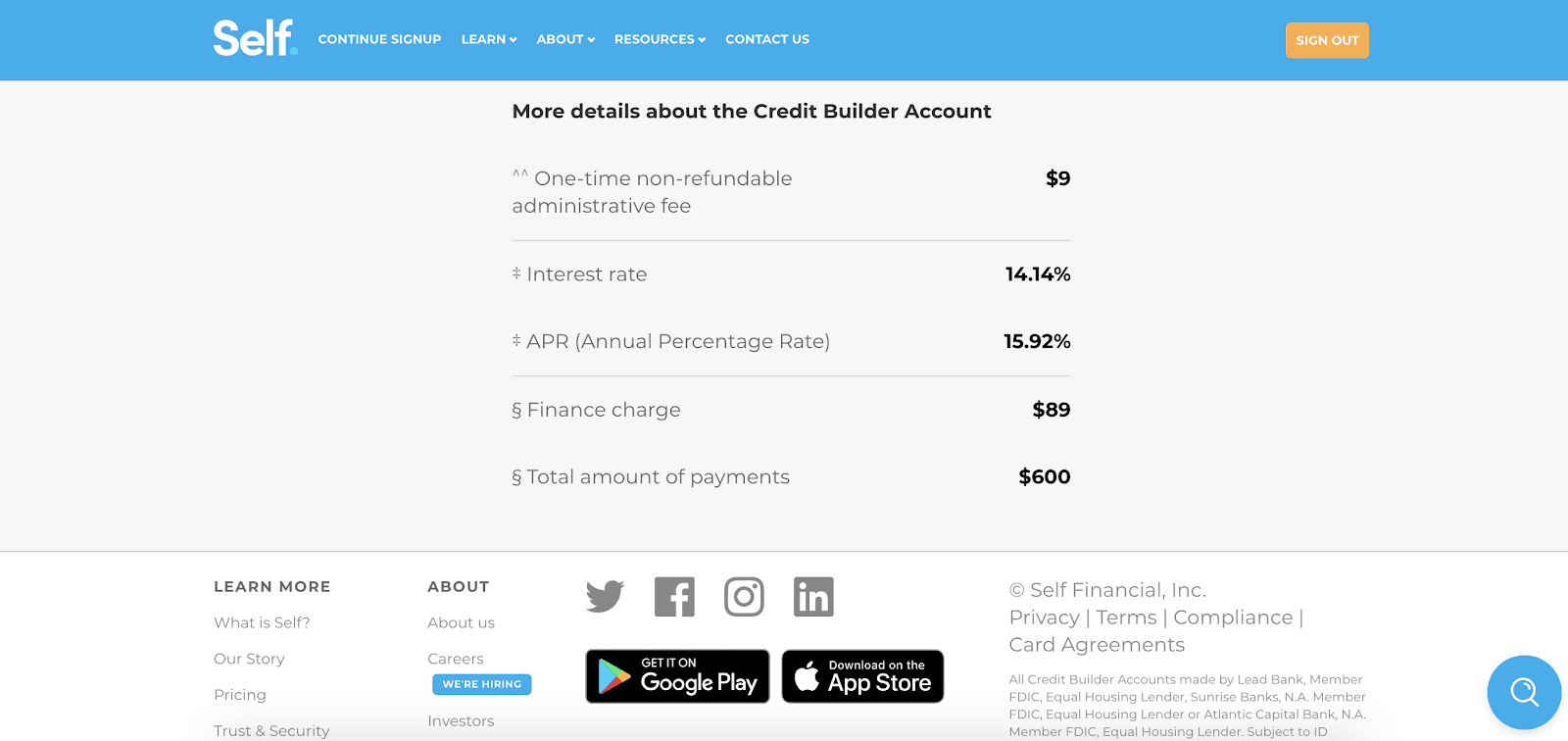

At the bottom of that screen, you’ll get details on the interest rate you’re paying on that monthly contribution. At $25* per month, I’d pay interest at a rate of 14.14% with an APR of 15.92%. The finance charge of $89 includes both the interest and the $9 administrative fee.

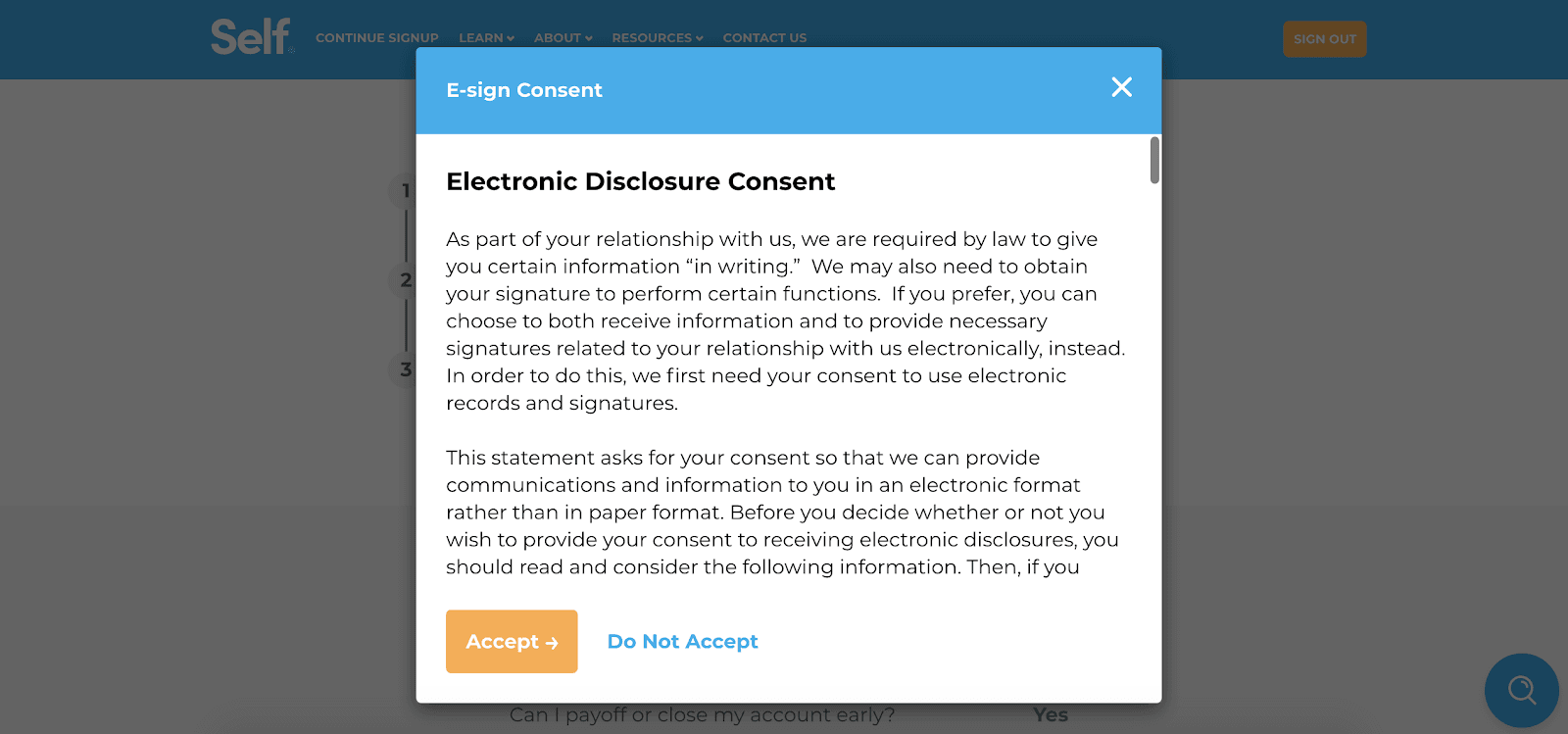

Next, you’ll be asked to accept the electronic disclosure.

Once you’ve done that, Self will verify your identity and create your account.

After that, you’ll have access to a dashboard that shows you updated information about your Self Credit Builder Account. You can see from the main screen where your credit score currently stands along with your remaining loan payments.

The interface can help motivate you to keep making your payments on time by showing you your progress.

Read more: Credit score calculator: Get your estimated credit score range

What does Self cost?

There is a $9 one-time administrative fee for all Self Credit Builder Accounts, which is non-refundable. You’ll pay this when activating your account. After that, you’ll choose your monthly payment amount, which can be between $25 to $150*. Your monthly payment determines how much money you receive, the length of your term, and what you’ll pay in interest.

Self charges an interest rate between 14.14% – 15.58% and an APR between 15.72% -15.97%. The exact APR and interest rate depends on which monthly commitment you make. Interest is deducted from your final payment or subtracted from the money you receive at the end of your loan term.

Interest rates, APRs, and fees vary depending on which term you choose. Here’s a breakdown of the charges and the total amount you’ll pay for each term:

- $25* monthly payment (24 months): 14.14% interest rate / 15.92% APR, $89 finance charge, $600 total

- $35* monthly payment (24 months): 14.70% interest rate / 15.97% APR, $125 finance charge, $840 total

- $48* monthly payment (24 months): 14.79% interest rate / 15.72% APR, $169 finance charge, $1,152 total

- $150* monthly payment (24 months): 15.58% interest rate / 15.88% APR, $533 finance charge, $3,600 total

To give you an example of what this looks like, if you pay $25* a month, you’ll receive $520 after 24 months. With an APR of 15.92%, you’ll pay $600 in total.

Self features

There are plenty of credit-building loan options out there. Here are a few features that make Self stand out from the rest.

Lower interest rate

Although Self charges a one-time administrative fee, it’s relatively low at only $9. Your interest rate is lower than some competitors, though, capping out at less than 16% APR. Some competitors charge 30% APR for poor credit loans. The cost savings can help you quickly recoup that $9.

Payment reporting

The tough thing about trying to build your credit is that lenders check credit in different ways. Self reports your monthly payments to all three credit bureaus to help you cover all your bases. Mortgage lenders, for instance, will pull a report from all three credit bureaus, then merge the information together to decide which score they’ll use.

Read more: How long does it take to build credit from scratch?

Early account payoff

Eager to get your loan money? You can pay off your account early to get your funds. However, in doing so, you’ll lose one of the biggest benefits of a credit-builder account. Once your loan is paid in full, Self won’t have any monthly payments to report for you so you won’t add as much history to your credit.

But if you saw enough of a bump in your credit score that you’re happy and you’re ready to settle up, it’s nice to have that option.

Relaxed qualification requirements

If you’re seeking a credit-builder loan, chances are your credit isn’t where you want it to be. While Self will run a soft credit check on you before approving your loan, they’re more lenient than other lenders. They understand that their borrowers are interested in improving their credit, so they accept people with poor credit or no credit history at all.

Easy application process

The application is surprisingly easy, as long as you have a bank account or debit card. You’ll just need to input some basic information, verify your identity, and choose your payment plan. Then you’ll start making monthly payments and receive the money in a year or two.

Self Visa® Credit Card

Once you’ve made three on-time monthly payments on your Self loan and saved at least $100, you can qualify for the Self Visa® Credit Card. This is a secured credit card, meaning it requires a security deposit as collateral. The amount you deposit becomes your credit limit.

With a Credit Builder Account, your loan progress (referred to as “savings”) can be used as security. So if you’ve paid $100 to date, you’ll have a $100 credit line on your card. This card can help you continue building credit and offer more spending freedom.

Who is Self best for?

A credit-builder loan with Self can help a lot of different types of people out. Here are a few good fits for this product.

Credit-challenged consumers

Credit-building loans are designed for improving your credit score. If your score is in a good enough range to qualify for a traditional personal loan, and you need the money now, you may be better off choosing one of these.

If you’re new to credit, you can build a solid credit score in a matter of months by paying your bills on time. But if you’ve damaged your credit, it can take a little longer through the traditional route, which is where a credit-building loan can come in handy.

Credit card seekers

If you need a credit card, a Self Credit Builder Account can help you get one. Although you’ll only be able to charge the amount you’ve saved, this is better than nothing, especially if you haven’t been able to qualify for another credit card. And the more your credit improves, the closer you’ll be to getting approved for an unsecured credit card if that’s what you want.

Read more: Best unsecured credit cards for bad credit

Those on limited budgets

Self lets you make payments as low as $25* and deducts the interest from the loan amount. So you’ll have 24 months to pay only $25* in exchange for a financial payout, minus interest and a $9 fee. If you have limited cash to work with but want to make progress on your credit, you can save a lot of money choosing Self.

Online borrowers

Self’s services are provided completely online and through the app, with no local branches to visit. If you’re comfortable using online lenders, this is a great option. You’ll be able to set up ACH to make your monthly payments automatic and only log into your account when you want to check on the status of your loan. At the end of the term, the funds will be deposited in your account. No visits to a brick-and-mortar bank are required.

Who shouldn’t use Self?

If you match any of these descriptions, you might be better suited to a different credit-building option.

Frequent late payers

The very thing that makes Self a valuable credit-building tool can also work against you. Self reports your payments to all three credit bureaus, for better or worse. If you aren’t sure you’ll be able to pay on time each month, a credit-building account can be a risky choice. But you can set things up so that your loan is automatically paid each month.

Those who need money now

Credit-building loans are a good way to build credit, but they also make you wait for your money. Unlike traditional loans that send your funds in as little as one business day and then require payments, credit-building loans basically help you save your money and then hand over what you’ve saved (minus interest) at the end of the term. In the case of Self, you won’t get your funds until at least one full year of payments has passed.

If you’re short on cash and need help now, consider a traditional loan or cash advance and steer clear of payday loans.

The competition

If your credit score is good enough for you to qualify for a personal loan and it’s something you’re in need of, then you may want to go with that alternative. Money Under 30 has partnered with dozens of different online lenders to enable you to check your personal loan rates and see how much you can borrow with just a few steps.

See great personal loan rates you qualify for in minutes from our trusted lending partners.

This service performs a soft credit check so there's no impact to your credit score, and never any obligation to request or take the loan.

- Won't affect your credit score

- Check your APR and loan amount before you apply

- Access to multiple lending partners

- Personal information required to see rates

- High APRs for applicants with fair or low credit

Self can be cheaper for those starting from scratch but does not give you your money until your term is up and won’t let you borrow as much as a traditional loan.

Summary

A Self Credit Builder Account can help you build your credit in as little as a few months with a credit-building loan for 24 months. By paying at least $25* a month, you can add payment history to your credit report to lift your creditworthiness and improve your chances of qualifying for credit in the future.

With relatively low interest rates and minimal fees, Self offers a good alternative to traditional loans for borrowers with lower credit scores.